12030 Mill Berger San Antonio, TX 78254

Estimated Value: $317,244 - $347,000

4

Beds

3

Baths

2,545

Sq Ft

$129/Sq Ft

Est. Value

About This Home

This home is located at 12030 Mill Berger, San Antonio, TX 78254 and is currently estimated at $329,311, approximately $129 per square foot. 12030 Mill Berger is a home located in Bexar County with nearby schools including Fields Elementary, John M. Folks Middle, and School of Science and Technology Northwest.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 26, 2016

Sold by

Rankin Kathryn and Rankin Gregg

Bought by

Benavidez Nalani M and Ortegon Jonese M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$214,051

Outstanding Balance

$177,445

Interest Rate

4.5%

Mortgage Type

FHA

Estimated Equity

$151,866

Purchase Details

Closed on

Aug 26, 2009

Sold by

Castlerock Communities Lp

Bought by

Rankin Kathryn and Rankin Gregg

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$192,930

Interest Rate

5.16%

Mortgage Type

FHA

Purchase Details

Closed on

Mar 31, 2008

Sold by

Hj Enterprises Lp

Bought by

Castlerock Communities Lp

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$476,648

Interest Rate

6.11%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Benavidez Nalani M | -- | None Available | |

| Rankin Kathryn | -- | Stc | |

| Castlerock Communities Lp | -- | Stc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Benavidez Nalani M | $214,051 | |

| Previous Owner | Rankin Kathryn | $192,930 | |

| Previous Owner | Castlerock Communities Lp | $476,648 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,468 | $328,250 | $48,740 | $279,510 |

| 2024 | $3,468 | $334,720 | $48,120 | $286,600 |

| 2023 | $3,468 | $312,676 | $48,120 | $307,200 |

| 2022 | $6,765 | $333,040 | $40,130 | $292,910 |

| 2021 | $5,440 | $258,410 | $38,850 | $219,560 |

| 2020 | $5,291 | $246,030 | $38,850 | $207,180 |

| 2019 | $5,271 | $237,370 | $38,850 | $198,520 |

| 2018 | $4,974 | $223,820 | $38,850 | $184,970 |

| 2017 | $4,869 | $218,650 | $36,270 | $182,380 |

| 2016 | $4,831 | $216,920 | $36,270 | $180,650 |

| 2015 | $4,132 | $204,390 | $36,270 | $168,120 |

| 2014 | $4,132 | $193,840 | $0 | $0 |

Source: Public Records

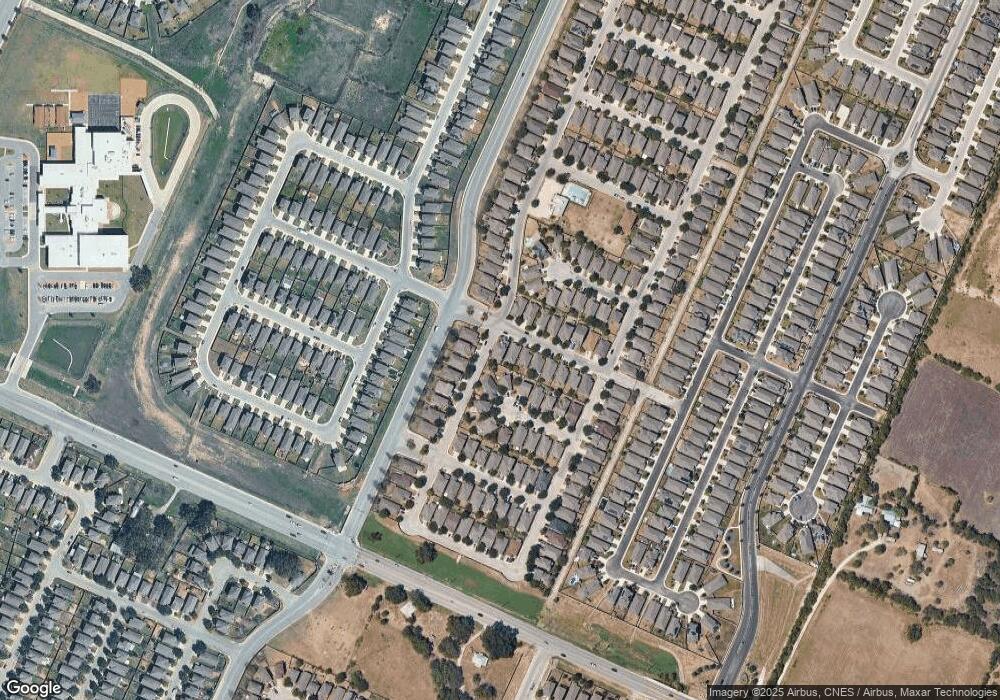

Map

Nearby Homes

- 12027 Mill Village

- 9723 Mill Path

- 12002 Mill Summit

- 9511 Mill Path

- 12031 Mill Pine

- 9502 Silver Mist Way

- 12011 Canyon Rock Ln

- 11935 Curtis Hill

- 12037 Silver Light

- 12029 Silver Lining

- 11830 Bricewood Pass

- 11911 Cheney Glen

- 12074 Canyon Rock Ln

- 9839 Mill Path

- 9502 Bricewood Tree

- 11723 Bricewood Tip

- 9946 Cowboy Ln

- 12372 Goulding

- 9923 Bricewood Hill

- 12031 Silver Valley

- 12026 Mill Berger

- 12022 Mill Berger

- 12023 Mill Village

- 9631 Mill Path

- 9627 Mill Path

- 12031 Mill Berger

- 12027 Mill Berger

- 9623 Mill Path

- 9703 Mill Path

- 12019 Mill Village

- 12023 Mill Berger

- 12014 Mill Berger

- 9619 Mill Path

- 12019 Mill Berger

- 12015 Mill Village

- 12026 Mill Village

- 9707 Mill Path

- 12010 Mill Berger

- 9615 Mill Path

- 12015 Mill Berger