Estimated Value: $431,000 - $713,000

4

Beds

2

Baths

2,418

Sq Ft

$236/Sq Ft

Est. Value

About This Home

This home is located at 118 County Road 4773, Boyd, TX 76023 and is currently estimated at $569,974, approximately $235 per square foot. 118 County Road 4773 is a home located in Wise County with nearby schools including Boyd Elementary School, Boyd Middle School, and Boyd High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 6, 2016

Sold by

Nicholson Wilson and Nicholson Kacie

Bought by

Deshaw Patrick E and Davies Eric

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$286,000

Outstanding Balance

$229,283

Interest Rate

3.46%

Mortgage Type

New Conventional

Estimated Equity

$340,691

Purchase Details

Closed on

Feb 25, 2014

Sold by

Kolb Dean and Kolb Marion

Bought by

Nicholson Kacie and Nicholson Wilson

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$249,850

Interest Rate

4.44%

Mortgage Type

New Conventional

Purchase Details

Closed on

Nov 15, 2001

Sold by

Singleton David Lee

Bought by

Deshaw Patrick

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Deshaw Patrick E | -- | None Available | |

| Nicholson Kacie | -- | Republic Title Of Texas | |

| Deshaw Patrick | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Deshaw Patrick E | $286,000 | |

| Previous Owner | Nicholson Kacie | $249,850 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,230 | $428,725 | $30,834 | $397,891 |

| 2024 | $4,230 | $432,783 | $30,601 | $402,182 |

| 2023 | $5,075 | $424,880 | $0 | $0 |

| 2022 | $5,603 | $377,275 | $0 | $0 |

| 2021 | $2,437 | $230,280 | $87,960 | $142,320 |

| 2020 | $2,221 | $200,230 | $70,920 | $129,310 |

| 2019 | $2,203 | $190,550 | $70,920 | $119,630 |

| 2018 | $2,240 | $174,660 | $56,580 | $118,080 |

| 2017 | $2,040 | $148,330 | $39,060 | $109,270 |

| 2016 | $3,724 | $278,390 | $62,160 | $216,230 |

| 2015 | -- | $261,950 | $59,040 | $202,910 |

| 2014 | -- | $200,720 | $8,200 | $192,520 |

Source: Public Records

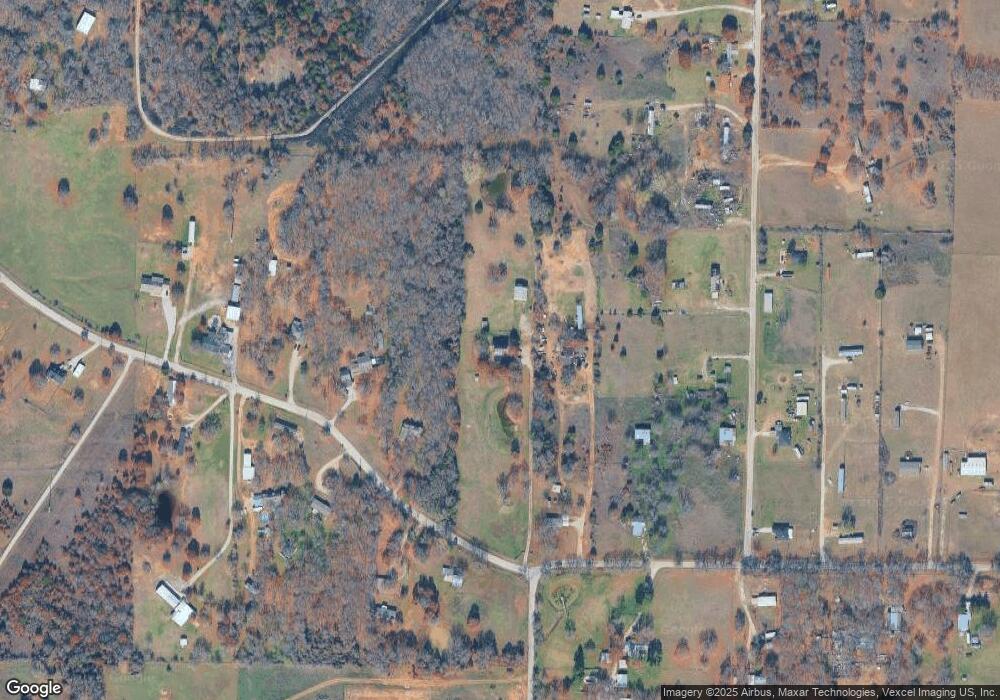

Map

Nearby Homes

- 122 Loveta Ln

- 128 Loveta Ln

- 144 Loveta Ln

- McKinley I Plan at Arbor Oaks

- McKinley V Plan at Arbor Oaks

- McKinley II Plan at Arbor Oaks

- Nolan Plan at Arbor Oaks

- Hudson II Plan at Arbor Oaks

- Witchita Plan at Arbor Oaks

- Hudson Plan at Arbor Oaks

- Iverson IV Plan at Arbor Oaks

- Iverson III Plan at Arbor Oaks

- Iverson I Plan at Arbor Oaks

- Garrison II Plan at Arbor Oaks

- 151 Rj Smith Dr

- 139 Rj Smith Dr

- 123 Rj Smith Dr

- 135 Rj Smith Dr

- 127 Rj Smith Dr

- 1621 County Road 4764

- 168 County Road 4773

- 210 County Road 4773

- 246 County Road 4773

- 0 Cr-4773

- 217 County Road 4773

- 129 County Road 4774

- 265 County Road 4773

- 1222 County Road 4764

- 270 County Road 4773

- 118 County Road 4774

- 118 County Road 4774

- 0 County Road 4773

- 1223 County Road 4764

- 276 County Road 4773

- 100 County Road 4774

- 755 County Road 4764

- 0 County Road 4764

- 110 Private Road 4765

- 104 County Road 4764

- 110 Pr 4765