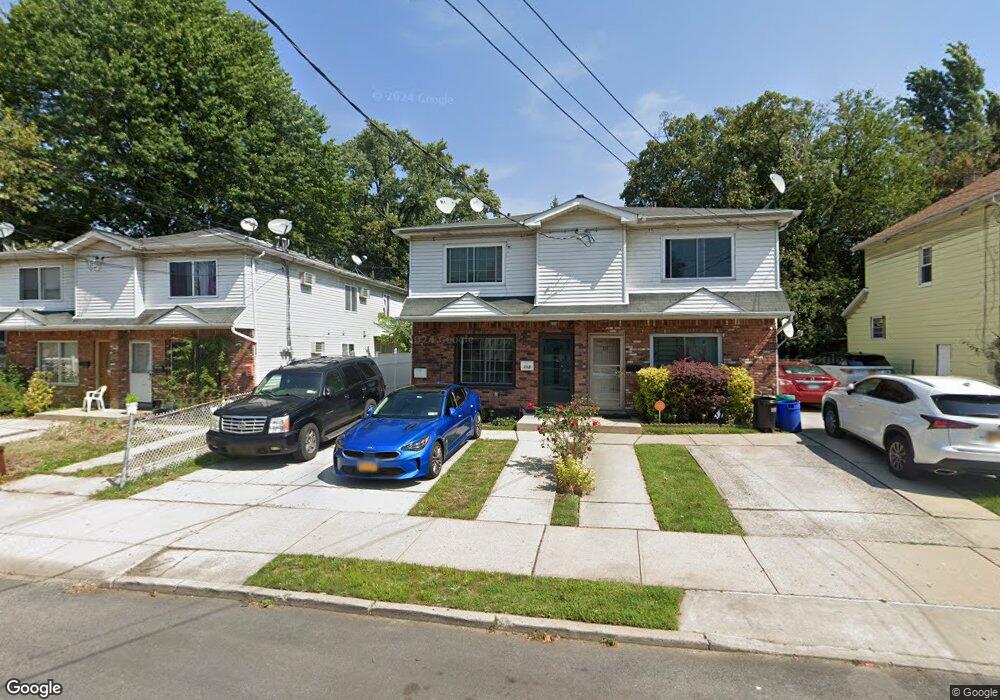

115 Elm St Unit 117 Staten Island, NY 10310

West Brighton NeighborhoodEstimated Value: $433,000 - $658,000

2

Beds

2

Baths

1,696

Sq Ft

$327/Sq Ft

Est. Value

About This Home

This home is located at 115 Elm St Unit 117, Staten Island, NY 10310 and is currently estimated at $555,194, approximately $327 per square foot. 115 Elm St Unit 117 is a home located in Richmond County with nearby schools including P.S. 18 John G. Whittier, Intermediate School 27, and Susan E Wagner High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 23, 2006

Sold by

Taranto Dale D and Taranto Paula A

Bought by

Banks Walter and Banks Celina

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$279,200

Outstanding Balance

$171,201

Interest Rate

7.75%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$383,993

Purchase Details

Closed on

Mar 26, 2002

Sold by

Smith Kenneth C and Smith Karen A

Bought by

Taranto Dale D and Taranto Paula A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$166,500

Interest Rate

6.88%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Banks Walter | $349,000 | None Available | |

| Taranto Dale D | $185,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Banks Walter | $279,200 | |

| Previous Owner | Taranto Dale D | $166,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,033 | $30,480 | $7,619 | $22,861 |

| 2024 | $5,045 | $26,460 | $8,671 | $17,789 |

| 2023 | $5,024 | $26,140 | $7,610 | $18,530 |

| 2022 | $4,636 | $24,660 | $8,280 | $16,380 |

| 2021 | $4,685 | $23,700 | $8,280 | $15,420 |

| 2020 | $4,886 | $26,160 | $8,280 | $17,880 |

| 2019 | $4,647 | $27,600 | $8,280 | $19,320 |

| 2018 | $4,335 | $22,725 | $5,973 | $16,752 |

| 2017 | $4,108 | $21,624 | $7,191 | $14,433 |

| 2016 | $3,768 | $20,400 | $8,280 | $12,120 |

| 2015 | $3,472 | $20,860 | $6,329 | $14,531 |

| 2014 | $3,472 | $19,680 | $6,900 | $12,780 |

Source: Public Records

Map

Nearby Homes

- 84 Elm St

- 163 Bement Ave

- 70 Elm St

- 154 Pelton Ave

- 699 Henderson Ave

- 16 Howard Ct

- 698 Henderson Ave

- 718 Henderson Ave

- 188 Davis Ave

- 207 N Burgher Ave

- 21 Elizabeth Ave

- 943 Castleton Ave

- 154 Bard Ave Unit 14A

- 11 Curtis Ct

- 46 Winegar Ln

- 1001 Castleton Ave

- 2 Livingston Ct

- 160 Bard Ave Unit 6A

- 144 Bard Ave Unit 25b

- 331 Oakland Ave