1165 Saint Phillips Ct Locust Grove, GA 30248

Estimated Value: $263,857 - $278,000

5

Beds

3

Baths

1,824

Sq Ft

$149/Sq Ft

Est. Value

About This Home

This home is located at 1165 Saint Phillips Ct, Locust Grove, GA 30248 and is currently estimated at $271,214, approximately $148 per square foot. 1165 Saint Phillips Ct is a home located in Henry County with nearby schools including Locust Grove Elementary School, Locust Grove Middle School, and Locust Grove High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 3, 2009

Sold by

Oneal Lindsey

Bought by

Stanley Deon A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$119,117

Outstanding Balance

$75,457

Interest Rate

5.14%

Mortgage Type

New Conventional

Estimated Equity

$195,757

Purchase Details

Closed on

Oct 7, 2008

Sold by

Us Bank Na

Bought by

Oneal Lindsey

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$64,176

Interest Rate

6.11%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 1, 2008

Sold by

Birlew Edgar A and Birlew Jacqueline M

Bought by

Us Bank Na

Purchase Details

Closed on

Aug 5, 2004

Sold by

M & M Custom Homes Inc

Bought by

Johnson Kristin T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$128,900

Interest Rate

5.78%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stanley Deon A | $114,000 | -- | |

| Oneal Lindsey | $80,300 | -- | |

| Us Bank Na | $101,915 | -- | |

| Johnson Kristin T | $132,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Stanley Deon A | $119,117 | |

| Previous Owner | Oneal Lindsey | $64,176 | |

| Previous Owner | Johnson Kristin T | $128,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,873 | $110,480 | $16,000 | $94,480 |

| 2024 | $2,873 | $106,320 | $16,000 | $90,320 |

| 2023 | $2,310 | $100,240 | $16,000 | $84,240 |

| 2022 | $2,662 | $93,400 | $16,000 | $77,400 |

| 2021 | $2,068 | $68,120 | $16,000 | $52,120 |

| 2020 | $1,967 | $63,880 | $12,000 | $51,880 |

| 2019 | $1,827 | $57,000 | $10,000 | $47,000 |

| 2018 | $1,719 | $52,840 | $9,200 | $43,640 |

| 2016 | $1,414 | $44,400 | $8,000 | $36,400 |

| 2015 | $1,387 | $42,640 | $7,200 | $35,440 |

| 2014 | $1,088 | $34,680 | $5,600 | $29,080 |

Source: Public Records

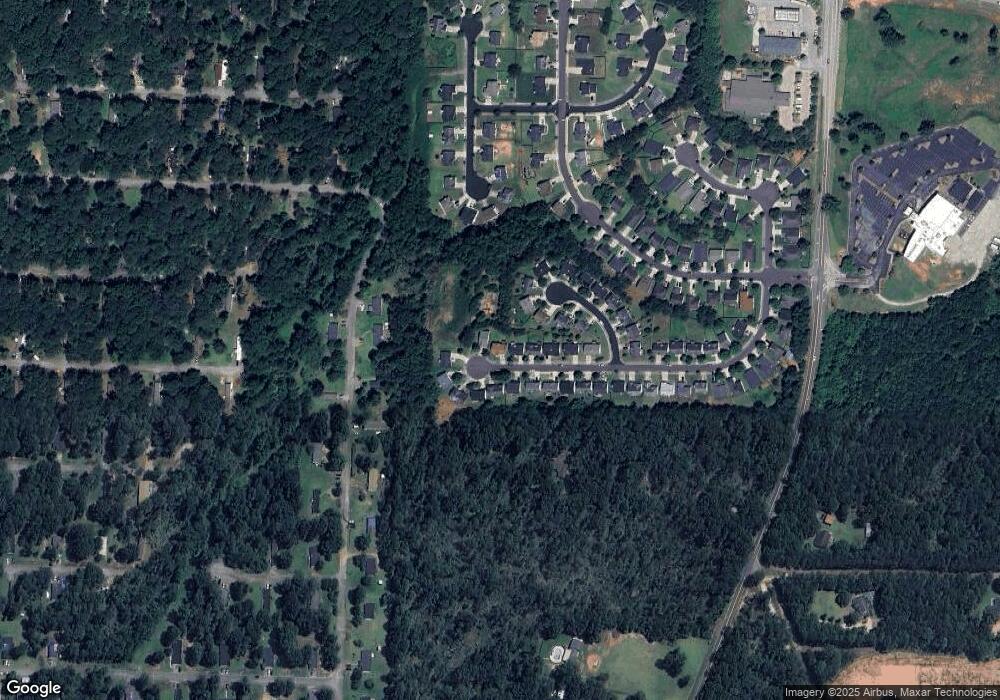

Map

Nearby Homes

- 1020 Saint Augustine Pkwy

- 1119 Saint Phillips Ct

- 1134 Saint Phillips Ct

- 1524 Queen Elizabeth Dr

- 1604 Lady Maria Ct

- 77 Rosser Ln

- 150 Aster Ave

- Cali Plan at Cedar Ridge - Locust Grove Station

- Belfort Plan at Cedar Ridge - Locust Grove Station

- Galen Plan at Cedar Ridge - Locust Grove Station

- Hayden Plan at Cedar Ridge - Locust Grove Station

- Packard Plan at Cedar Ridge - Locust Grove Station

- Flora Plan at Cedar Ridge - Locust Grove Station

- Penwell Plan at Cedar Ridge - Locust Grove Station

- 134 Aster Ave

- 138 Aster Ave

- 322 Chattahoochee Cir

- 239 Ferguson Ave

- 269 Baumgard Way

- 188 Sophie Cir

- 1167 St Phillips Ct Unit 68

- 1167 St Phillips Ct

- 1167 St Phillips Ct

- 1163 Saint Phillips Ct

- 1167 Saint Phillips Ct

- 1161 Saint Phillips Ct

- 1161 St Phillips Ct

- 1265 Saint Francis Ct

- 1255 Saint Francis Ct

- 1166 Saint Phillips Ct

- 1255 St Francis Ct

- 1164 Saint Phillips Ct

- 1159 Saint Phillips Ct

- 1168 Saint Phillips Ct

- 1162 Saint Phillips Ct Unit 75

- 1162 Saint Phillips Ct

- 1162 St Phillips Ct

- 1174 Saint Phillips Ct

- 1275 Saint Francis Ct

- 1245 St Francis Ct