11707 Maha Loop Rd Unit 4 Austin, TX 78719

Southeast Austin NeighborhoodEstimated Value: $397,000 - $611,000

--

Bed

2

Baths

2,736

Sq Ft

$172/Sq Ft

Est. Value

About This Home

This home is located at 11707 Maha Loop Rd Unit 4, Austin, TX 78719 and is currently estimated at $470,311, approximately $171 per square foot. 11707 Maha Loop Rd Unit 4 is a home located in Travis County with nearby schools including Creedmoor Elementary School, John P Ojeda Middle School, and Del Valle High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 19, 2024

Sold by

Pepper Aaron and Pepper Katherine

Bought by

Lowery William Zachary

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$400,000

Outstanding Balance

$395,504

Interest Rate

6.47%

Mortgage Type

VA

Estimated Equity

$74,807

Purchase Details

Closed on

Aug 11, 2020

Sold by

Vallejo Debbie Ovalle

Bought by

Pepper Aaron and Pepper Katherine

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$253,000

Interest Rate

3%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 23, 2018

Sold by

Vallejo Robert

Bought by

Vallejo Debbie Ovalle

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lowery William Zachary | -- | Texas National Title | |

| Pepper Aaron | -- | Itc | |

| Vallejo Debbie Ovalle | -- | None Available | |

| Vallejo Debbie Ovalle | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lowery William Zachary | $400,000 | |

| Previous Owner | Pepper Aaron | $253,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,898 | $609,819 | $133,711 | $476,108 |

| 2023 | $5,238 | $330,330 | $0 | $0 |

| 2022 | $6,610 | $300,300 | $0 | $0 |

| 2021 | $7,002 | $296,169 | $57,897 | $238,272 |

| 2020 | $4,280 | $167,259 | $18,829 | $148,430 |

| 2019 | $4,623 | $174,171 | $25,741 | $148,430 |

| 2018 | $4,668 | $170,568 | $25,741 | $144,827 |

| 2017 | $3,769 | $139,822 | $25,741 | $114,081 |

| 2016 | $3,769 | $139,822 | $25,741 | $114,081 |

| 2015 | $3,904 | $160,564 | $25,741 | $134,823 |

| 2014 | $3,904 | $157,110 | $0 | $0 |

Source: Public Records

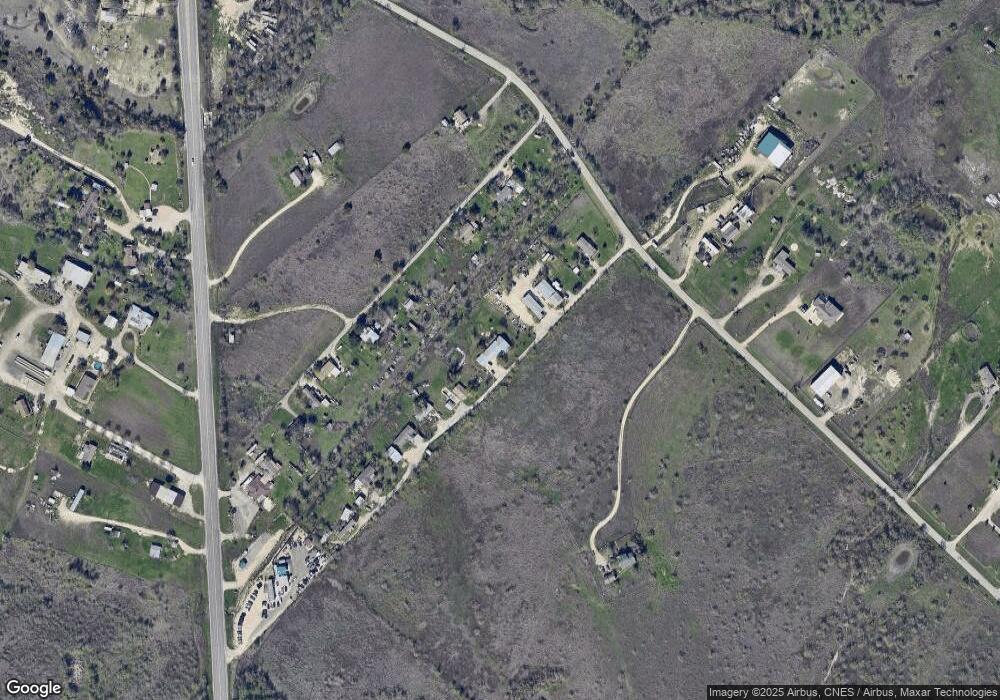

Map

Nearby Homes

- 9717 Sunflower Dr

- 9900 Shively

- 6607 Farm To Market Road 1327

- 11248 Tom Sassman Rd

- 12916 Eastland Dr

- 0 Farm To Market Road 1625

- 11604 Moore Rd

- 11212 Superior Bay Ln

- Nettleton Plan at Schriber Ranch

- Ramsey Plan at Schriber Ranch

- Newlin Plan at Schriber Ranch

- Littleton Plan at Schriber Ranch

- Selsey Plan at Schriber Ranch

- Oxford Plan at Schriber Ranch

- Gannes Plan at Schriber Ranch

- Springsteen Plan at Schriber Ranch

- Hendrix Plan at Schriber Ranch

- 11624 S Us Hy 183 Hwy

- 11701 Reata Dr

- Lot B & D Saddle Cir

- 11707 Maha Loop Rd Unit 6

- 11707 Maha Loop Rd Unit 2 B

- 10044 Vallejo Plains Ln Unit 4

- 11725 Maha Loop Rd Unit 1

- 11725 Maha Loop Rd Unit 5

- 9921 Otilia Ln Unit 1

- 9921 Otilia Ln

- 10001 Us Highway 183 S

- 11697 Maha Loop Rd

- 9917 Us Highway 183 S

- 10111 Us Highway 183 S

- 10111 S Highway 183

- 9914 Us Highway 183 S

- 10022 Us Highway 183 S

- 10000 Us Highway 183 S

- 11690 Maha Loop Rd

- 10020 Us Highway 183 S

- 10020 Us Highway 183 S

- 11682 Maha Loop Rd