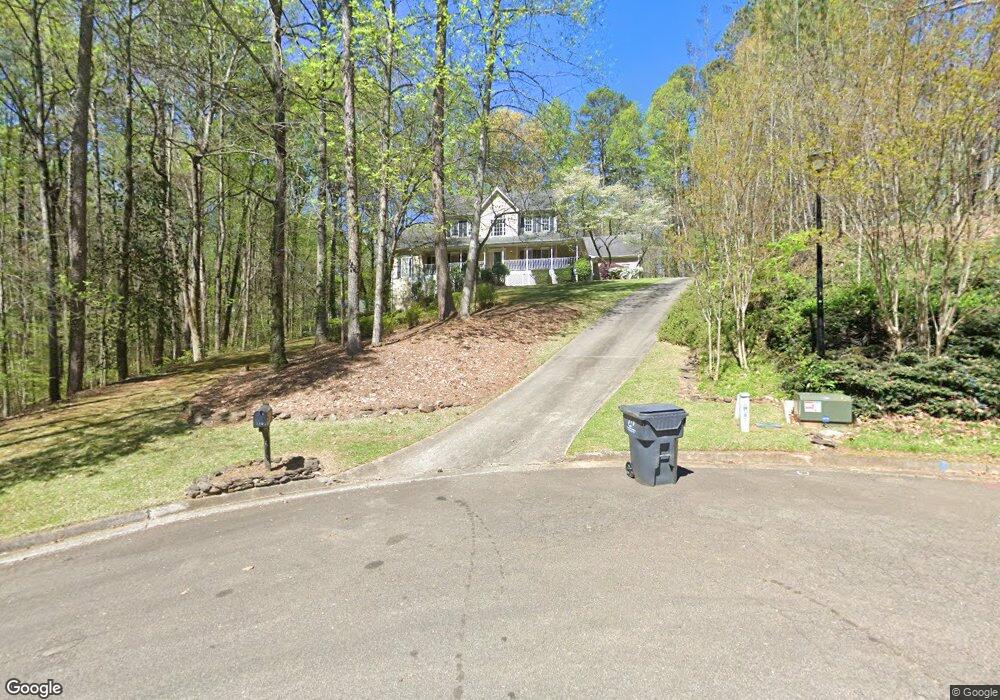

120 Red Oak Close Alpharetta, GA 30004

Union Hill NeighborhoodEstimated Value: $693,000 - $775,000

4

Beds

3

Baths

3,786

Sq Ft

$193/Sq Ft

Est. Value

About This Home

This home is located at 120 Red Oak Close, Alpharetta, GA 30004 and is currently estimated at $730,294, approximately $192 per square foot. 120 Red Oak Close is a home located in Cherokee County with nearby schools including Free Home Elementary School, Creekland Middle School, and Creekview High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 29, 2004

Sold by

Rankin Jon R and Rankin Kathy

Bought by

Wallace Stuart H

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$220,700

Outstanding Balance

$103,830

Interest Rate

5.13%

Mortgage Type

New Conventional

Estimated Equity

$626,464

Purchase Details

Closed on

Feb 11, 1999

Sold by

Mccorkle Charles A and Mccorkle Judith C

Bought by

Rankin Jon R and Rankin Kathy R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$198,455

Interest Rate

6.73%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wallace Stuart H | $275,900 | -- | |

| Rankin Jon R | $208,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wallace Stuart H | $220,700 | |

| Previous Owner | Rankin Jon R | $198,455 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,626 | $214,240 | $32,280 | $181,960 |

| 2024 | $6,128 | $235,800 | $32,280 | $203,520 |

| 2023 | $5,736 | $220,720 | $27,200 | $193,520 |

| 2022 | $4,872 | $185,360 | $20,400 | $164,960 |

| 2021 | $4,712 | $166,000 | $20,400 | $145,600 |

| 2020 | $4,059 | $142,840 | $19,720 | $123,120 |

| 2019 | $3,826 | $134,640 | $19,720 | $114,920 |

| 2018 | $3,935 | $137,640 | $19,720 | $117,920 |

| 2017 | $3,765 | $326,700 | $19,720 | $110,960 |

| 2016 | $3,211 | $275,700 | $20,400 | $89,880 |

| 2015 | $2,928 | $249,000 | $15,280 | $84,320 |

| 2014 | $2,894 | $245,600 | $15,280 | $82,960 |

Source: Public Records

Map

Nearby Homes

- 722 Creekside Bend

- 3590 Manor Dr N

- 3580 Manor Dr N Unit LOT 1

- 3590 Manor Dr N Unit LOT 2

- 3580 Manor Dr N

- 715 Creekside Bend

- 16660 Hopewell Rd

- 6250 Clydesdale Ct

- 16540 Hopewell Rd

- 116 Waverly Dr

- 16520 Hopewell Rd

- 16510 Hopewell Rd

- 7440 Trotting Trail

- 16500 Hopewell Rd

- 7480 Trotting Trail

- 16662 Phillips Rd

- 3280 Hopewell Chase Dr

- 2960 Manorview Ln

- 7220 Bridlefield Pass

- 2930 Manorview Ln

- 130 Red Oak Close

- 110 Red Oak Close

- 230 Roxbury Cir

- 230 Roxbury Cir Unit 12

- 220 Roxbury Cir

- 135 Red Oak Close

- 0 Red Oak Close

- 4630 Oakhurst Ln

- 125 Red Oak Close

- 4610 Oakhurst Ln

- 115 Red Oak Close

- 128 Manor Dr N

- 130 Manor Dr N

- 210 Roxbury Cir

- 130 Manor North Dr

- 126 Manor Dr N

- 115 Red Oak Close

- 126 Manor North Dr

- 132 Manor Dr N