1153 Tee Time Dr Farmington, UT 84025

Estimated Value: $665,648 - $737,000

5

Beds

3

Baths

3,095

Sq Ft

$224/Sq Ft

Est. Value

About This Home

This home is located at 1153 Tee Time Dr, Farmington, UT 84025 and is currently estimated at $691,912, approximately $223 per square foot. 1153 Tee Time Dr is a home located in Davis County with nearby schools including Knowlton Elementary School, Farmington High, and Farmington Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 29, 2017

Sold by

Anderson Dennis R

Bought by

Monk Monk L and Monk Laura Ann

Current Estimated Value

Purchase Details

Closed on

Aug 3, 2005

Sold by

Barton Jay Golden and Barton Norene

Bought by

Anderson Dennis R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$64,400

Interest Rate

5.56%

Mortgage Type

Stand Alone Second

Purchase Details

Closed on

Aug 14, 2000

Sold by

Gmw Development Inc

Bought by

Barton Jay Golden and Barton Norene

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$270,000

Interest Rate

8.19%

Mortgage Type

Seller Take Back

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Monk Monk L | -- | Backman Title | |

| Anderson Dennis R | -- | Merrill Title Company | |

| Barton Jay Golden | -- | Bonneville Title Company Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Anderson Dennis R | $64,400 | |

| Previous Owner | Anderson Dennis R | $257,600 | |

| Previous Owner | Barton Jay Golden | $270,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,092 | $318,450 | $173,562 | $144,888 |

| 2024 | $3,092 | $309,100 | $137,485 | $171,615 |

| 2023 | $3,041 | $554,000 | $230,997 | $323,003 |

| 2022 | $3,067 | $317,350 | $103,027 | $214,323 |

| 2021 | $3,168 | $488,000 | $150,195 | $337,805 |

| 2020 | $2,810 | $422,000 | $109,727 | $312,273 |

| 2019 | $2,828 | $412,000 | $138,766 | $273,234 |

| 2018 | $2,780 | $399,000 | $122,933 | $276,067 |

| 2016 | $2,347 | $173,415 | $46,784 | $126,631 |

| 2015 | $2,338 | $163,900 | $46,784 | $117,116 |

| 2014 | $2,319 | $167,065 | $46,784 | $120,281 |

| 2013 | -- | $155,038 | $49,115 | $105,923 |

Source: Public Records

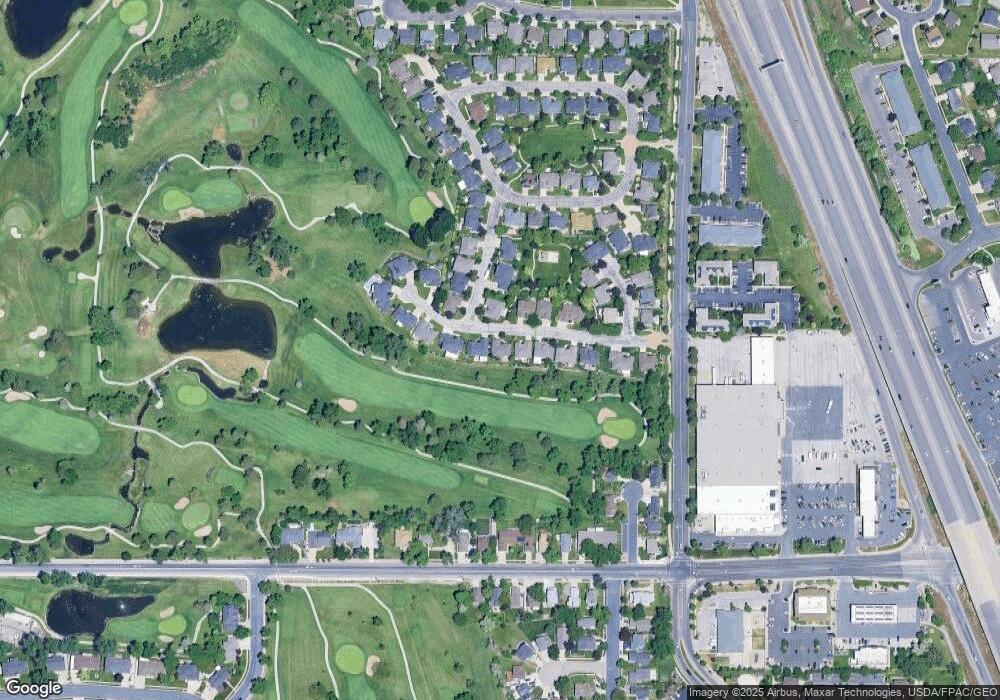

Map

Nearby Homes

- 1083 Tee Time Dr

- 1204 N 1100 W

- 1212 Pinehurst Cir

- 1012 W Willow Wind Dr

- 1356 Fairway Cir

- 1048 Shepard Creek Pkwy Unit 4

- 1181 Set Ct Unit 2

- 1332 N 1580 W

- 1406 Swinton Ln

- 1372 Sweetwater Ln

- 868 N Shepard Creek Pkwy

- 1789 Stayner Dr

- 1175 W 1875 N

- Trio Plan at Hidden Farm Estates

- Timpani Plan at Hidden Farm Estates

- Tenor Plan at Hidden Farm Estates

- Prelude Plan at Hidden Farm Estates

- Octave Plan at Hidden Farm Estates

- Madrigal Plan at Hidden Farm Estates

- Interlude Plan at Hidden Farm Estates

- 1145 1340 North Tee Time Dr

- 1145 Tee Time Dr

- 1163 Tee Time Dr

- 1133 Tee Time Dr

- 1354 Fairway Ln

- 1146 Tee Time Dr

- 1173 W 1340 N

- 1173 Tee Time Dr

- 1136 Tee Time Dr

- 1123 Tee Time Dr Unit 5

- 1123 Tee Time Dr

- 1351 Fairway Ln

- 1366 Fairway Ln

- 1118 Tee Time Dr

- 1363 Fairway Ln

- 1183 Tee Time Dr

- 1119 W Tee Time Dr

- 1119 Tee Time Dr

- 1373 Fairway Ln

- 1384 Fairway Ln