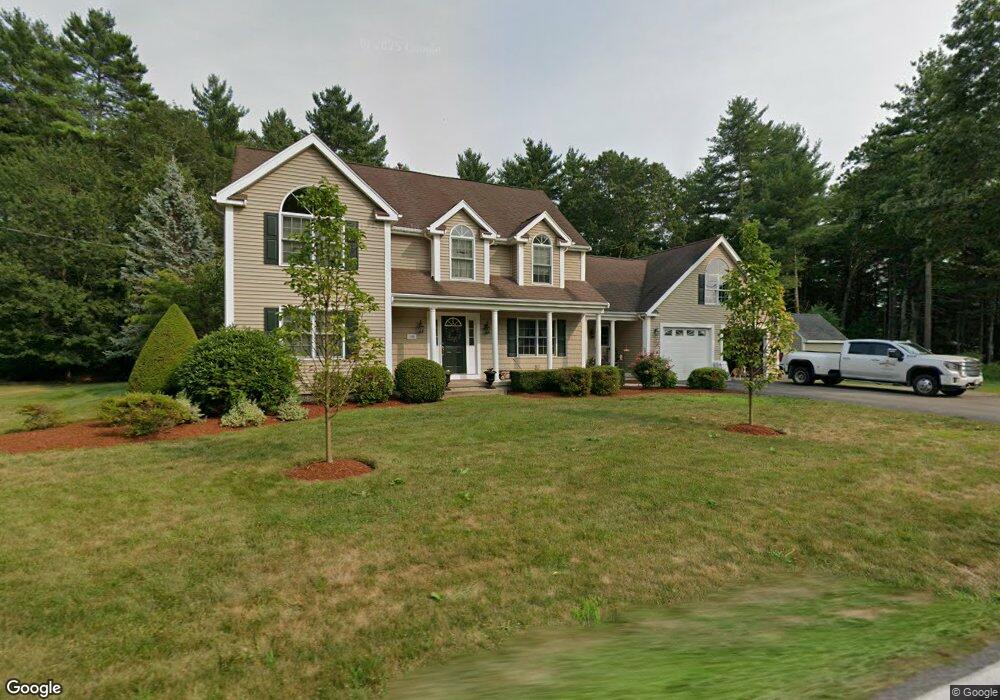

1166 West St Mansfield, MA 02048

Estimated Value: $817,482 - $989,000

4

Beds

3

Baths

2,464

Sq Ft

$369/Sq Ft

Est. Value

About This Home

This home is located at 1166 West St, Mansfield, MA 02048 and is currently estimated at $910,371, approximately $369 per square foot. 1166 West St is a home located in Bristol County with nearby schools including Everett W. Robinson Elementary School, Jordan/Jackson Elementary School, and Harold L. Qualters Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 27, 2006

Sold by

Degirolamo Ronald M and Swenson Linda L

Bought by

Degirolamo Ronald M and Degirolamo Linda L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$228,000

Outstanding Balance

$136,901

Interest Rate

6.48%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$773,470

Purchase Details

Closed on

Nov 10, 1989

Sold by

Corey Christopher P

Bought by

Degirolamo Ronald M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$131,400

Interest Rate

10.03%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Degirolamo Ronald M | -- | -- | |

| Degirolamo Ronald M | $146,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Degirolamo Ronald M | $228,000 | |

| Previous Owner | Degirolamo Ronald M | $223,700 | |

| Previous Owner | Degirolamo Ronald M | $126,000 | |

| Previous Owner | Degirolamo Ronald M | $131,400 | |

| Previous Owner | Degirolamo Ronald M | $15,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,179 | $772,900 | $254,600 | $518,300 |

| 2024 | $9,819 | $727,300 | $254,600 | $472,700 |

| 2023 | $9,402 | $667,300 | $254,600 | $412,700 |

| 2022 | $9,012 | $594,100 | $235,900 | $358,200 |

| 2021 | $0 | $546,900 | $206,300 | $340,600 |

| 2020 | $8,112 | $528,100 | $196,500 | $331,600 |

| 2019 | $3,773 | $498,400 | $163,800 | $334,600 |

| 2018 | $3,419 | $485,000 | $156,400 | $328,600 |

| 2017 | $0 | $471,600 | $152,100 | $319,500 |

| 2016 | $6,782 | $440,100 | $144,600 | $295,500 |

| 2015 | $6,588 | $425,000 | $144,600 | $280,400 |

Source: Public Records

Map

Nearby Homes