11675 S Auburn Fields Way Draper, UT 84020

Estimated Value: $480,000 - $545,000

3

Beds

3

Baths

2,297

Sq Ft

$224/Sq Ft

Est. Value

About This Home

This home is located at 11675 S Auburn Fields Way, Draper, UT 84020 and is currently estimated at $513,495, approximately $223 per square foot. 11675 S Auburn Fields Way is a home located in Salt Lake County with nearby schools including Sprucewood School, St John the Baptist Catholic Elementary School, and St. John the Baptist Catholic Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 15, 2020

Sold by

Wolf Amy E

Bought by

Wolf Amy E and Wyman Aaron

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$203,475

Outstanding Balance

$180,307

Interest Rate

3.3%

Mortgage Type

New Conventional

Estimated Equity

$333,188

Purchase Details

Closed on

Aug 30, 2017

Sold by

Morgese Cosimo and Morgese Annie

Bought by

Wolf Amy E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$205,000

Interest Rate

3.96%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 31, 2013

Sold by

Auburn Fields 70 Developments Inc

Bought by

Morgese Cosimo

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$188,283

Interest Rate

3.33%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 30, 2013

Sold by

Morgese Cosimo

Bought by

Morgese Cosimo and Anderson Anne

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$188,283

Interest Rate

3.33%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wolf Amy E | -- | Integrated Title Ins Svcs | |

| Wolf Amy E | -- | Title Guarantee | |

| Morgese Cosimo | -- | United Title Services | |

| Morgese Cosimo | -- | United Title Services |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wolf Amy E | $203,475 | |

| Closed | Wolf Amy E | $205,000 | |

| Previous Owner | Morgese Cosimo | $188,283 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,406 | $471,600 | $51,200 | $420,400 |

| 2024 | $2,406 | $459,700 | $49,400 | $410,300 |

| 2023 | $2,371 | $449,600 | $48,200 | $401,400 |

| 2022 | $2,497 | $457,300 | $47,300 | $410,000 |

| 2021 | $2,125 | $332,400 | $44,500 | $287,900 |

| 2020 | $2,030 | $301,100 | $39,100 | $262,000 |

| 2019 | $2,134 | $309,200 | $39,100 | $270,100 |

| 2018 | $1,994 | $295,300 | $67,000 | $228,300 |

| 2017 | $1,850 | $262,500 | $63,700 | $198,800 |

| 2016 | $1,814 | $250,100 | $105,400 | $144,700 |

| 2015 | $1,808 | $230,800 | $104,300 | $126,500 |

| 2014 | $1,673 | $208,700 | $95,900 | $112,800 |

Source: Public Records

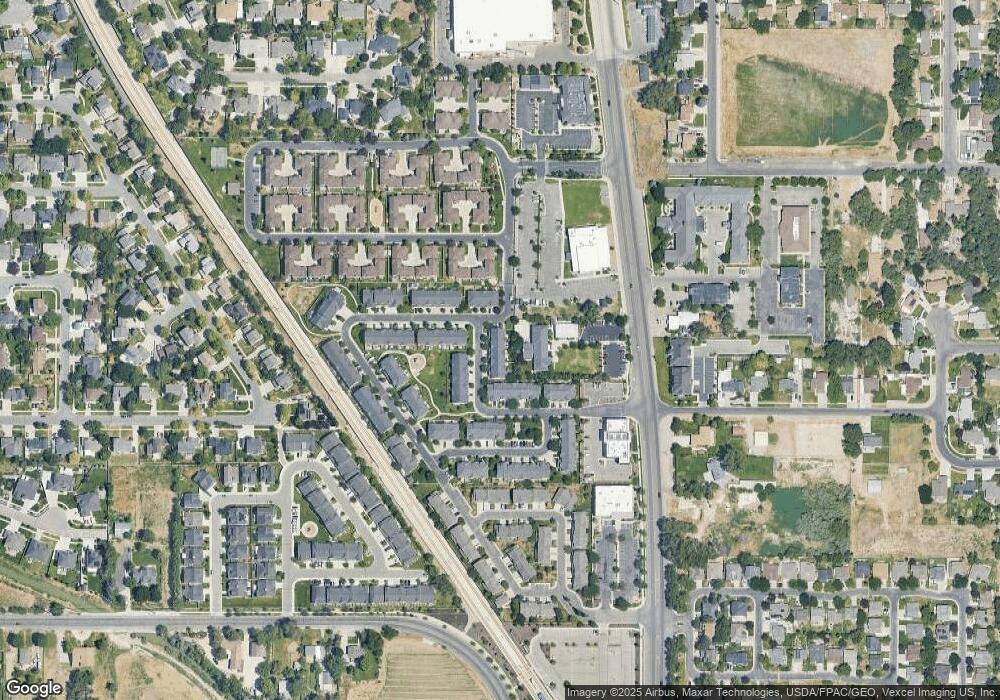

Map

Nearby Homes

- 11685 S Auburn Fields Way

- 655 E Auburn Fields Way

- 670 Wyngate Pointe Ln

- 654 Wyngate Pointe Ln

- 11743 S Nigel Peak Ln

- 11594 S Tuscan View Ct Unit 8

- 778 E Park Mesa Way

- 795 E Sunrise View Dr

- 677 E Moray Hill Ct

- 8858 S Willow Wood Dr

- 544 E 11900 S

- 951 E South Fork Cir

- 11533 S Berryknoll Cir

- 11726 S 1000 E

- 468 E 12000 S

- 735 E Dusty Creek Ave

- 989 E Dry Gulch Rd

- 1052 E 11780 S

- 262 Hidden View Dr Unit 94

- 677 E 12000 S

- 11675 S Auburn Fields Way Unit 19C

- 11673 S Auburn Fields Way Unit 19B

- 11673 S Auburn Fields Way

- 11679 S Auburn Fields Way

- 11667 S Auburn Fields Way

- 11667 S Auburn Fields Way Unit 19A

- 11687 S Auburn Fields Way

- 11687 S Auburn Fields Way Unit F

- 638 E Autumn Branch Way

- 11678 S Auburn Fields Way Unit 20F

- 11688 S Auburn Fields Way

- 647 E Auburn Fields Way

- 647 E Auburn Fields Way

- 643 E Auburn Fields Way

- 11690 S Auburn Fields Way Unit 20D

- 649 E Auburn Fields Way

- 649 Auburn Fields Way

- 632 E Autumn Branch Way Unit 17-B

- 632 E Autumn Branch Way

- 11706 S 700 E