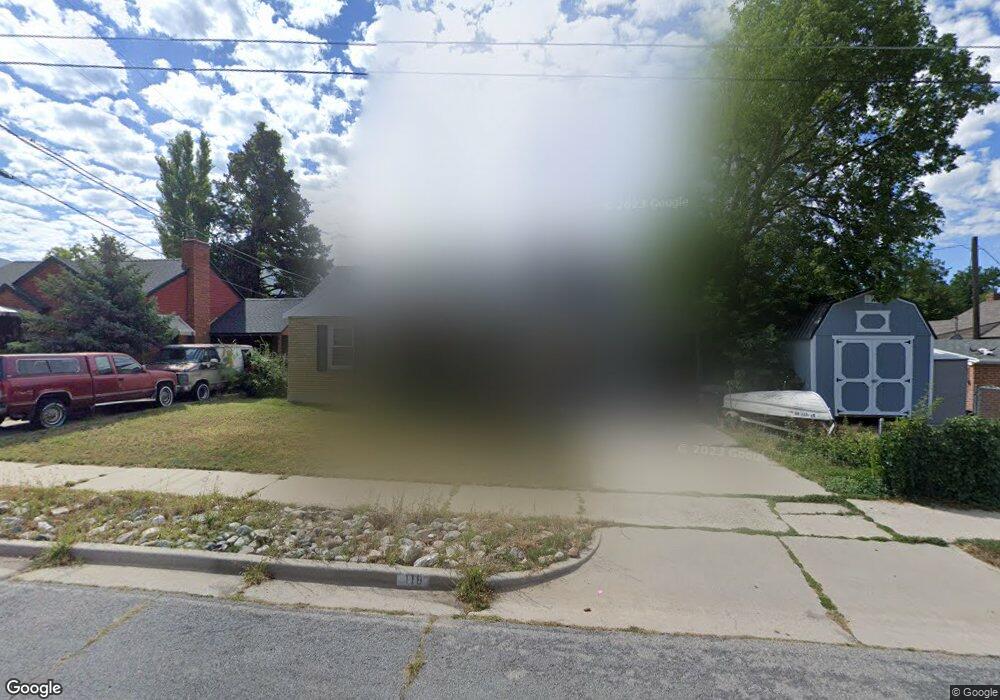

118 E 300 N Brigham City, UT 84302

Estimated Value: $326,050 - $366,000

4

Beds

2

Baths

1,576

Sq Ft

$219/Sq Ft

Est. Value

About This Home

This home is located at 118 E 300 N, Brigham City, UT 84302 and is currently estimated at $344,513, approximately $218 per square foot. 118 E 300 N is a home located in Box Elder County with nearby schools including Box Elder Middle School, Adele C. Young Intermediate School, and Box Elder High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 19, 2010

Sold by

Romer Paul J

Bought by

Romer Paul J and Reynolds Tamara M

Current Estimated Value

Purchase Details

Closed on

Mar 25, 2008

Sold by

Young Zachary W

Bought by

Young Zachary W and Young Ashley M

Purchase Details

Closed on

May 12, 2006

Sold by

American Pension Services In

Bought by

Young Zachary W

Purchase Details

Closed on

May 10, 2006

Sold by

American Pension Services Inc

Bought by

American Pension Services Inc and Ira 6040

Purchase Details

Closed on

May 8, 2006

Sold by

Law Loran M

Bought by

American Pension Services Inc and Ira 6040

Purchase Details

Closed on

Apr 24, 2006

Sold by

Takara Franklin K

Bought by

American Pension Services Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Romer Paul J | -- | -- | |

| Romer Paul J | -- | -- | |

| Young Zachary W | -- | -- | |

| Young Zachary W | -- | -- | |

| Young Zachary W | -- | Centenntal Title Ins Agency | |

| American Pension Services Inc | -- | Centennial Titel Ins Agency | |

| American Pension Services Inc | -- | Centennial Title Ins Agency | |

| American Pension Services Inc | -- | Centennial Title Ins Agency |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $25 | $310,513 | $105,000 | $205,513 |

| 2024 | $25 | $303,513 | $100,000 | $203,513 |

| 2023 | $1,568 | $309,146 | $95,000 | $214,146 |

| 2022 | $84 | $160,111 | $22,000 | $138,111 |

| 2021 | $1,216 | $173,346 | $40,000 | $133,346 |

| 2020 | $1,067 | $173,346 | $40,000 | $133,346 |

| 2019 | $1,005 | $86,903 | $22,000 | $64,903 |

| 2018 | $456 | $78,437 | $22,000 | $56,437 |

| 2017 | $753 | $111,994 | $16,500 | $81,994 |

| 2016 | $395 | $59,450 | $16,500 | $42,950 |

| 2015 | $370 | $55,545 | $16,500 | $39,045 |

| 2014 | $370 | $53,686 | $16,500 | $37,186 |

| 2013 | -- | $53,686 | $16,500 | $37,186 |

Source: Public Records

Map

Nearby Homes