11743 Harvest Bend Way Unit F Draper, UT 84020

Estimated Value: $489,000 - $563,199

3

Beds

3

Baths

2,755

Sq Ft

$191/Sq Ft

Est. Value

About This Home

This home is located at 11743 Harvest Bend Way Unit F, Draper, UT 84020 and is currently estimated at $526,300, approximately $191 per square foot. 11743 Harvest Bend Way Unit F is a home located in Salt Lake County with nearby schools including Sprucewood School, St John the Baptist Catholic Elementary School, and St. John the Baptist Catholic Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 11, 2014

Sold by

Evans Grant M and Evans Jackie

Bought by

Cram Pamela

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$219,080

Interest Rate

4.09%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 8, 2012

Sold by

Evans Grant M

Bought by

Evans Grant M and Evans Jackie

Purchase Details

Closed on

Mar 7, 2012

Sold by

Gengler Laura

Bought by

Evans Grant M

Purchase Details

Closed on

Jul 14, 2008

Sold by

Wachtel Dieter

Bought by

Auburn Fields Llc

Purchase Details

Closed on

Jul 10, 2008

Sold by

Auburn Fields Llc

Bought by

Gengler Laura

Purchase Details

Closed on

Mar 11, 2008

Sold by

Auburn Fields Of Draper Homeowners Assn

Bought by

Auburn Fields Llc

Purchase Details

Closed on

Mar 10, 2008

Sold by

Auburn Fields Of Draper Homeowners Assn

Bought by

Davis Jaren

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cram Pamela | -- | Metro National Title | |

| Evans Grant M | -- | Us Title | |

| Evans Grant M | -- | Cottonwood Title | |

| Auburn Fields Llc | -- | Integrated Title Ins Svcs | |

| Gengler Laura | -- | Integrated Title Ins Svcs | |

| Auburn Fields Llc | -- | Integrated Title Ins Svcs | |

| Davis Jaren | -- | Integrated Title Ins Svcs |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Cram Pamela | $219,080 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,512 | $491,100 | $51,200 | $439,900 |

| 2024 | $2,512 | $479,800 | $49,400 | $430,400 |

| 2023 | $2,476 | $469,500 | $48,200 | $421,300 |

| 2022 | $2,602 | $476,600 | $47,300 | $429,300 |

| 2021 | $2,223 | $347,800 | $44,500 | $303,300 |

| 2020 | $2,122 | $314,700 | $39,100 | $275,600 |

| 2019 | $2,271 | $329,100 | $39,100 | $290,000 |

| 2018 | $2,127 | $315,100 | $67,000 | $248,100 |

| 2017 | $2,121 | $300,900 | $63,700 | $237,200 |

| 2016 | $2,200 | $303,400 | $105,400 | $198,000 |

| 2015 | $2,019 | $257,800 | $107,500 | $150,300 |

| 2014 | $1,832 | $228,500 | $99,100 | $129,400 |

Source: Public Records

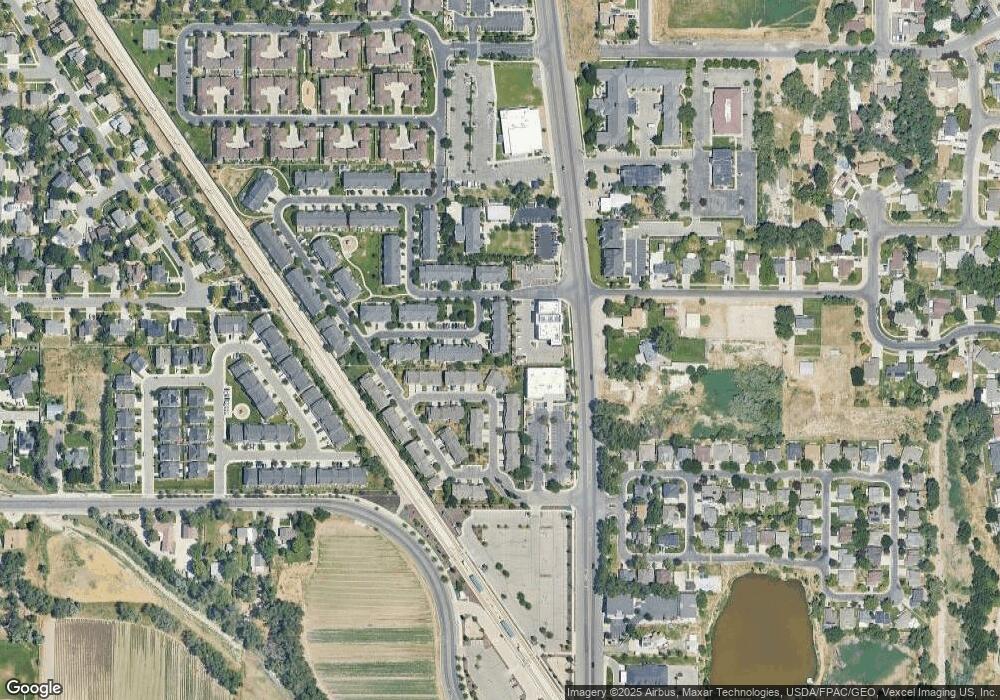

Map

Nearby Homes

- 655 E Auburn Fields Way

- 11685 S Auburn Fields Way

- 11743 S Nigel Peak Ln

- 670 Wyngate Pointe Ln

- 654 Wyngate Pointe Ln

- 11594 S Tuscan View Ct Unit 8

- 795 E Sunrise View Dr

- 677 E Moray Hill Ct

- 8858 S Willow Wood Dr

- 778 E Park Mesa Way

- 544 E 11900 S

- 951 E South Fork Cir

- 11726 S 1000 E

- 468 E 12000 S

- 1052 E 11780 S

- 989 E Dry Gulch Rd

- 677 E 12000 S

- 11533 S Berryknoll Cir

- 735 E Dusty Creek Ave

- 12073 S 300 E

- 11743 Harvest Bend Way

- 11743 S Harvest Bend Way

- 11737 S Harvest Bend Way

- 11737 S Harvest Bend Way

- 11733 Harvest Bend Way

- 11733 S Harvest Bend Way

- 11727 Harvest Bend Way

- 11727 S Harvest Bend Way

- 656 Harvest Bend Way Unit 135

- 11715 Harvest Bend Way

- 654 E Harvest Bend Way

- 11715 S Harvest Bend Way

- 654 Harvest Bend Way Unit 5

- 657 E Long Shadow Dr Unit 25

- 657 E Long Shadow Dr

- 657 Long Shadow Dr

- 661 Long Shadow Dr

- 661 E Long Shadow Dr

- 651 Long Shadow Dr

- 651 E Long Shadow Dr Unit 24