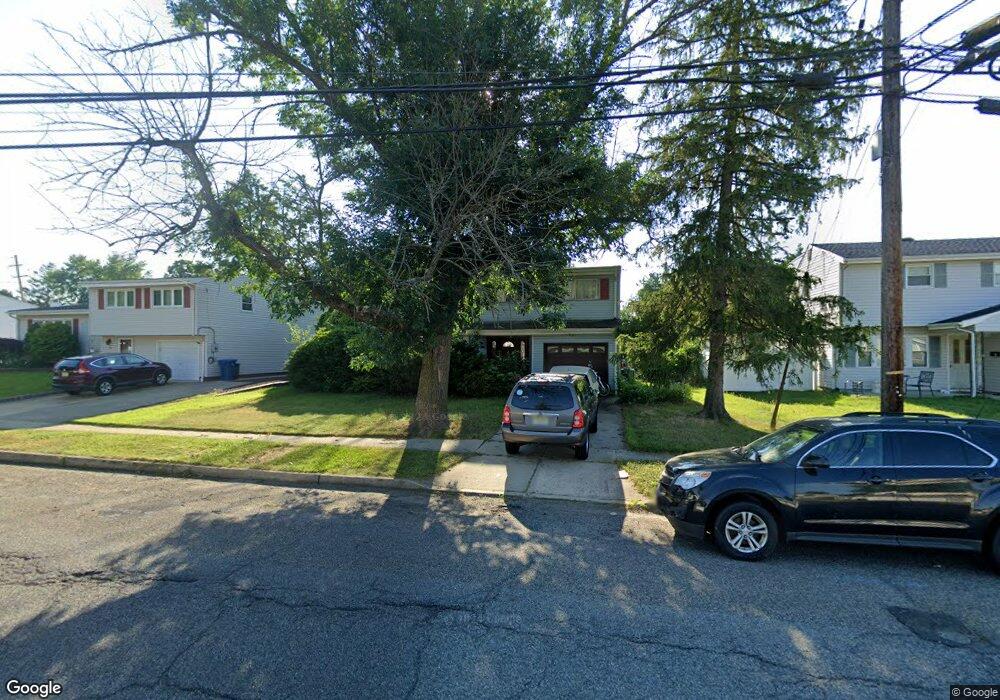

12 Thomas St Old Bridge, NJ 08857

Estimated Value: $481,112 - $629,000

Studio

--

Bath

1,529

Sq Ft

$358/Sq Ft

Est. Value

About This Home

This home is located at 12 Thomas St, Old Bridge, NJ 08857 and is currently estimated at $547,028, approximately $357 per square foot. 12 Thomas St is a home located in Middlesex County with nearby schools including Old Bridge High School, St. Ambrose School, and Calvary Christian School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 5, 2024

Sold by

Muriel Ashenden Irrevocable Residence Tr and Ashenden Stephen

Bought by

Ashenden Thomas James and Ashenden Kimberly Sarah

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$170,000

Outstanding Balance

$168,106

Interest Rate

6.95%

Mortgage Type

New Conventional

Estimated Equity

$378,922

Purchase Details

Closed on

Jan 17, 2008

Sold by

The Muriel Ashenden Trust

Bought by

Ashenden Muriel and Ashenden James

Purchase Details

Closed on

Sep 10, 1999

Sold by

Tobias Norman

Bought by

Kowalski Joseph

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$127,945

Interest Rate

7.85%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ashenden Thomas James | -- | Commonwealth Title | |

| Ashenden Thomas James | -- | Commonwealth Title | |

| Ashenden Muriel | -- | None Available | |

| Kowalski Joseph | $129,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ashenden Thomas James | $170,000 | |

| Closed | Ashenden Thomas James | $170,000 | |

| Previous Owner | Kowalski Joseph | $127,945 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,431 | $149,300 | $69,000 | $80,300 |

| 2024 | $8,088 | $149,300 | $69,000 | $80,300 |

Source: Public Records

Map

Nearby Homes

- 27 Mabaline Rd

- 52 Gaub Rd

- 18 Bruce St

- 51 Malibu Ct

- 20 Valley Vale Dr

- 32 Victorian Dr

- 236 Community Cir

- 143 Ticetown Rd

- 50 Victory Ct

- 119 Nightingale Ct

- 22 Tuscarora Cir

- 55 Valley Vale Dr

- 40 Emerald Ln

- 107 Nightingale Ct

- 1 Kerry Ct

- 46 Owens Rd

- 104 Diamond Ln

- 15 Lindsey Cir

- 65 Diamond Ln

- 815 Marlboro Rd