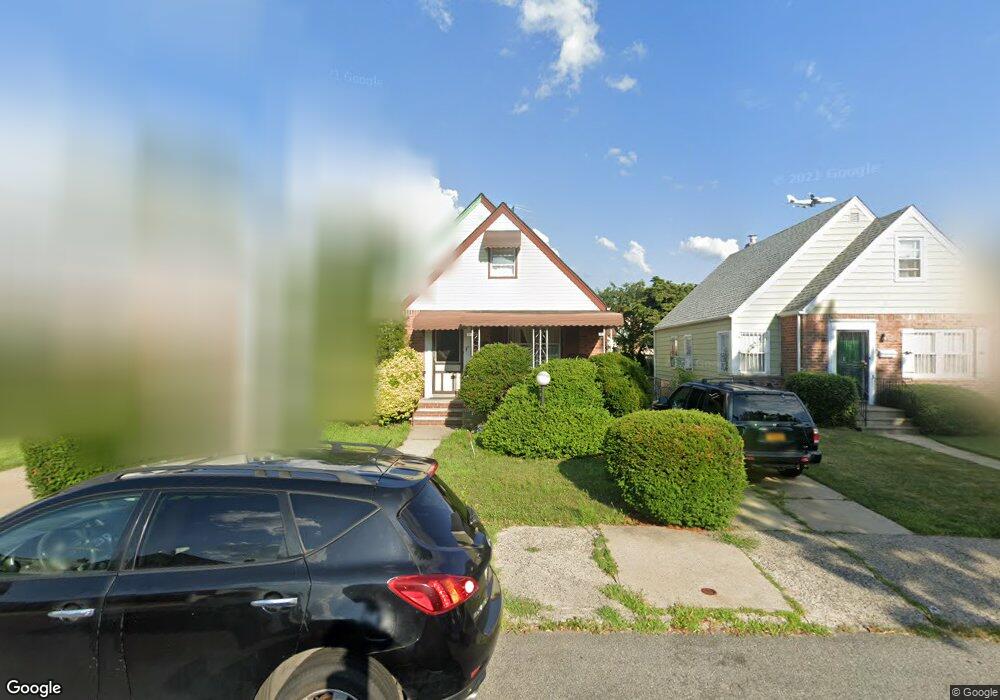

12033 230th St Cambria Heights, NY 11411

Cambria Heights NeighborhoodEstimated Value: $608,000 - $715,000

4

Beds

2

Baths

1,103

Sq Ft

$593/Sq Ft

Est. Value

About This Home

This home is located at 12033 230th St, Cambria Heights, NY 11411 and is currently estimated at $654,439, approximately $593 per square foot. 12033 230th St is a home located in Queens County with nearby schools including P.S. 176 Cambria Heights, Is 59 Springfield Gardens, and Cambria Center For The Gifted Child.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 10, 2022

Sold by

Desulme Magalie and Desulme Pierre M

Bought by

Desulme Magalie and Desulme Pierre M

Current Estimated Value

Purchase Details

Closed on

May 17, 2021

Sold by

Delph Jocele and Pinkerton Thomas

Bought by

Desulme Magalie and Desulme Pierre

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$427,350

Outstanding Balance

$386,068

Interest Rate

2.9%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$268,371

Purchase Details

Closed on

Aug 15, 2016

Sold by

Pinkerton Thomas

Bought by

Delph Sherlock H and Delph Jocele

Purchase Details

Closed on

Jun 21, 2004

Sold by

Delph Duane S

Bought by

Pinkerton Thomas

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$303,300

Interest Rate

6.3%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Feb 28, 2001

Sold by

Roquemore Johnny C and Roquemore Mary W

Bought by

Delph Duane S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$232,400

Interest Rate

7.15%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Desulme Magalie | -- | -- | |

| Desulme Magalie | $460,000 | -- | |

| Delph Sherlock H | -- | -- | |

| Pinkerton Thomas | $303,300 | -- | |

| Delph Duane S | $242,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Desulme Magalie | $427,350 | |

| Previous Owner | Pinkerton Thomas | $303,300 | |

| Previous Owner | Delph Duane S | $232,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,724 | $35,489 | $11,242 | $24,247 |

| 2024 | $6,724 | $33,480 | $10,459 | $23,021 |

| 2023 | $6,346 | $31,596 | $10,584 | $21,012 |

| 2022 | $5,951 | $30,600 | $12,240 | $18,360 |

| 2021 | $5,599 | $32,760 | $12,240 | $20,520 |

| 2020 | $5,586 | $31,500 | $12,240 | $19,260 |

| 2019 | $5,162 | $27,900 | $12,240 | $15,660 |

| 2018 | $5,508 | $26,330 | $11,728 | $14,602 |

| 2016 | $4,974 | $24,883 | $11,888 | $12,995 |

| 2015 | $2,831 | $24,693 | $13,096 | $11,597 |

| 2014 | $2,831 | $23,296 | $13,220 | $10,076 |

Source: Public Records

Map

Nearby Homes

- 120-42 231st St

- 120-47 228th St

- 23107 126th Ave

- 120-43 234th St

- 12031 234th St

- 120-51 234th St

- 119-39 226th St

- 0 235th St

- 120-35 225th St

- 231-15 128th Rd

- 118-43 227th St

- 12831 233rd St

- 12819 234th St

- 11919 236th St

- 11841 225th St

- 23318 118th Ave

- 129-08 Francis Lewis Blvd

- 12908 Francis Lewis Blvd

- 11836 236th St

- 12810 236th St