1201 S 750 E Lafayette, IN 47905

Estimated Value: $293,064 - $341,000

--

Bed

--

Bath

1,792

Sq Ft

$180/Sq Ft

Est. Value

About This Home

This home is located at 1201 S 750 E, Lafayette, IN 47905 and is currently estimated at $322,266, approximately $179 per square foot. 1201 S 750 E is a home located in Tippecanoe County with nearby schools including Dayton Elementary School, Wainwright Middle School, and McCutcheon High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 6, 2003

Sold by

Sexson Jon M and Sexson Cathy

Bought by

Anacker Charles and Anacker Joy

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$127,006

Interest Rate

5.78%

Mortgage Type

FHA

Purchase Details

Closed on

Nov 22, 2002

Sold by

Cohen Leo and Cohen Mary E

Bought by

Sexson Jon M and Sexson Cathy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$99,480

Interest Rate

6.08%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Anacker Charles | -- | -- | |

| Sexson Jon M | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Anacker Charles | $38,000 | |

| Open | Anacker Charles | $148,000 | |

| Closed | Anacker Charles | $38,500 | |

| Closed | Anacker Charles | $115,200 | |

| Closed | Anacker Joy | $107,449 | |

| Closed | Anacker Charles | $20,100 | |

| Closed | Anacker Charles | $127,006 | |

| Previous Owner | Sexson Jon M | $99,480 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $944 | $164,200 | $32,600 | $131,600 |

| 2023 | $871 | $155,300 | $32,600 | $122,700 |

| 2022 | $835 | $142,600 | $32,600 | $110,000 |

| 2021 | $719 | $129,100 | $32,600 | $96,500 |

| 2020 | $616 | $119,200 | $32,600 | $86,600 |

| 2019 | $566 | $113,700 | $32,600 | $81,100 |

| 2018 | $525 | $109,400 | $32,600 | $76,800 |

| 2017 | $515 | $107,400 | $32,600 | $74,800 |

| 2016 | $489 | $104,900 | $32,600 | $72,300 |

| 2014 | $389 | $92,800 | $32,600 | $60,200 |

| 2013 | $403 | $92,100 | $32,600 | $59,500 |

Source: Public Records

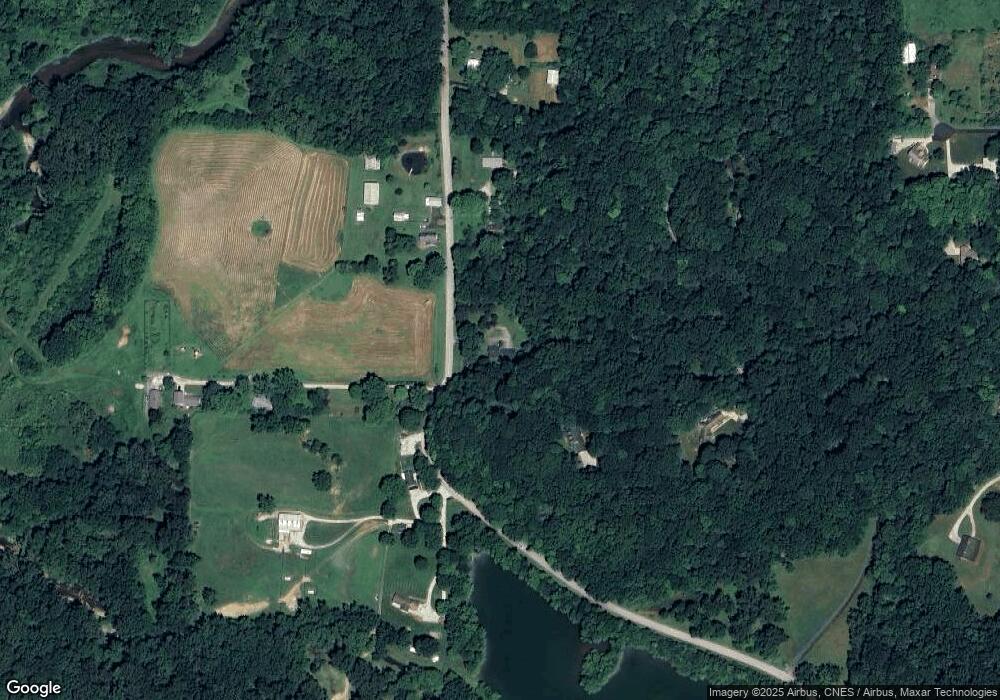

Map

Nearby Homes

- 1441 S 650 E

- 7858 Spain Ct

- 500 S 775 E

- 397 Wallingford (Lot #293) St

- 743 Clifty Falls Ln

- 391 Folkston (Lot 254) Way

- 347 Folkston (Lot 249) Way

- 337 Folkston (Lot 248) Way

- 457 Elbridge Ln

- 613 Harrison Cir

- 660 Harrison Cir

- 6148 Helmsdale Dr

- 138 Finsbury St

- 6124 Helmsdale Dr

- 736 Main St

- 750 Main St

- 757 South St

- 861 Farrier Place

- 379 Chapelhill Dr

- 209 N Wilmington Ln