11535 Regency Square Ct Unit 1 Cincinnati, OH 45231

Pleasant Run NeighborhoodEstimated Value: $131,000 - $148,000

2

Beds

2

Baths

998

Sq Ft

$139/Sq Ft

Est. Value

About This Home

This home is located at 11535 Regency Square Ct Unit 1, Cincinnati, OH 45231 and is currently estimated at $138,280, approximately $138 per square foot. 11535 Regency Square Ct Unit 1 is a home located in Hamilton County with nearby schools including Pleasant Run Elementary School, Pleasant Run Middle School, and Northwest High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 8, 2009

Sold by

Deutsche Bank National Trust Company

Bought by

Dalton Nicole

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$47,460

Interest Rate

5.07%

Mortgage Type

FHA

Purchase Details

Closed on

Aug 20, 2009

Sold by

Honis Nathan

Bought by

Deutsche Bank National Trust Company

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$47,460

Interest Rate

5.07%

Mortgage Type

FHA

Purchase Details

Closed on

Jan 4, 2007

Sold by

Hiles Charles D

Bought by

Honis Nathan and Honis Brittney

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$7,500

Interest Rate

6.21%

Mortgage Type

Stand Alone Second

Purchase Details

Closed on

Mar 18, 1994

Sold by

Hal Homes Inc

Bought by

Hiles Charles D and Hiles Beverly J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dalton Nicole | $51,500 | Attorney | |

| Deutsche Bank National Trust Company | $54,000 | None Available | |

| Honis Nathan | $90,500 | Attorney | |

| Hiles Charles D | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Dalton Nicole | $47,460 | |

| Previous Owner | Honis Nathan | $7,500 | |

| Previous Owner | Honis Nathan | $81,450 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,892 | $32,767 | $5,075 | $27,692 |

| 2023 | $1,766 | $32,767 | $5,075 | $27,692 |

| 2022 | $1,540 | $23,286 | $3,955 | $19,331 |

| 2021 | $1,529 | $23,286 | $3,955 | $19,331 |

| 2020 | $1,542 | $23,286 | $3,955 | $19,331 |

| 2019 | $1,652 | $23,286 | $3,955 | $19,331 |

| 2018 | $1,482 | $23,286 | $3,955 | $19,331 |

| 2017 | $1,406 | $23,286 | $3,955 | $19,331 |

| 2016 | $1,040 | $16,944 | $3,619 | $13,325 |

| 2015 | $1,049 | $16,944 | $3,619 | $13,325 |

| 2014 | $1,051 | $16,944 | $3,619 | $13,325 |

| 2013 | $1,064 | $18,025 | $3,850 | $14,175 |

Source: Public Records

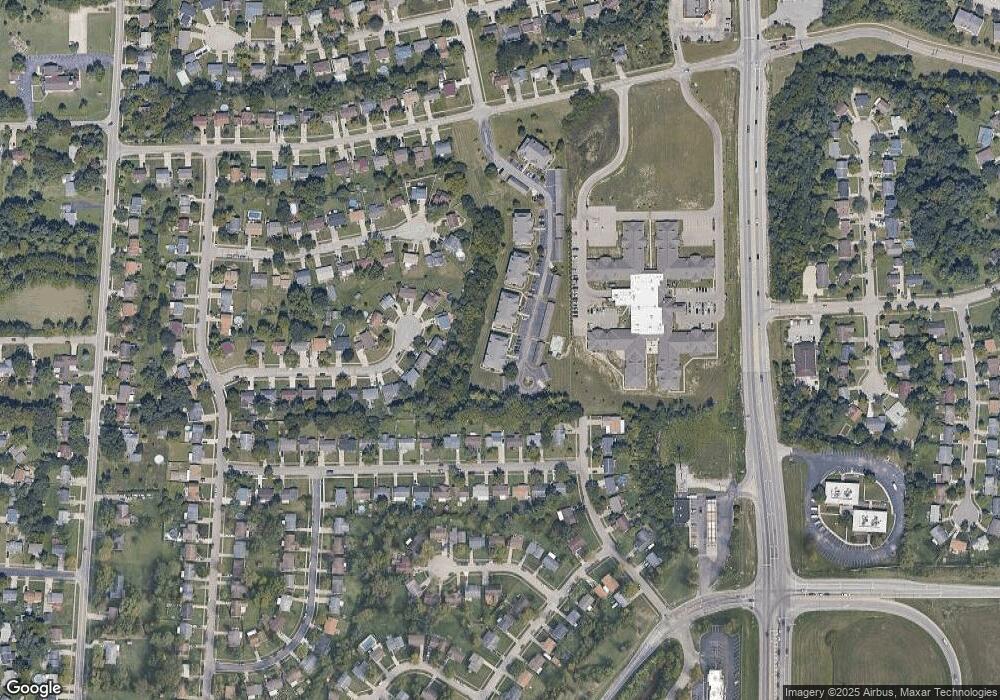

Map

Nearby Homes

- 11565 Regency Square Ct

- 2456 Houston Rd

- 11364 Gravenhurst Dr

- 11478 Ramondi Place

- 2580 Cranbrook Dr

- 2465 Owlcrest Dr

- 11717 Hamilton Ave

- 2891 Greenbrook Ln

- 2756 Cranbrook Dr

- 3000 Crest Rd

- 11835 Wincanton Dr

- 11321 Melissa Ct

- 2776 Klondike Ct

- 11995 Wincanton Dr

- 1863 W Kemper Rd

- 10897 Sprucehill Dr

- 2508 Wilson Ave

- 12017 Brookway Dr

- 12066 Spalding Dr

- 12080 Regency Run Ct Unit 4

- 11535 Regency Square Ct Unit 4

- 11535 Regency Square Ct

- 11535 Regency Square Ct

- 11535 Regency Square Ct

- 11535 Regency Square Ct Unit 6

- 11535 Regency Square Ct Unit 2

- 11535 Regency Square Ct Unit 12

- 11535 Regency Square Ct

- 11535 Regency Square Ct

- 11535 Regency Square Ct

- 11535 Regency Square Ct Unit 5

- 11535 Regency Square Ct Unit 8

- 11535 Regency Square Ct Unit 3

- 11535 Regency Square Ct Unit 9

- 11535 Regency Square Ct Unit 10

- 11535 Regency Square Ct Unit 7

- 11545 Regency Square Ct Unit 5

- 11545 Regency Square Ct Unit 8

- 11545 Regency Square Ct Unit 3

- 11545 Regency Square Ct Unit 4