1191 New Hope Rd Locust Grove, GA 30248

Estimated Value: $296,000 - $316,411

3

Beds

2

Baths

1,908

Sq Ft

$160/Sq Ft

Est. Value

About This Home

This home is located at 1191 New Hope Rd, Locust Grove, GA 30248 and is currently estimated at $305,353, approximately $160 per square foot. 1191 New Hope Rd is a home located in Henry County with nearby schools including New Hope Elementary School and Ola Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 28, 2004

Sold by

Smith Lonnie R

Bought by

Shelnutt Christine M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$108,500

Outstanding Balance

$53,926

Interest Rate

6.25%

Mortgage Type

New Conventional

Estimated Equity

$251,427

Purchase Details

Closed on

Apr 26, 2000

Sold by

Beaver Builders Inc

Bought by

Smith Lonnie R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$122,000

Interest Rate

8.24%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Shelnutt Christine M | $158,500 | -- | |

| Smith Lonnie R | $122,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Shelnutt Christine M | $108,500 | |

| Previous Owner | Smith Lonnie R | $122,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,569 | $129,720 | $16,560 | $113,160 |

| 2024 | $3,569 | $117,920 | $14,920 | $103,000 |

| 2023 | $2,744 | $111,560 | $14,360 | $97,200 |

| 2022 | $2,781 | $91,760 | $13,240 | $78,520 |

| 2021 | $2,466 | $78,400 | $11,360 | $67,040 |

| 2020 | $2,243 | $68,960 | $10,720 | $58,240 |

| 2019 | $2,168 | $65,800 | $10,160 | $55,640 |

| 2018 | $2,035 | $60,160 | $9,400 | $50,760 |

| 2016 | $1,771 | $52,200 | $7,560 | $44,640 |

| 2015 | $1,694 | $49,120 | $8,480 | $40,640 |

| 2014 | $1,196 | $36,240 | $8,480 | $27,760 |

Source: Public Records

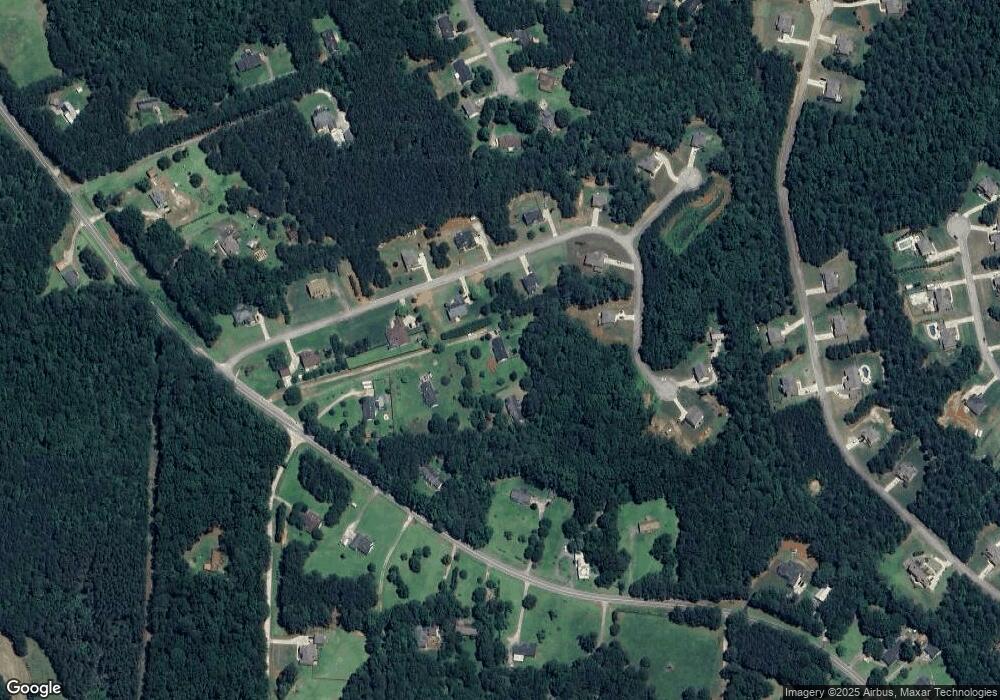

Map

Nearby Homes

- 1611 Laney Rd

- 314 Marbella Way

- 813 S Ola Rd

- 0 S Ola Rd Unit 10563258

- 238 Knob Hill Dr

- 121 Ducati Dr

- 732 New Hope Rd

- 407 Victoria Place Dr

- 888 Laney Rd

- 214 Knob Hill Dr

- 1712 New Hope Rd

- 1003 Ola Dale Dr

- 114 Aristocratic Way

- 143 Whitworth Dr Unit 10

- 143 Whitworth Dr

- 147 Whitworth Dr

- 376 Cattlemans Cir

- 150 Whitworth Dr

- 1105 Patriot Cir

- 2001 Jefferson Way

- 1197 New Hope Rd

- 112 Constance Dr Unit LOT 15

- 112 Constance Dr

- 1193 New Hope Rd

- 126 Constance Dr

- 126 Constance Dr Unit 13

- 120 Constance Rd

- 0 Constance Dr Unit 14 3181643

- 120 Constance Dr Unit 14

- 120 Constance Dr

- 113 Constance Dr Unit 4

- 113 Constance Dr

- 120 Constance Dr

- 109 Constance Dr

- 1253 New Hope Rd

- 117 Constance Dr Unit 5

- 0 Constance Dr Unit 8514074

- 0 Constance Dr Unit 8359944

- 0 Constance Dr Unit 8327775

- 0 Constance Dr Unit 7502678