115 Evans Ln Wayland, MI 49348

Estimated Value: $208,000 - $367,000

1

Bed

1

Bath

800

Sq Ft

$366/Sq Ft

Est. Value

About This Home

This home is located at 115 Evans Ln, Wayland, MI 49348 and is currently estimated at $292,679, approximately $365 per square foot. 115 Evans Ln is a home located in Barry County with nearby schools including Wayland High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 16, 2018

Sold by

Zyskowski Timothy J and Zyskowski Tim

Bought by

Brooks Heather and Brooks Andrew

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$157,500

Outstanding Balance

$135,510

Interest Rate

4.46%

Mortgage Type

New Conventional

Estimated Equity

$157,169

Purchase Details

Closed on

Nov 9, 2006

Sold by

Lavigne Joseph J and Lavigne Barbara

Bought by

Zyskowski Timothy J and Zyskowski Josephine A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$130,200

Interest Rate

6.41%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 29, 2005

Sold by

Lavigne Joseph J and Lavigne Barbara

Bought by

Zyskowski Tim and Zyskowski Josephine A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Brooks Heather | -- | Lighthouse Title Agency | |

| Zyskowski Timothy J | $129,500 | Metropolitan Title Company | |

| Zyskowski Tim | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Brooks Heather | $157,500 | |

| Previous Owner | Zyskowski Timothy J | $130,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,225 | $118,900 | $0 | $0 |

| 2024 | $3,225 | $109,700 | $0 | $0 |

| 2023 | $2,914 | $76,800 | $0 | $0 |

| 2022 | $2,914 | $76,800 | $0 | $0 |

| 2021 | $2,914 | $70,800 | $0 | $0 |

| 2020 | $2,814 | $64,700 | $0 | $0 |

| 2019 | $2,814 | $63,700 | $0 | $0 |

| 2018 | $2,711 | $57,500 | $35,700 | $21,800 |

| 2017 | $2,711 | $57,500 | $0 | $0 |

| 2016 | -- | $57,600 | $0 | $0 |

| 2015 | -- | $55,500 | $0 | $0 |

| 2014 | -- | $55,500 | $0 | $0 |

Source: Public Records

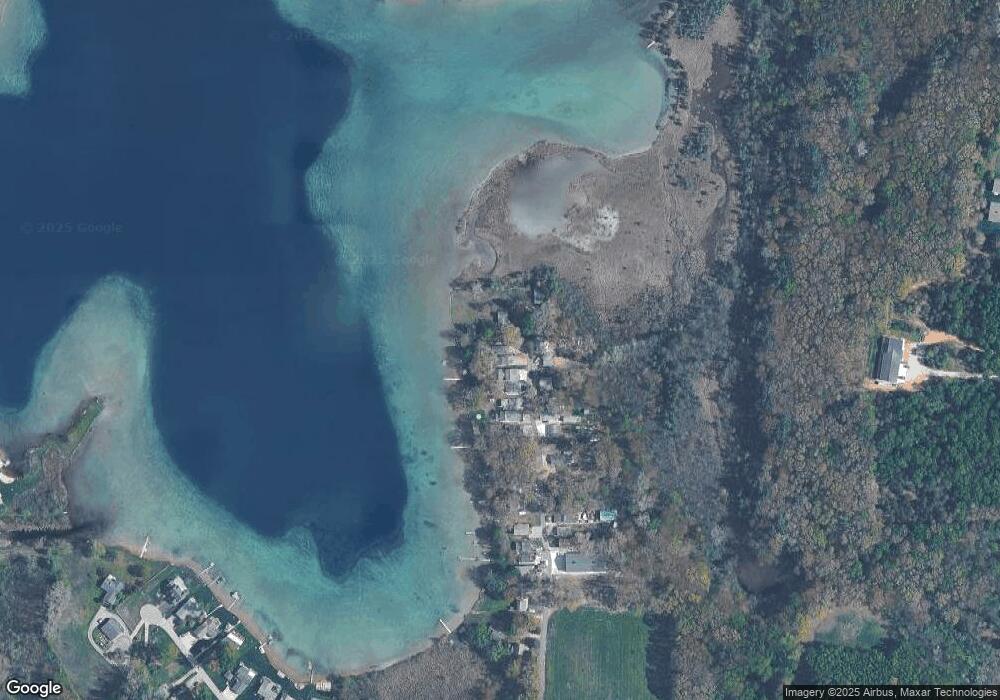

Map

Nearby Homes

- 12031 Sandstone Dr

- 12169 Pine Meadows Dr

- 1164 E Bernie Ct

- 12720 S Grey Ct

- 12857 Michael Dr Unit 49

- 1391 Shadowridge Dr

- 1736 Parker Dr

- 1875 Edwin Dr

- 1980 Parker Dr

- 11753 Rosemary Ln

- 11751 Rosemary Ln

- 11065 W M 179 Hwy

- 12712 Sunrise Ct

- 2724 Pasture Ln

- 35 Cannonball Ln

- 1823 Starr View Ln Unit 11

- 11401 Davis Rd

- 0 Spruce Hollow Dr Unit Parcel B

- 2615 Harwood Lake Rd

- 3140 Sandy Beach St