11526 Centaur Way Unit 24 Lehigh Acres, FL 33971

Centennial NeighborhoodEstimated Value: $422,000 - $474,000

4

Beds

4

Baths

3,249

Sq Ft

$136/Sq Ft

Est. Value

About This Home

This home is located at 11526 Centaur Way Unit 24, Lehigh Acres, FL 33971 and is currently estimated at $443,022, approximately $136 per square foot. 11526 Centaur Way Unit 24 is a home located in Lee County with nearby schools including Gateway Elementary School, Tice Elementary School, and Orange River Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 30, 2022

Sold by

Gonzalez Yolanda E and Gonzalez Giovanni

Bought by

Labrie Mark Richard and Labrie Rachel Joanne

Current Estimated Value

Purchase Details

Closed on

Dec 5, 2013

Sold by

Schwatka Walter

Bought by

Gonzalez Yolanda E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$229,245

Interest Rate

4.43%

Mortgage Type

FHA

Purchase Details

Closed on

Sep 13, 2013

Sold by

Hu Yuan Yuan

Bought by

Schwatka Walter

Purchase Details

Closed on

Apr 29, 2009

Sold by

Premier Investment Enterprises Inc

Bought by

Hu Yuan Yuan

Purchase Details

Closed on

Aug 2, 2006

Sold by

Eh Transeastern Llc

Bought by

Premier Investment Enterprises Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$321,470

Interest Rate

7.12%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Labrie Mark Richard | $465,000 | Fidelity National Title | |

| Gonzalez Yolanda E | $233,000 | Dougan Land Title Llc | |

| Schwatka Walter | $100,000 | Attorney | |

| Hu Yuan Yuan | $200,000 | Attorney | |

| Premier Investment Enterprises Inc | $401,900 | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Gonzalez Yolanda E | $229,245 | |

| Previous Owner | Premier Investment Enterprises Inc | $321,470 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,368 | $354,254 | $52,488 | $297,000 |

| 2024 | $6,368 | $354,012 | $65,823 | $283,639 |

| 2023 | $6,508 | $355,795 | $59,657 | $296,138 |

| 2022 | $3,520 | $215,681 | $0 | $0 |

| 2021 | $3,565 | $230,224 | $36,900 | $193,324 |

| 2020 | $3,520 | $206,508 | $0 | $0 |

| 2019 | $3,483 | $201,865 | $0 | $0 |

| 2018 | $3,487 | $198,101 | $0 | $0 |

| 2017 | $3,496 | $194,026 | $0 | $0 |

| 2016 | $3,470 | $204,967 | $36,900 | $168,067 |

| 2015 | $3,519 | $211,597 | $32,900 | $178,697 |

| 2014 | -- | $187,216 | $29,500 | $157,716 |

| 2013 | -- | $136,498 | $20,200 | $116,298 |

Source: Public Records

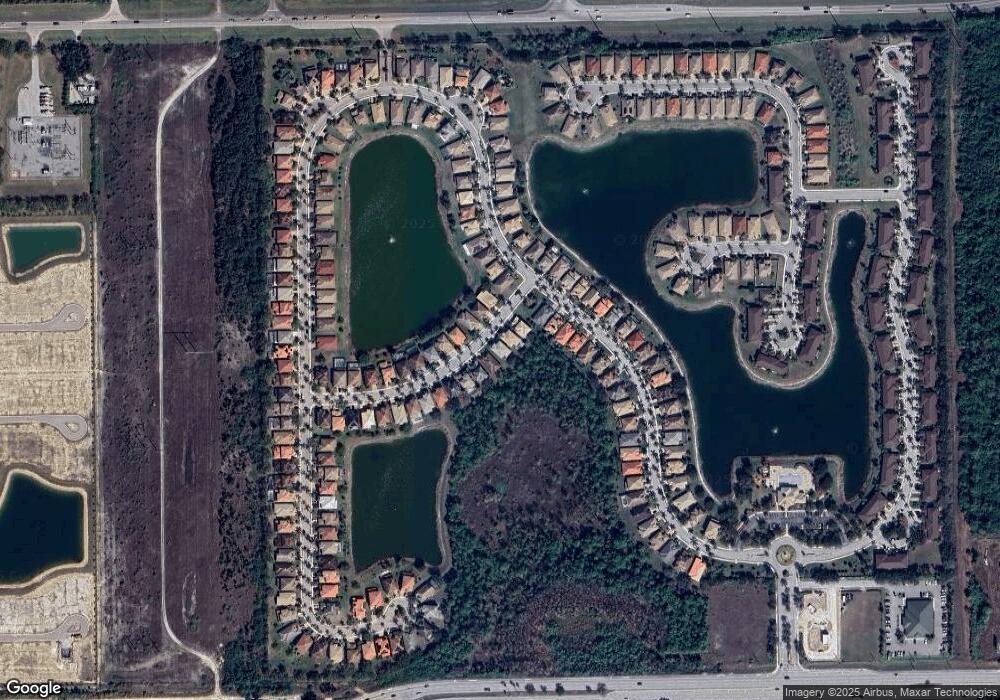

Map

Nearby Homes

- 11527 Centaur Way

- 8558 Pegasus Dr

- 8584 Pegasus Dr

- 11422 Icarus Cir

- 11430 Icarus Cir

- 8645 Pegasus Dr

- 11744 Eros Rd

- 11735 Eros Rd

- 11739 Eros Rd

- 11743 Eros Rd

- 8602 Athena Ct

- 8600 Athena Ct

- 8590 Athena Ct

- 8584 Athena Ct

- 8591 Athena Ct

- 8529 Athena Ct

- 8668 Athena Ct

- 8681 Athena Ct

- 8094 Silver Birch Way

- 8477 Everly Preserve Dr

- 11526 Centaur Way

- 11526 Centaur Way Lehigh

- 11528 Centaur Way

- 11524 Centaur Way

- 11530 Centaur Way

- 11522 Centaur Way

- 11525 Centaur Way

- 11520 Centaur Way

- 11523 Centaur Way

- 8568 Pegasus Dr

- 11529 Centaur Way

- 8566 Pegasus Dr

- 11521 Centaur Way

- 11518 Centaur Way

- 8564 Pegasus Dr

- 8574 Pegasus Dr

- 11517 Centaur Way

- 8562 Pegasus Dr

- 11516 Centaur Way

- 8576 Pegasus Dr