120 Forrest Ln Swedesboro, NJ 08085

Woolwich Township NeighborhoodEstimated Value: $661,837 - $745,000

4

Beds

3

Baths

3,300

Sq Ft

$207/Sq Ft

Est. Value

About This Home

This home is located at 120 Forrest Ln, Swedesboro, NJ 08085 and is currently estimated at $684,459, approximately $207 per square foot. 120 Forrest Ln is a home located in Gloucester County with nearby schools including Margaret C Clifford School, Gen. Charles G. Harker School, and Gov. Charles C. Stratton School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 10, 2010

Sold by

Scott Paul and Scott Patricia

Bought by

Page Gerald J and Page Becky J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$362,123

Outstanding Balance

$227,732

Interest Rate

3.75%

Mortgage Type

FHA

Estimated Equity

$456,727

Purchase Details

Closed on

Dec 20, 2002

Sold by

Pulte Homes Of Nj Lp

Bought by

Scott Paul and Scott Patricia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$240,000

Interest Rate

6.62%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Page Gerald J | $367,000 | None Available | |

| Scott Paul | $300,000 | Surety Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Page Gerald J | $362,123 | |

| Previous Owner | Scott Paul | $240,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $13,113 | $390,500 | $61,800 | $328,700 |

| 2024 | $12,883 | $390,500 | $61,800 | $328,700 |

| 2023 | $12,883 | $390,500 | $61,800 | $328,700 |

| 2022 | $13,148 | $390,500 | $61,800 | $328,700 |

| 2021 | $13,418 | $390,500 | $61,800 | $328,700 |

| 2020 | $13,398 | $390,500 | $61,800 | $328,700 |

| 2019 | $13,259 | $353,000 | $74,000 | $279,000 |

| 2018 | $13,206 | $353,000 | $74,000 | $279,000 |

| 2017 | $12,948 | $353,000 | $74,000 | $279,000 |

| 2016 | $12,821 | $353,000 | $74,000 | $279,000 |

| 2015 | $12,528 | $353,000 | $74,000 | $279,000 |

| 2014 | $11,903 | $353,000 | $74,000 | $279,000 |

Source: Public Records

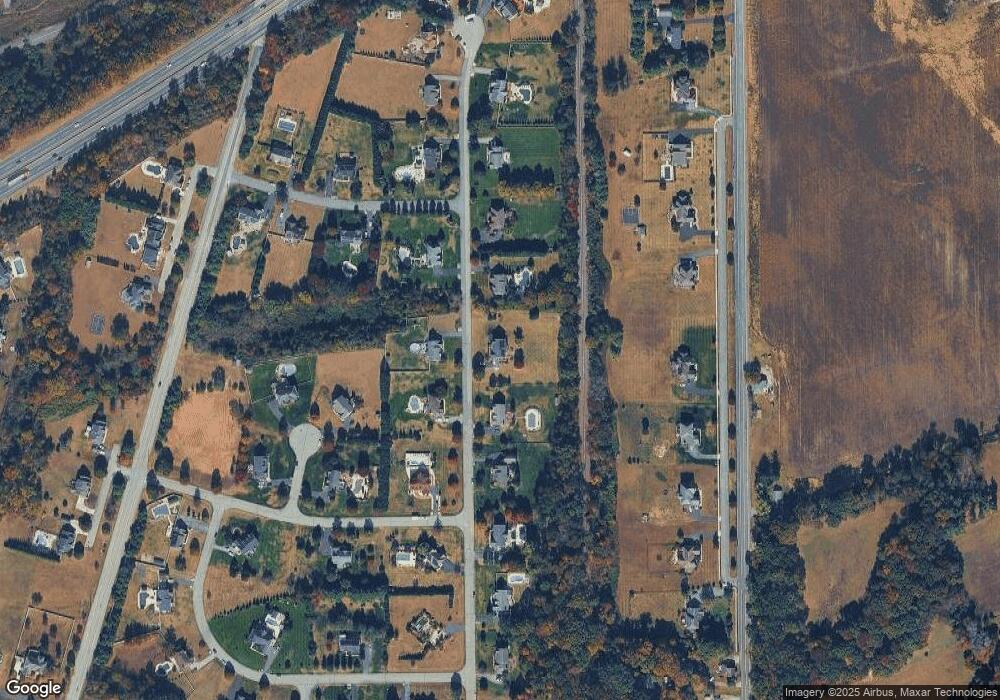

Map

Nearby Homes

- 201 Weston Dr

- 104 Waterford Way

- 613 Sammy St

- 213 Dalton Dr

- 105 Sammy St

- 137 Davidson Rd

- 81 Wexford Dr S

- Greyson Plan at The Ridings at Woolwich

- Hadley Plan at The Ridings at Woolwich

- Greenbriar Plan at The Ridings at Woolwich

- Chelsea Plan at The Ridings at Woolwich

- Winterberry Plan at The Ridings at Woolwich

- Belmont Plan at The Ridings at Woolwich

- 180 Cambridge Blvd

- 1573 Oldmans Creek Rd

- 1932 Kings Hwy

- 5 Wesley Dr

- 4 Hylton Rd

- 1508 Lexington Mews

- 555 Woodstown Rd