11865 Tevare Ln Unit 1080 Las Vegas, NV 89138

Estimated Value: $378,905 - $426,000

2

Beds

2

Baths

1,466

Sq Ft

$274/Sq Ft

Est. Value

About This Home

This home is located at 11865 Tevare Ln Unit 1080, Las Vegas, NV 89138 and is currently estimated at $400,976, approximately $273 per square foot. 11865 Tevare Ln Unit 1080 is a home located in Clark County with nearby schools including Billy And Rosemary Vassiliadis Elementary School, Sig Rogich Middle School, and Palo Verde High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 24, 2021

Sold by

Garand David T and Garand Michele

Bought by

Garand David T and Garand Michele A

Current Estimated Value

Purchase Details

Closed on

Aug 30, 2018

Sold by

Stepuchin Frank and Stepuchin Louise

Bought by

Garand David T and Garand Michele

Purchase Details

Closed on

Dec 2, 2009

Sold by

Ocean Ii Llc

Bought by

Stepuchin Frank N and Stepuchin Louise A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$105,000

Interest Rate

5.01%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 29, 2008

Sold by

H D Paseo Llc

Bought by

Ocean Ii Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Garand David T | -- | None Available | |

| Garand David T | $286,259 | None Available | |

| Stepuchin Frank N | $155,000 | Chicago Title Las Vegas | |

| Ocean Ii Llc | $300,000 | Stewart Title Of Nevada Las |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Stepuchin Frank N | $105,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,877 | $106,782 | $45,150 | $61,632 |

| 2024 | $1,823 | $106,782 | $45,150 | $61,632 |

| 2023 | $1,912 | $101,614 | $45,150 | $56,464 |

| 2022 | $1,856 | $89,970 | $37,800 | $52,170 |

| 2021 | $1,717 | $90,266 | $39,900 | $50,366 |

| 2020 | $1,664 | $83,375 | $39,900 | $43,475 |

| 2019 | $1,523 | $67,465 | $26,950 | $40,515 |

| 2018 | $1,476 | $55,621 | $16,958 | $38,663 |

| 2017 | $1,783 | $54,212 | $14,963 | $39,249 |

| 2016 | $1,399 | $52,803 | $14,630 | $38,173 |

| 2015 | $1,395 | $46,275 | $8,313 | $37,962 |

| 2014 | $1,355 | $45,613 | $7,980 | $37,633 |

Source: Public Records

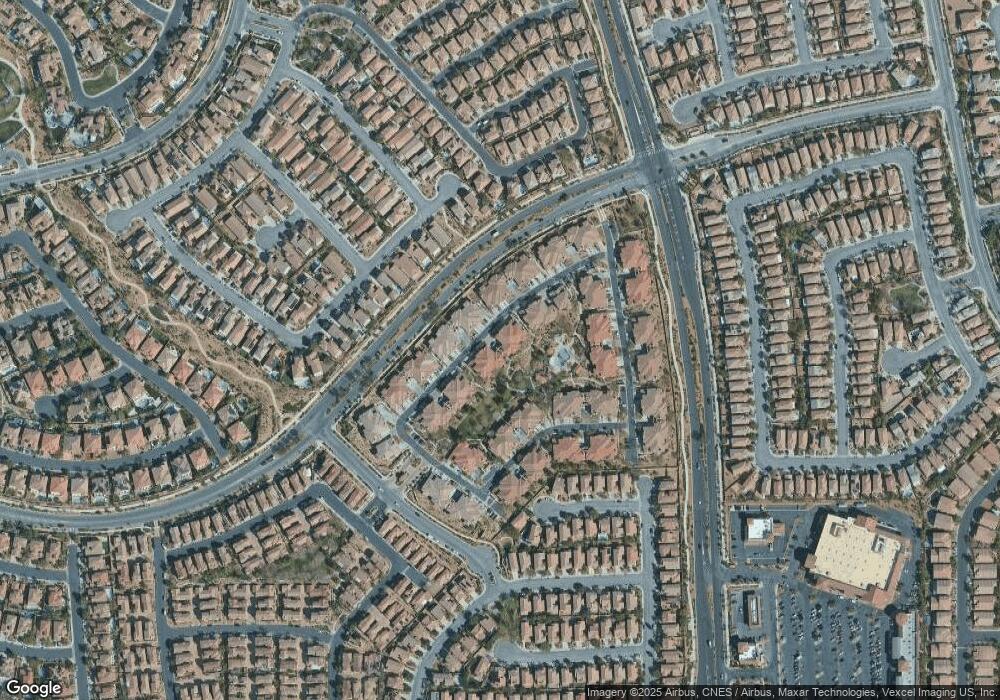

Map

Nearby Homes

- 11865 Tevare Ln Unit 1079

- 845 Canterra St Unit 2051

- 860 Canterra St Unit 1036

- 875 Pantara Place Unit 1003

- 840 Paseo Rocoso Place

- 11848 Orense Dr

- 11832 Arenoso Dr

- 841 Colina Alta Place

- 11620 Longhirst Hall Ln

- 12020 Prada Verde Dr

- 1064 Calvia St

- 11904 Amistoso Ln

- 11925 Luna Del Mar Ln

- 716 Chervil Valley Dr

- 776 Anacapri St

- 873 Roseberry Dr

- 11745 Via Esperanza Ave

- 1020 Puerta Del Sol Dr

- 712 Tandoori Ln

- 636 Chervil Valley Dr

- 11865 Tevare Ln Unit 1078

- 11865 Tevare Ln Unit 2077

- 11865 Tevare Ln Unit 2082

- 11865 Tevare Ln Unit 2081

- 11865 Tevare Ln Unit 2080

- 11865 Tevare Ln Unit 2079

- 11865 Tevare Ln Unit 1081

- 11865 Tevare Ln Unit 2078

- 11816 Pandion Ave

- 11528 Fleet Wing Ave

- 11520 Fleet Wing Ave

- 11512 Fleet Wing Ave

- 11777 Pandion Ave

- 11789 Pandion Ave

- 11801 Pandion Ave

- 11870 Tevare Ln

- 11870 Tevare Ln

- 11870 Tevare Ln Unit 1084

- 11870 Tevare Ln Unit 2087

- 11870 Tevare Ln Unit 2083