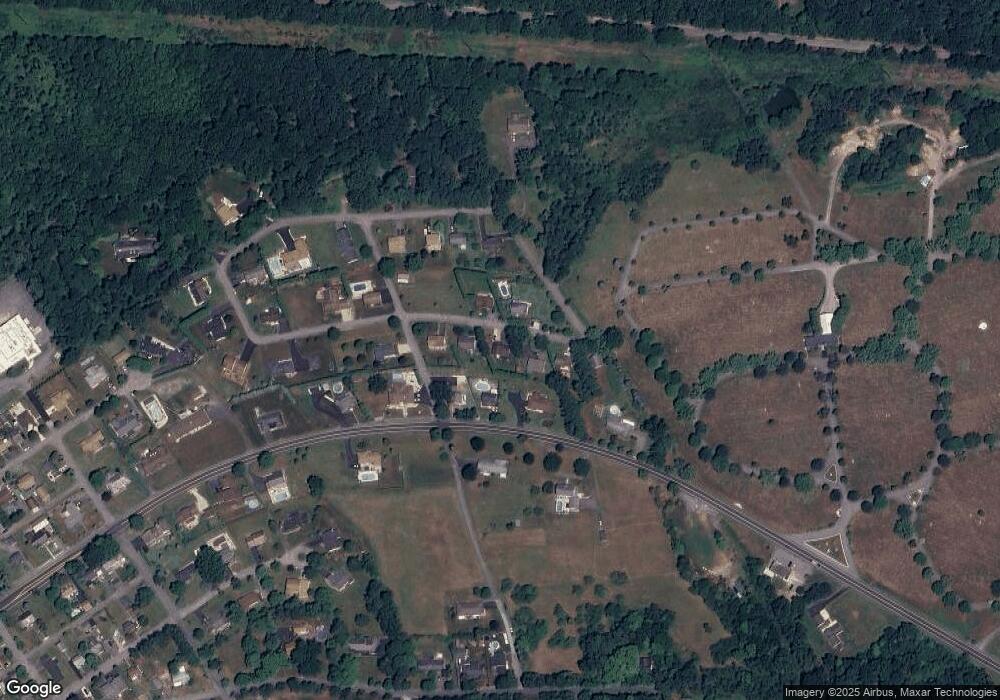

12 Crest Ln Tamaqua, PA 18252

Estimated Value: $263,000 - $282,000

3

Beds

2

Baths

1,552

Sq Ft

$174/Sq Ft

Est. Value

About This Home

This home is located at 12 Crest Ln, Tamaqua, PA 18252 and is currently estimated at $269,791, approximately $173 per square foot. 12 Crest Ln is a home located in Schuylkill County with nearby schools including Tamaqua Area Senior High School and Marian Catholic High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 2, 2011

Sold by

Donovan Shaun

Bought by

Valasek John and Valasek Patricia

Current Estimated Value

Purchase Details

Closed on

May 12, 2011

Sold by

Wells Fargo Bank Na

Bought by

The Secretary Of Housing And Urban Devel

Purchase Details

Closed on

Apr 18, 2011

Sold by

Sherrif Of Schuylkill

Bought by

Wells Fargo Bank Na

Purchase Details

Closed on

Jun 9, 2005

Sold by

Household Finance Consumer Discount Co

Bought by

Booth Steven

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$24,600

Interest Rate

5.73%

Mortgage Type

Stand Alone Second

Purchase Details

Closed on

Feb 18, 2005

Sold by

Dunbar Owen W and Dunbar Gena M

Bought by

Household Finance Consumer Discount Co

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Valasek John | $70,000 | Allco Abstract Inc | |

| The Secretary Of Housing And Urban Devel | -- | None Available | |

| Wells Fargo Bank Na | $931 | None Available | |

| Booth Steven | $123,000 | None Available | |

| Household Finance Consumer Discount Co | $917 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Booth Steven | $24,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,087 | $58,235 | $5,000 | $53,235 |

| 2024 | $4,356 | $58,235 | $5,000 | $53,235 |

| 2023 | $3,655 | $58,235 | $5,000 | $53,235 |

| 2022 | $3,544 | $58,235 | $5,000 | $53,235 |

| 2021 | $3,579 | $58,235 | $5,000 | $53,235 |

| 2020 | $3,498 | $58,235 | $5,000 | $53,235 |

| 2018 | $3,388 | $58,235 | $5,000 | $53,235 |

| 2017 | $3,260 | $58,235 | $5,000 | $53,235 |

| 2015 | -- | $58,235 | $5,000 | $53,235 |

| 2011 | -- | $58,235 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 57 Ardmore Ave

- 1 Lafayette Ave

- 225 Claremont Ave

- 1080 Claremont Ave

- 6 Meadow Ave

- 26 Lincoln Dr

- 0 Ryan Ave

- 0 Lincoln Dr Unit 765974

- 0 Lincoln Dr Unit PASK2023774

- 0 Lincoln Dr Unit PM-136722

- 0 Lincoln Dr

- 0 Lincoln Dr Unit 725051

- East Lincoln St

- 0 Hauto Highway Lot Unit WP001

- 0 Claremont Ave Unit 8-8824

- 603 Brew St

- 533 N Railroad St

- 515 N Railroad St

- 504 Pine St

- 500 Pine St