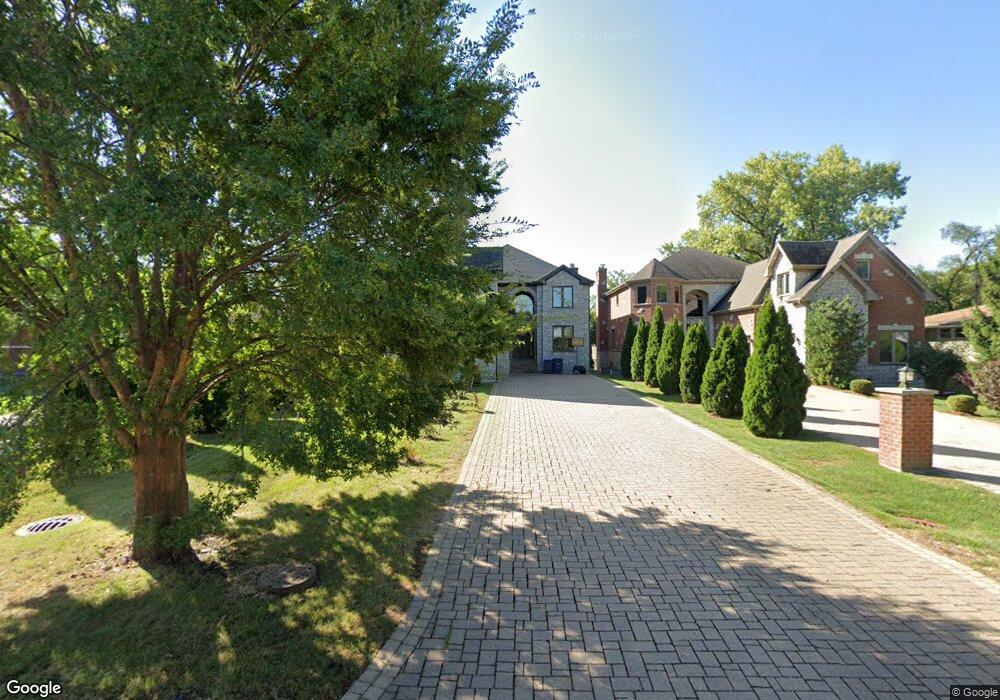

1145 Everett Ln Des Plaines, IL 60018

Estimated Value: $976,453 - $1,284,000

6

Beds

5

Baths

4,350

Sq Ft

$259/Sq Ft

Est. Value

About This Home

This home is located at 1145 Everett Ln, Des Plaines, IL 60018 and is currently estimated at $1,125,613, approximately $258 per square foot. 1145 Everett Ln is a home located in Cook County with nearby schools including Plainfield Elementary School, Algonquin Middle School, and Maine West High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 6, 2024

Sold by

Clopton Lisa

Bought by

Clopton Jacob C

Current Estimated Value

Purchase Details

Closed on

Sep 11, 2017

Sold by

Kaplan Justin and Kaplan Blair

Bought by

Clopton Jacob C and Clopton Lisa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$704,425

Interest Rate

3.99%

Mortgage Type

Adjustable Rate Mortgage/ARM

Purchase Details

Closed on

Aug 1, 2013

Sold by

Dabrowski Stanislaw

Bought by

Kaplan Justin and Kaplan Blair

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$416,250

Interest Rate

3.37%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Clopton Jacob C | -- | None Listed On Document | |

| Clopton Jacob C | $741,500 | Altima Title Llc | |

| Kaplan Justin | $585,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Clopton Jacob C | $704,425 | |

| Previous Owner | Kaplan Justin | $416,250 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $16,242 | $88,257 | $6,346 | $81,911 |

| 2024 | $16,242 | $60,730 | $5,500 | $55,230 |

| 2023 | $15,825 | $64,921 | $5,500 | $59,421 |

| 2022 | $15,825 | $64,921 | $5,500 | $59,421 |

| 2021 | $14,350 | $50,014 | $7,191 | $42,823 |

| 2020 | $14,176 | $50,014 | $7,191 | $42,823 |

| 2019 | $17,048 | $66,776 | $7,191 | $59,585 |

| 2018 | $16,717 | $59,334 | $6,345 | $52,989 |

| 2017 | $16,440 | $59,334 | $6,345 | $52,989 |

| 2016 | $17,837 | $66,688 | $6,345 | $60,343 |

| 2015 | $15,664 | $54,437 | $5,499 | $48,938 |

| 2014 | $15,350 | $54,437 | $5,499 | $48,938 |

| 2013 | -- | $5,499 | $5,499 | $0 |

Source: Public Records

Map

Nearby Homes

- 1080 Bogart St

- 1445 Everett Ave

- 1696 S Elm St

- 815 E Oakton St Unit 311

- 1689 S Elm St

- 1645 Illinois St

- 1370 Fargo Ave Unit E

- 1394 Carol Ln

- 2220 S Chestnut St

- 635 Birchwood Ave

- 664 E Oakton St

- 614 Birchwood Ave

- 1721 Prospect Ave

- 1754 E Lincoln Ave

- 2323 Douglas Ave

- 1700 E Forest Ave

- 1162 W Grant Dr

- 1048 E Walnut Ave

- 1596 Oxford Rd

- 674 E Algonquin Rd

- 1141 Everett Ln

- 1157 Everett Ln

- 1125 Everett Ln

- 1177 Everett Ln

- 1111 Everett Ln

- 1140 Everett Ln

- 1780 Lee St

- 1790 Lee St

- 1160 Everett Ln

- 1126 Everett Ln

- 1095 Everett Ln

- 1172 Everett Ln

- 1766 Lee St

- 1100 Everett Ln

- 1094 Everett Ln

- 1079 Everett Ln

- 1744 Lee St

- 1144 Prospect Ln

- 1154 Prospect Ln

- 1136 Prospect Ln

Your Personal Tour Guide

Ask me questions while you tour the home.