12 Governors Row West Hartford, CT 06117

Estimated Value: $582,000 - $715,000

3

Beds

4

Baths

3,911

Sq Ft

$163/Sq Ft

Est. Value

About This Home

This home is located at 12 Governors Row, West Hartford, CT 06117 and is currently estimated at $639,411, approximately $163 per square foot. 12 Governors Row is a home located in Hartford County with nearby schools including Norfeldt School, King Philip Middle School, and Hall High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 25, 2021

Sold by

Davila Andreea O

Bought by

Davila Miguel and Mada-Davila Andrea O

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$148,000

Interest Rate

2.8%

Mortgage Type

Stand Alone Refi Refinance Of Original Loan

Purchase Details

Closed on

Oct 2, 2006

Sold by

Davila Miguel

Bought by

Chiriac Andrea Mada

Purchase Details

Closed on

Jul 17, 2006

Sold by

Berman John A

Bought by

Davila Miguel and Chiriac Andrea M

Purchase Details

Closed on

Jun 20, 2001

Sold by

Danaher Eileen K

Bought by

Berman John A

Purchase Details

Closed on

Feb 25, 1999

Sold by

Kellogg Kathleen W

Bought by

Danaher Eileen K

Purchase Details

Closed on

Jul 5, 1995

Sold by

Multi Family Co Llc

Bought by

Kellogg Kathleen

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Davila Miguel | -- | None Available | |

| Davila Miguel | -- | None Available | |

| Chiriac Andrea Mada | $128,725 | -- | |

| Davila Miguel | $610,000 | -- | |

| Davila Miguel | $610,000 | -- | |

| Berman John A | $425,000 | -- | |

| Berman John A | $425,000 | -- | |

| Danaher Eileen K | $360,000 | -- | |

| Danaher Eileen K | $360,000 | -- | |

| Kellogg Kathleen | $318,482 | -- | |

| Kellogg Kathleen | $318,482 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Davila Miguel | $148,000 | |

| Previous Owner | Kellogg Kathleen | $100,000 | |

| Previous Owner | Kellogg Kathleen | $417,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $12,520 | $279,580 | $0 | $279,580 |

| 2024 | $11,840 | $279,580 | $0 | $279,580 |

| 2023 | $11,440 | $279,580 | $0 | $279,580 |

| 2022 | $11,373 | $279,580 | $0 | $279,580 |

| 2021 | $13,383 | $315,490 | $0 | $315,490 |

| 2020 | $13,354 | $319,480 | $0 | $319,480 |

| 2019 | $13,354 | $319,480 | $0 | $319,480 |

| 2018 | $13,099 | $319,480 | $0 | $319,480 |

| 2017 | $13,111 | $319,480 | $0 | $319,480 |

| 2016 | $14,061 | $355,880 | $0 | $355,880 |

| 2015 | $13,634 | $355,880 | $0 | $355,880 |

| 2014 | $13,841 | $370,370 | $0 | $370,370 |

Source: Public Records

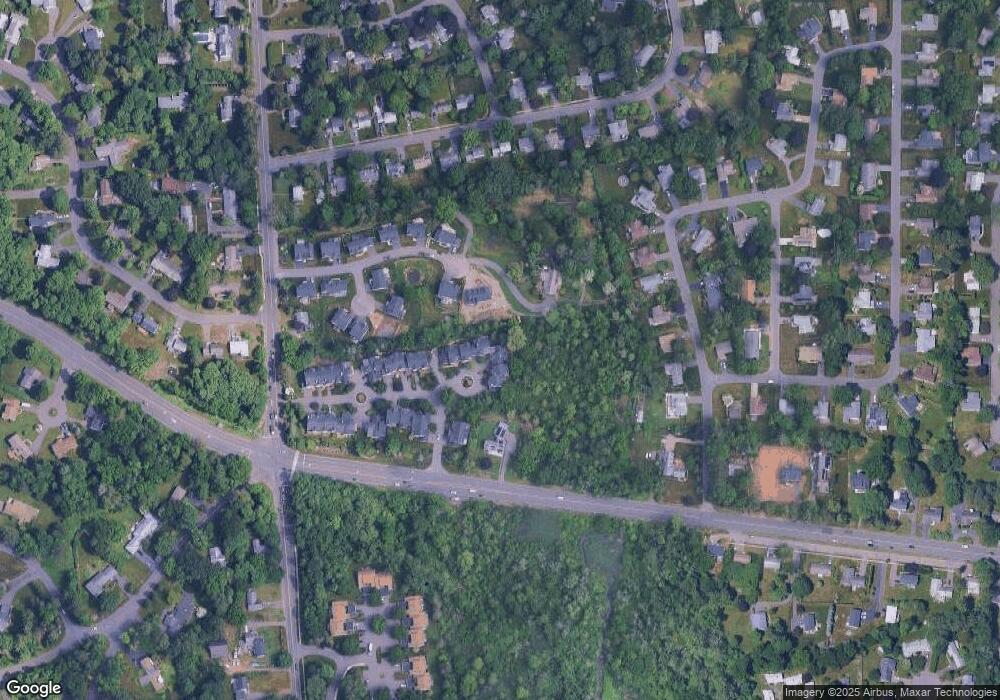

Map

Nearby Homes

- 592 Mountain Rd Unit A

- 10 Hosmer Dr

- 21 Barksdale Rd

- 11 Rye Ridge Pkwy

- 75 Arlen Way

- 40 Ferncliff Dr

- 50 Magnolia Hill

- 36 Richmond Ln

- 2581 Albany Ave

- 47 Flagg Rd

- 10 Ironwood Ln

- 124 High Ridge Rd

- 30 Farmstead Ln

- 62 Blue Ridge Ln

- 16 Morningcrest Dr

- 21 Rushleigh Rd

- 17 Cranbrook

- 15 Rushleigh Rd

- 56 Fox Chase Ln

- 25 Lakeview Dr

- 8 Governors Row

- 6 Governors Row

- 4 Governors Row

- 34 Governors Row

- 32 Governors Row

- 14 Governors Row

- 9 Governors Row

- 7 Governors Row

- 5 Governors Row

- 11 Governors Row

- 5 Governors Row Unit 5

- 11 Governors Row Unit 11

- 14 Governors Row Unit 14

- 34 Governors Row

- 7 Governors Row Unit 7

- 34 Governors Row Unit 34

- 1 Governors Row

- 22 Governors Row

- 22 Governors Row Unit 22

- 20 Governors Row