11901 NW 11th St Unit 11901 Pembroke Pines, FL 33026

Pembroke Lakes NeighborhoodEstimated Value: $287,997 - $309,000

3

Beds

2

Baths

900

Sq Ft

$330/Sq Ft

Est. Value

About This Home

This home is located at 11901 NW 11th St Unit 11901, Pembroke Pines, FL 33026 and is currently estimated at $296,999, approximately $329 per square foot. 11901 NW 11th St Unit 11901 is a home located in Broward County with nearby schools including Pembroke Lakes Elementary School, Walter C. Young Middle School, and Charles W Flanagan High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 1, 2017

Bought by

Hill Tiffany

Current Estimated Value

Purchase Details

Closed on

Oct 15, 2015

Sold by

Secretary Of Veterans Affairs

Bought by

Agudelo Angel David

Purchase Details

Closed on

Mar 4, 2015

Sold by

Jpmorgan Chase Bank National Association

Bought by

Secretary Of Veterans Affairs

Purchase Details

Closed on

Feb 10, 2015

Sold by

Garza Richard A

Bought by

Jpmorgan Chase Bank National Association

Purchase Details

Closed on

Apr 17, 2012

Sold by

Garza Richard A

Bought by

Pierpointe Five Condominium I Associatio

Purchase Details

Closed on

Jun 16, 2000

Sold by

Insinga Robert

Bought by

Garza Richard A

Purchase Details

Closed on

May 19, 1993

Sold by

Ballard Lee M and Ballard Kelly

Bought by

Insinga Robert and Insinga Addys

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$57,400

Interest Rate

7.18%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hill Tiffany | $180,000 | -- | |

| Agudelo Angel David | $119,100 | Attorney | |

| Secretary Of Veterans Affairs | -- | Attorney | |

| Jpmorgan Chase Bank National Association | $10,100 | None Available | |

| Pierpointe Five Condominium I Associatio | $400 | None Available | |

| Garza Richard A | $85,000 | -- | |

| Insinga Robert | $59,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Garza Richard A | $92,319 | |

| Previous Owner | Insinga Robert | $57,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,587 | $268,260 | -- | -- |

| 2024 | $4,939 | $260,700 | -- | -- |

| 2023 | $4,939 | $225,290 | $0 | $0 |

| 2022 | $4,201 | $204,810 | $20,480 | $184,330 |

| 2021 | $2,584 | $159,250 | $0 | $0 |

| 2020 | $2,553 | $157,060 | $0 | $0 |

| 2019 | $2,489 | $153,530 | $0 | $0 |

| 2018 | $2,386 | $150,670 | $15,070 | $135,600 |

| 2017 | $2,938 | $131,890 | $0 | $0 |

| 2016 | $2,660 | $119,900 | $0 | $0 |

| 2015 | $604 | $89,050 | $0 | $0 |

| 2014 | $2,003 | $80,960 | $0 | $0 |

| 2013 | -- | $73,600 | $7,360 | $66,240 |

Source: Public Records

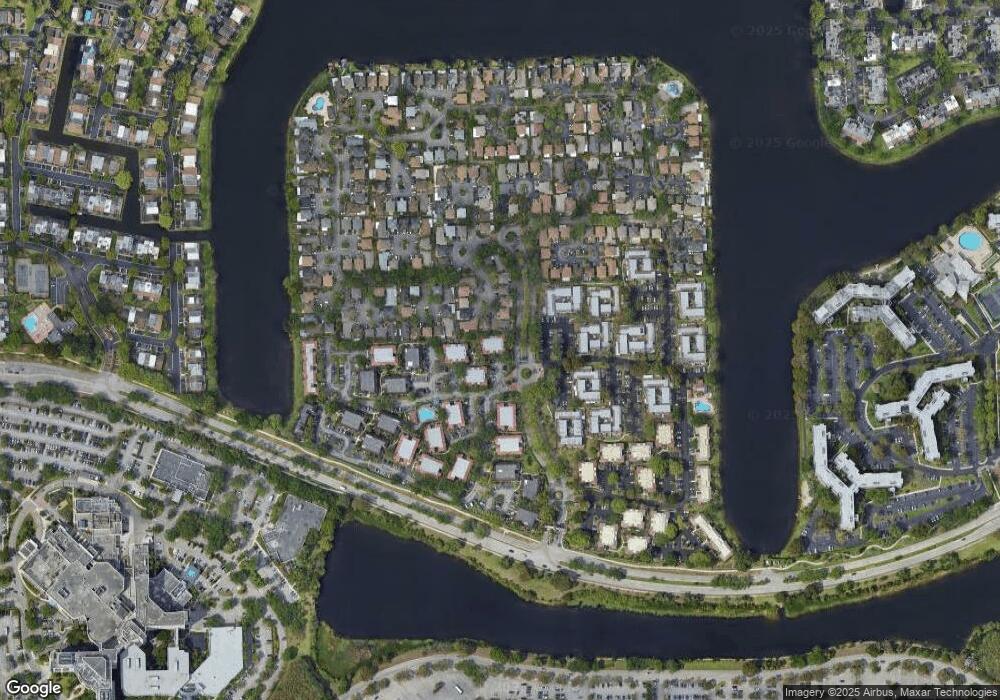

Map

Nearby Homes

- 11740 NW 12th St Unit 11740

- 11733 NW 11th St

- 11652 NW 11th St

- 12018 NW 13th St

- 11657 NW 11th St

- 11972 NW 11th St Unit 11972

- 11862 NW 13th St

- 11976 NW 12th St

- 12078 NW 11th St Unit 12078

- 11604 NW 11th St

- 11537 NW 10th St Unit 11537

- 11533 NW 10th St Unit 11533

- 12064 NW 13th St

- 1178 NW 122nd Terrace

- 1239 NW 122nd Terrace

- 1100 Colony Point Cir Unit 3105

- 1100 Colony Point Cir Unit 215

- 1100 Colony Point Cir Unit 504

- 1100 Colony Point Cir Unit 205

- 1100 Colony Point Cir Unit 201

- 11901 NW 11th St Unit 11901

- 11905 NW 11th St Unit 11905

- 11913 NW 11th St Unit 1193

- 11909 NW 11th St Unit 11909

- 11914 NW 12th St

- 11921 NW 11th St Unit 11921

- 11916 NW 12th St

- 11900 NW 11th St Unit 11901

- 11917 NW 11th St Unit 11917

- 11912 NW 12th St

- 11925 NW 11th St Unit 11925

- 11925 NW 11th St Unit 11925

- 11918 NW 12th St

- 11937 NW 11th St Unit 11937

- 11937 NW 11th St Unit 11937

- 11929 NW 11th St Unit 11929

- 11903 NW 11th St Unit 11903

- 11910 NW 12th St

- 11920 NW 12th St

- 11945 NW 11th St Unit 11945