12021 NW 11th St Unit 12021 Pembroke Pines, FL 33026

Pembroke Lakes NeighborhoodEstimated Value: $314,474 - $351,000

3

Beds

2

Baths

1,130

Sq Ft

$288/Sq Ft

Est. Value

About This Home

This home is located at 12021 NW 11th St Unit 12021, Pembroke Pines, FL 33026 and is currently estimated at $325,869, approximately $288 per square foot. 12021 NW 11th St Unit 12021 is a home located in Broward County with nearby schools including Pembroke Lakes Elementary School, Walter C. Young Middle School, and Charles W Flanagan High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 20, 2019

Sold by

Tessel Sandra C and Tessel Stephanie

Bought by

Jimenez Eladio Efrain Flores

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$192,850

Outstanding Balance

$170,357

Interest Rate

3.7%

Mortgage Type

New Conventional

Estimated Equity

$155,512

Purchase Details

Closed on

Nov 9, 2018

Sold by

Tessel Sandra C

Bought by

Tessel Stephanie and Tessel Sandra C

Purchase Details

Closed on

Sep 19, 2011

Sold by

Oberle Raymond and Oberle Ann

Bought by

Tessel Sandra C

Purchase Details

Closed on

Sep 12, 2011

Sold by

Oberle Andrew

Bought by

Tessel Sandra C

Purchase Details

Closed on

May 23, 2011

Sold by

Cola Louise M and Oberle Louise Cola

Bought by

Oberle Raymond and Oberle Andrew

Purchase Details

Closed on

Jul 1, 1989

Sold by

Available Not

Bought by

Available Not

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jimenez Eladio Efrain Flores | $203,000 | Attorney | |

| Tessel Stephanie | -- | Attorney | |

| Tessel Sandra C | -- | Attorney | |

| Tessel Sandra C | $93,000 | Attorney | |

| Oberle Raymond | -- | Attorney | |

| Available Not | $54,136 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Jimenez Eladio Efrain Flores | $192,850 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,800 | $225,450 | -- | -- |

| 2024 | $3,671 | $219,100 | -- | -- |

| 2023 | $3,671 | $212,720 | $0 | $0 |

| 2022 | $3,453 | $206,530 | $0 | $0 |

| 2021 | $3,372 | $200,520 | $0 | $0 |

| 2020 | $3,334 | $197,760 | $19,780 | $177,980 |

| 2019 | $3,271 | $193,730 | $19,370 | $174,360 |

| 2018 | $3,825 | $189,180 | $18,920 | $170,260 |

| 2017 | $3,606 | $165,050 | $0 | $0 |

| 2016 | $3,261 | $150,050 | $0 | $0 |

| 2015 | $3,133 | $136,410 | $0 | $0 |

| 2014 | $2,813 | $124,010 | $0 | $0 |

| 2013 | -- | $77,230 | $7,720 | $69,510 |

Source: Public Records

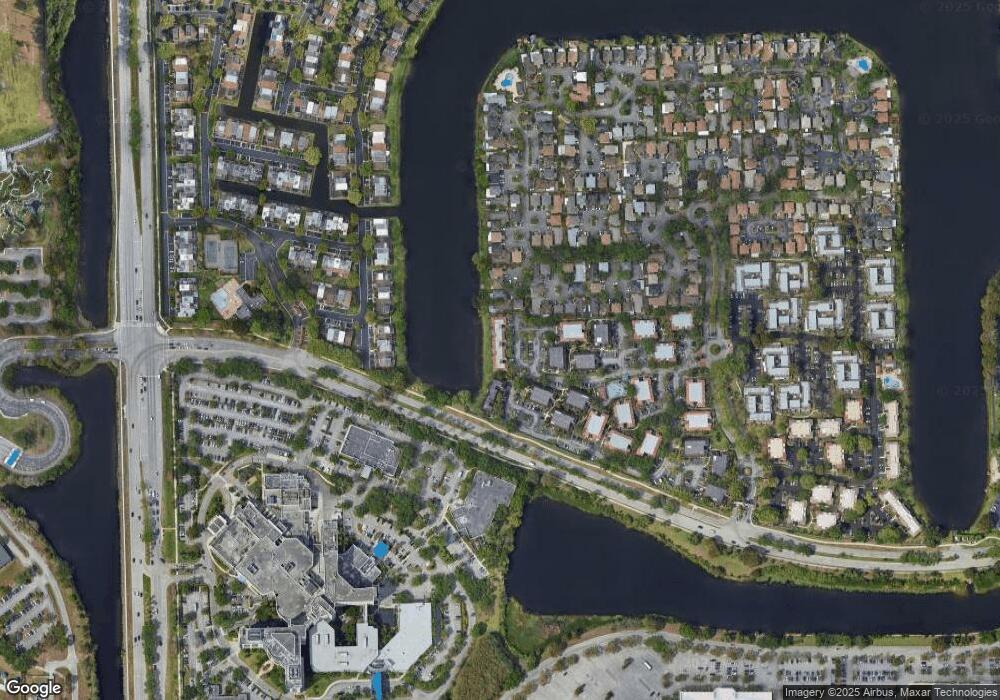

Map

Nearby Homes

- 11976 NW 12th St

- 12078 NW 11th St Unit 12078

- 12018 NW 13th St

- 11972 NW 11th St Unit 11972

- 12064 NW 13th St

- 11740 NW 12th St Unit 11740

- 11733 NW 11th St

- 11652 NW 11th St

- 11862 NW 13th St

- 1178 NW 122nd Terrace

- 11657 NW 11th St

- 12305 NW 11th Ct

- 1239 NW 122nd Terrace

- 11604 NW 11th St

- 11533 NW 10th St Unit 11533

- 11537 NW 10th St Unit 11537

- 1237 NW 123rd Terrace

- 1333 NW 122nd Terrace

- 1325 NW 123rd Terrace

- 900 Colony Point Cir Unit 121

- 12021 NW 11th St Unit 12021

- 12023 NW 11th St Unit 12023

- 12064 NW 11th St Unit 12064

- 12023 NW 11th St Unit 12023

- 12074 NW 11th St Unit 12074

- 12025 NW 11th St Unit 12025

- 12019 NW 11th St Unit 12019

- 12015 NW 11th St Unit 12015

- 12070 NW 11th St Unit 12070

- 12031 NW 11th St Unit 12031

- 12035 NW 11th St Unit 2035

- 12029 11 Unit 12029

- 12029 NW 11th St

- 12076 NW 11th St Unit 12076

- 12017 NW 11th St Unit 12017

- 12066 NW 11th St

- 12027 NW 11th St Unit 12027

- 12013 NW 11th St Unit 12013

- 12076 NW 11th St Unit 12076