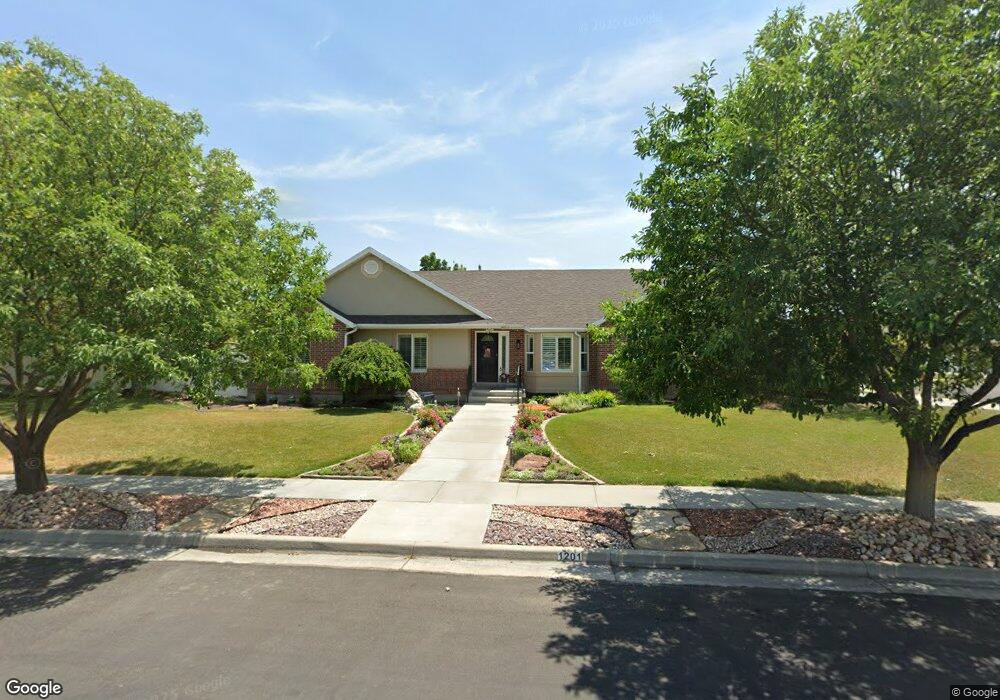

1201 W Sirmingo Way Riverton, UT 84065

Estimated Value: $761,000 - $851,000

5

Beds

3

Baths

3,528

Sq Ft

$230/Sq Ft

Est. Value

About This Home

This home is located at 1201 W Sirmingo Way, Riverton, UT 84065 and is currently estimated at $811,206, approximately $229 per square foot. 1201 W Sirmingo Way is a home located in Salt Lake County with nearby schools including Rosamond Elementary School, Oquirrh Hills Middle School, and Riverton High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 16, 2020

Sold by

Giles Joseph F and Giles Sue Ellen

Bought by

Giles Joseph and Giles Sue

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$174,950

Outstanding Balance

$155,325

Interest Rate

2.8%

Mortgage Type

New Conventional

Estimated Equity

$655,881

Purchase Details

Closed on

Aug 17, 2016

Sold by

Giles Joseph F and Giles Sue

Bought by

Giles Joseph F and Giles Sue Ellen

Purchase Details

Closed on

May 5, 1998

Sold by

Pugh Kayleen

Bought by

Western Marc F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$160,800

Interest Rate

7.05%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Giles Joseph | -- | Vanguard Title Ins Agcy | |

| Giles Joseph F | -- | None Available | |

| Western Marc F | -- | -- | |

| Pugh Kayleen | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Giles Joseph | $174,950 | |

| Closed | Western Marc F | $160,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,089 | $730,900 | $303,200 | $427,700 |

| 2024 | $4,089 | $707,800 | $294,600 | $413,200 |

| 2023 | $4,166 | $679,700 | $288,800 | $390,900 |

| 2022 | $4,340 | $694,700 | $283,100 | $411,600 |

| 2021 | $3,748 | $534,200 | $240,000 | $294,200 |

| 2020 | $46 | $469,000 | $238,800 | $230,200 |

| 2019 | $3,484 | $455,100 | $235,100 | $220,000 |

| 2018 | $3,306 | $425,200 | $149,600 | $275,600 |

| 2017 | $3,206 | $401,800 | $149,600 | $252,200 |

| 2016 | $3,109 | $373,900 | $149,600 | $224,300 |

| 2015 | $3,073 | $358,300 | $171,300 | $187,000 |

| 2014 | $2,903 | $331,900 | $160,300 | $171,600 |

Source: Public Records

Map

Nearby Homes

- 1184 W Margaret Rose Dr

- 1182 River Hills Dr

- 12091 S Lampton View Dr

- 11860 S Alysum Cir

- 1337 Natasha Cir

- 12216 S 1300 W

- 1410 W 12115 S

- 11784 Stone Ridge Ct

- 12392 S 1300 W

- 11664 S Lampton View Dr

- 12294 S 1490 W

- 11697 Tattered Angel Cove

- 11711 Stone Crest Cir

- 11622 S Halcom Dr Unit 601

- 12566 S Tithing Hill Dr

- 11606 S Halcom Dr

- 11694 Stone Crest Cir

- 1233 W 12500 S

- 1611 W Laurel Chase Dr

- 1182 Country Ridge Dr

- 1201 Sirmingo Way

- 12069 Kandi Cir

- 12064 Fastback Cir

- 12074 Fastback Cir

- 12074 S Fastback Cir

- 12072 Kandi Cir

- 1168 Sirmingo Way

- 1168 W Sirmingo Way

- 12052 S Kandi Cir

- 12052 Kandi Cir

- 1222 Sirmingo Way

- 1166 Margaret Rose Dr

- 12062 Kandi Cir

- 12062 S Kandi Cir

- 1184 Margaret Rose Dr

- 1204 Margaret Rose Dr

- 1154 W Sirmingo Way

- 1154 Sirmingo Way

- 12075 Fastback Cir

- 12057 S Fastback Cir