12 Davis St Jamestown, OH 45335

Estimated Value: $112,000 - $146,000

2

Beds

1

Bath

992

Sq Ft

$134/Sq Ft

Est. Value

About This Home

This home is located at 12 Davis St, Jamestown, OH 45335 and is currently estimated at $133,157, approximately $134 per square foot. 12 Davis St is a home located in Greene County with nearby schools including Greeneview Elementary School, Greeneview Middle School, and Greeneview High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 7, 2021

Sold by

Estate Of Connie M Huff

Bought by

Warner Kellie I and Huff Kimberlie R

Current Estimated Value

Purchase Details

Closed on

Jun 23, 2016

Sold by

Sharpe Carol I and Sharpe Carol I

Bought by

Sharpe Donald Phillips and Sharpe Carole Irene

Purchase Details

Closed on

Mar 4, 2009

Sold by

Kiser Annabelle

Bought by

Sharpe Carol I and Huff Connie M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Warner Kellie I | -- | None Available | |

| Sharpe Donald Phillips | $14,000 | None Available | |

| Sharpe Carol I | -- | Attorney |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,720 | $36,500 | $3,660 | $32,840 |

| 2023 | $1,720 | $36,500 | $3,660 | $32,840 |

| 2022 | $1,554 | $27,450 | $3,660 | $23,790 |

| 2021 | $1,566 | $27,450 | $3,660 | $23,790 |

| 2020 | $964 | $27,450 | $3,660 | $23,790 |

| 2019 | $916 | $25,880 | $3,660 | $22,220 |

| 2018 | $919 | $25,880 | $3,660 | $22,220 |

| 2017 | $896 | $25,880 | $3,660 | $22,220 |

| 2016 | $897 | $25,800 | $3,660 | $22,140 |

| 2015 | $877 | $25,800 | $3,660 | $22,140 |

| 2014 | $829 | $25,800 | $3,660 | $22,140 |

Source: Public Records

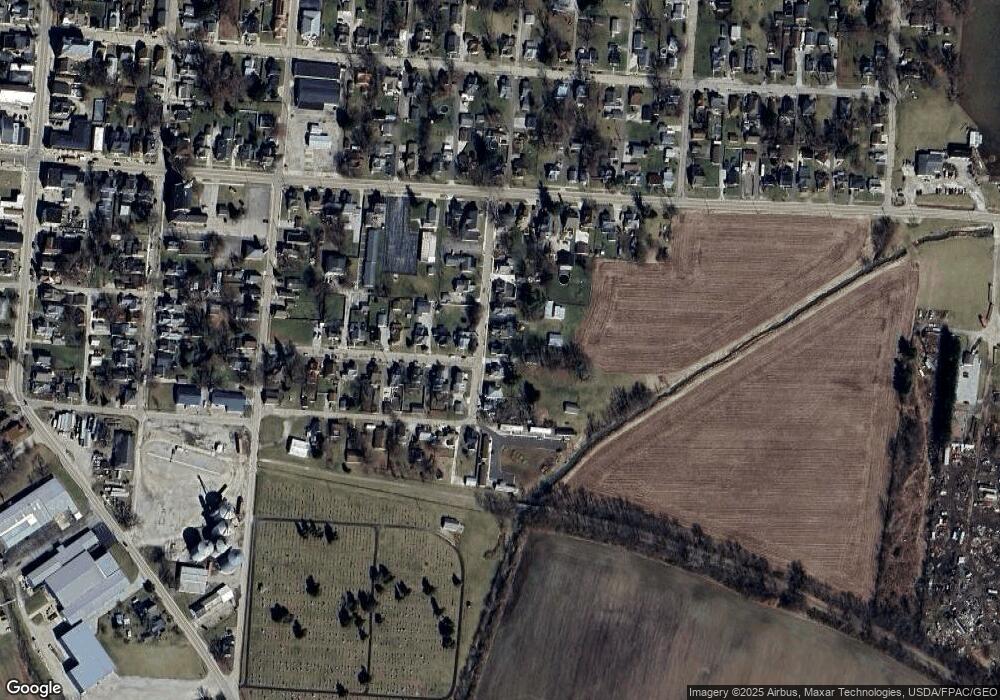

Map

Nearby Homes

- 23 Verity St

- 8 S Sycamore St

- 21 E Xenia St

- 4 Verity St

- 24 S Limestone St

- 26 S Limestone St

- 21 S Buckles Ave

- 0 Adams St Unit 943175

- 280 S Charleston Rd

- 56 W Xenia St

- 10 Maplewood Dr

- 14 Brookside St

- 3 Brookside St

- 0 Brickel Rd Unit 1850484

- 0 Apache Trail Unit 941961

- 204 Ivy Creek Cove

- 6345 Old Us Route 35 E

- 855 Quarry Rd

- 621 Quarry Rd

- 4533 Navajo Trail