1175 E Johnson Lake Rd Pleasant Lake, IN 46779

Estimated Value: $196,941 - $331,000

3

Beds

2

Baths

1,739

Sq Ft

$152/Sq Ft

Est. Value

About This Home

This home is located at 1175 E Johnson Lake Rd, Pleasant Lake, IN 46779 and is currently estimated at $263,971, approximately $151 per square foot. 1175 E Johnson Lake Rd is a home located in Steuben County with nearby schools including Hamilton Community Elementary School and Hamilton Community High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 13, 2012

Sold by

Sanders Paul R

Bought by

Bird Branden P and Stuckey Jessica E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$84,932

Outstanding Balance

$59,680

Interest Rate

3.75%

Mortgage Type

FHA

Estimated Equity

$204,291

Purchase Details

Closed on

May 10, 2012

Sold by

Sanders Dorothy J

Bought by

Sanders Paul R

Purchase Details

Closed on

Dec 28, 2000

Sold by

Sanders Dorothy Jean Meyer

Bought by

Sanders Dorothy J and Sanders Paul

Purchase Details

Closed on

Nov 3, 2000

Sold by

Sanders Richard L and Sanders Dorothy J

Bought by

Sanders Dorothy Jean Meyer

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bird Branden P | -- | None Available | |

| Sanders Paul R | $250,734 | Stout Law Group Pc | |

| Sanders Dorothy J | -- | -- | |

| Sanders Dorothy Jean Meyer | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bird Branden P | $84,932 | |

| Closed | Sanders Dorothy Jean Meyer | $0 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,695 | $271,200 | $246,700 | $24,500 |

| 2023 | $2,347 | $230,900 | $206,200 | $24,700 |

| 2022 | $1,708 | $176,700 | $147,600 | $29,100 |

| 2021 | $1,726 | $151,200 | $127,100 | $24,100 |

| 2020 | $1,740 | $150,000 | $125,900 | $24,100 |

| 2019 | $2,013 | $177,000 | $152,900 | $24,100 |

| 2018 | $2,168 | $182,200 | $163,000 | $19,200 |

| 2017 | $2,270 | $204,900 | $187,400 | $17,500 |

| 2016 | $2,535 | $215,700 | $198,500 | $17,200 |

| 2014 | $2,444 | $223,300 | $207,500 | $15,800 |

| 2013 | $2,444 | $190,800 | $176,000 | $14,800 |

Source: Public Records

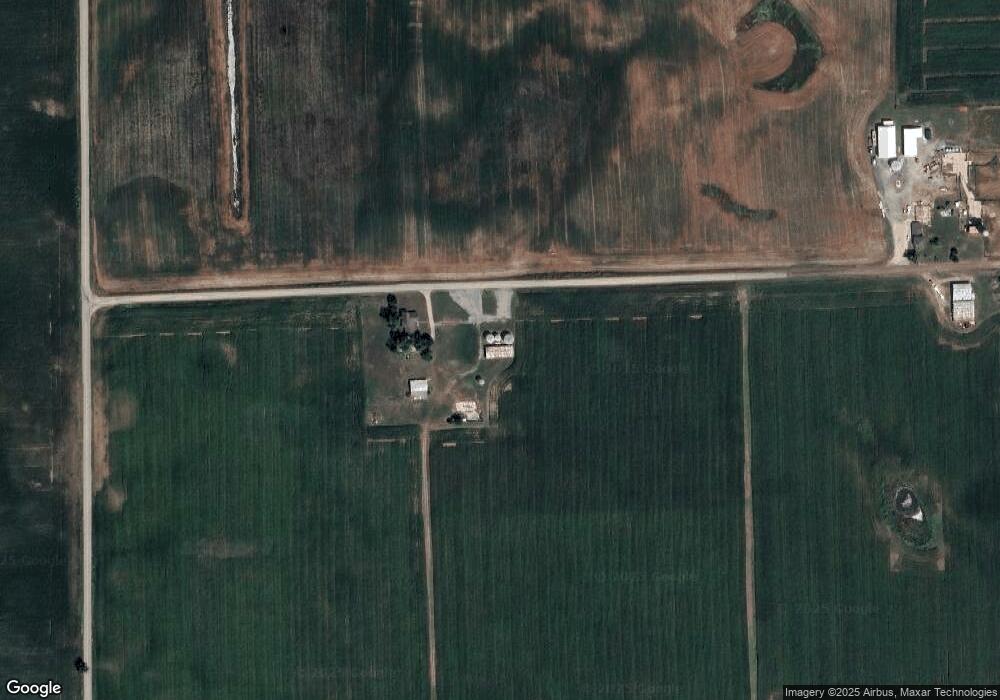

Map

Nearby Homes

- 990 W 400 S

- 180 Ln 282 Hamilton Lake Unit 180

- 6517 S Meridian Rd

- 940 Ln 282 Hamilton Lake Unit 179

- 200 Lane 280aa Hamilton Lake

- 140 Lane 270a Hamilton Lake

- ---- N Arthur Ct

- 707 Bluffview Dr

- 114 Chaudoin Dr

- 1105 Redding Ln

- 215 Ln 101a Hamilton Lake Unit Lot 33

- Clark's Landing Co Op 36

- Clarks Landing Ln

- 2080 S State Road 1

- 1003 Crestview Dr

- 405 Hilltop Dr

- 1045 S West St

- 320 Ln 110 Hamilton Lake

- 1007 S Superior St

- 501 W Fox Lake Rd