12015 Maxim Way Unit 12015 Cincinnati, OH 45249

Highpoint NeighborhoodEstimated Value: $265,469 - $304,000

2

Beds

2

Baths

1,282

Sq Ft

$224/Sq Ft

Est. Value

About This Home

This home is located at 12015 Maxim Way Unit 12015, Cincinnati, OH 45249 and is currently estimated at $286,617, approximately $223 per square foot. 12015 Maxim Way Unit 12015 is a home located in Hamilton County with nearby schools including Edwin H Greene Intermediate Middle School, Sycamore Junior High School, and Sycamore High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 21, 2012

Sold by

Hubbard Carol J

Bought by

Hubbard Carol J and The Carol J Hubbard Trust

Current Estimated Value

Purchase Details

Closed on

Jun 8, 2010

Sold by

Rathbun Marilyn

Bought by

Hubbard Carol J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$114,800

Outstanding Balance

$76,066

Interest Rate

4.74%

Mortgage Type

Unknown

Estimated Equity

$210,551

Purchase Details

Closed on

Mar 7, 2009

Sold by

Wolery Mary

Bought by

Rathbun Marilyn

Purchase Details

Closed on

Oct 31, 2008

Sold by

Estate Of Mark Laviola

Bought by

Wolery Mary

Purchase Details

Closed on

Feb 23, 1998

Sold by

Royal Point Ltd

Bought by

Laviola Mark

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hubbard Carol J | -- | Attorney | |

| Hubbard Carol J | $143,500 | Attorney | |

| Rathbun Marilyn | -- | Attorney | |

| Wolery Mary | -- | None Available | |

| Laviola Mark | $132,900 | Title First Agency Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hubbard Carol J | $114,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,623 | $74,757 | $14,210 | $60,547 |

| 2023 | $3,605 | $74,757 | $14,210 | $60,547 |

| 2022 | $3,128 | $52,749 | $11,368 | $41,381 |

| 2021 | $3,064 | $52,749 | $11,368 | $41,381 |

| 2020 | $3,092 | $52,749 | $11,368 | $41,381 |

| 2019 | $2,775 | $45,472 | $9,800 | $35,672 |

| 2018 | $2,669 | $45,472 | $9,800 | $35,672 |

| 2017 | $2,501 | $45,472 | $9,800 | $35,672 |

| 2016 | $2,598 | $45,500 | $12,250 | $33,250 |

| 2015 | $2,330 | $45,500 | $12,250 | $33,250 |

| 2014 | $2,554 | $50,225 | $12,250 | $37,975 |

| 2013 | $2,633 | $50,225 | $12,250 | $37,975 |

Source: Public Records

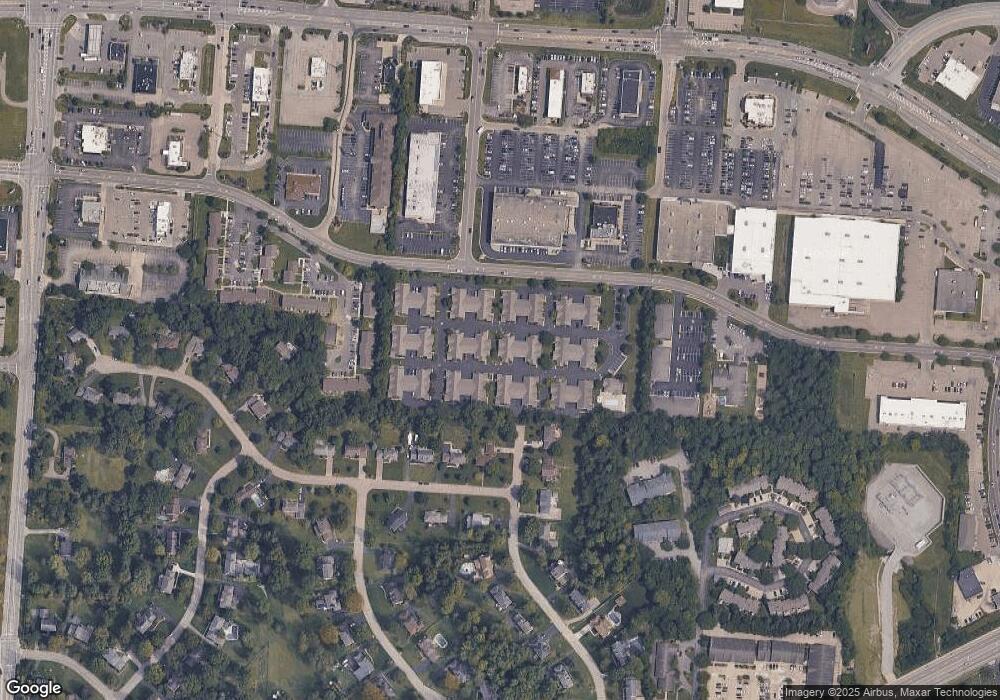

Map

Nearby Homes

- 8936 Cypresspoint Ln

- 11971 Olde Dominion Dr Unit 7

- 9141 Dominion Cir

- 9130 Dominion Cir

- 12016 Mason Rd

- 9160 Symmes Landing Dr

- 11724 Gable Glen Ln

- 220 Carrington Ln

- 11730 Gable Glen Ln

- 11722 Gable Glen Ln

- 210 Carrington Ln

- 11782 Gable Glen Ln

- 11659 Symmes Valley Dr

- 11783 Gable Glen Ln

- 11811 Vaukvalley Ln

- 11807 Vaukvalley Ln

- 710 Carrington Place

- 12091 Carrington Ln

- 210 Carrington Place

- 12016 Maxim Way

- 12010 Maxim Way Unit 12010

- 12064 Maxim Way Unit D12064

- 12075 Maxim Way Unit 12075

- 12066 Maxim Way Unit 12066

- 12060 Maxim Way

- 12062 Maxim Way

- 12012 Maxim Way

- 12016 Maxim Ave

- 12073 Maxim Way

- 12013 Maxim Way Unit 12013

- 12004 Maxim Way

- 12021 Maxim Way

- 12076 Maxim Way

- 12014 Maxim Way

- 12084 Maxim Way Unit 12084

- 12000 Maxim Way Unit 12000

- 12074 Maxim Way Unit 12074

- 12083 Maxim Way

- 12006 Maxim Way Unit 12006