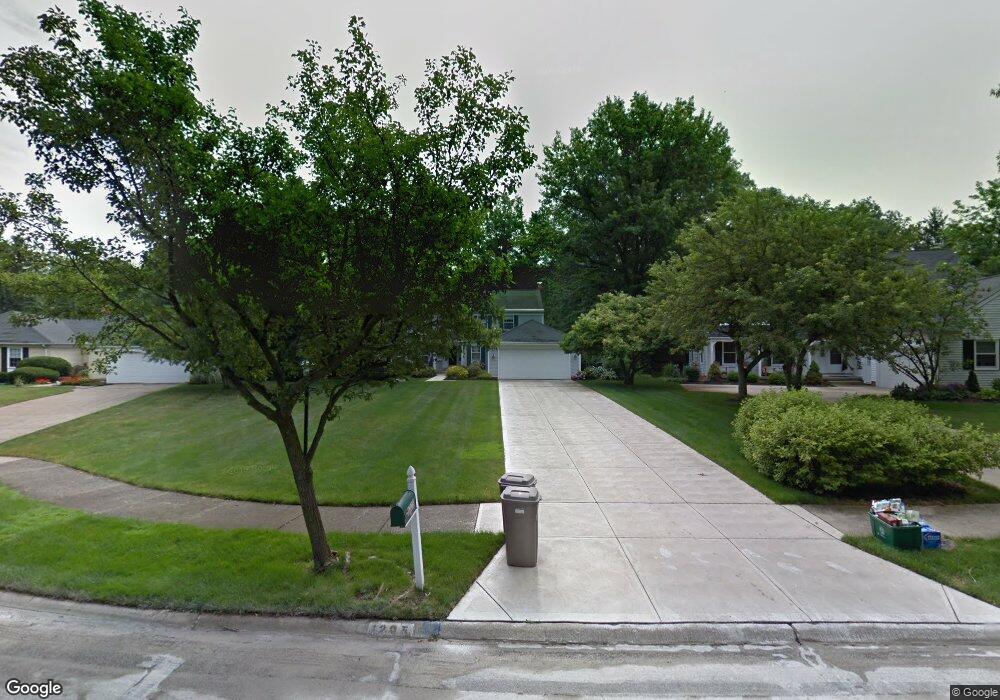

1205 Charter Oak Ln Westlake, OH 44145

Estimated Value: $579,000 - $658,000

4

Beds

3

Baths

2,667

Sq Ft

$226/Sq Ft

Est. Value

About This Home

This home is located at 1205 Charter Oak Ln, Westlake, OH 44145 and is currently estimated at $601,590, approximately $225 per square foot. 1205 Charter Oak Ln is a home located in Cuyahoga County with nearby schools including Westlake Elementary School, Dover Intermediate School, and Lee Burneson Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 3, 2011

Sold by

Hill Donald J and Hill Kathleen M

Bought by

Hill Donald J and Hill Kathleen M

Current Estimated Value

Purchase Details

Closed on

Feb 18, 2005

Sold by

Hill Donald J and Hill Kathleen M

Bought by

Hill Donald J and Hill Kathleen M

Purchase Details

Closed on

Sep 8, 2003

Sold by

Krevis Edwin A and Krevis Noreen M

Bought by

Hill Donald J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$251,200

Outstanding Balance

$114,363

Interest Rate

5.97%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$487,227

Purchase Details

Closed on

Jun 25, 1997

Sold by

Portaro Joanne D

Bought by

Krevis Edwin A

Purchase Details

Closed on

Oct 29, 1993

Sold by

Portaro Ross J and Portaro Joanne D

Bought by

Portaro Joanne D

Purchase Details

Closed on

Apr 3, 1985

Sold by

Portaro Ross J and Portaro Joanne D

Bought by

Portaro Ross J and Portaro Joanne D

Purchase Details

Closed on

Jan 1, 1975

Bought by

Portaro Ross J and Portaro Joanne D

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hill Donald J | -- | Attorney | |

| Hill Donald J | -- | Boulevard Title Agency | |

| Hill Donald J | $314,000 | Chicago Title Insurance Co | |

| Krevis Edwin A | $279,900 | -- | |

| Portaro Joanne D | -- | -- | |

| Portaro Ross J | -- | -- | |

| Portaro Ross J | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hill Donald J | $251,200 | |

| Closed | Hill Donald J | $47,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $8,406 | $177,450 | $32,410 | $145,040 |

| 2023 | $7,296 | $131,670 | $35,140 | $96,530 |

| 2022 | $7,179 | $131,670 | $35,140 | $96,530 |

| 2021 | $7,188 | $131,670 | $35,140 | $96,530 |

| 2020 | $6,268 | $105,320 | $28,110 | $77,210 |

| 2019 | $6,077 | $300,900 | $80,300 | $220,600 |

| 2018 | $6,622 | $105,320 | $28,110 | $77,210 |

| 2017 | $7,217 | $117,110 | $25,340 | $91,770 |

| 2016 | $7,179 | $117,110 | $25,340 | $91,770 |

| 2015 | $6,587 | $117,110 | $25,340 | $91,770 |

| 2014 | $6,587 | $105,490 | $22,820 | $82,670 |

Source: Public Records

Map

Nearby Homes

- 23864 Wonneta Pkwy

- 1301 Clague Rd

- 1720 Westhill Blvd

- 23322 Belmont Dr

- 1787 Donna Dr

- 1330 E Melrose Dr

- 24411 E Oakland Rd

- 23782 Cornwell Dr

- 561 Upland Rd

- 23903 Wolf Rd

- 800 Brick Mill Run Unit 515

- 549 Vineland Rd

- 1874 Donna Dr

- 700 Brick Mill Run Unit 406

- 851 Brick Mill Run Unit 10

- 526 Vineland Rd

- 1931 King James Pkwy Unit 427

- 22576 Peach Tree Ln

- 1579 Queens Ct

- 2045 Clague Rd

- 1193 Charter Oak Ln

- 1221 Charter Oak Ln

- 1237 Charter Oak Ln

- 24091 Detroit Rd

- 1180 Charter Oak Ln

- 1240 Charter Oak Ln

- 1253 Charter Oak Ln

- 1334 Glenbrook Ln

- 1155 1155 Charter Oak Ln Unit 103

- 1322 Glenbrook Ln

- 1155 Charter Oak Ln Unit 107

- 1155 Charter Oak Ln Unit 101

- 1155 Charter Oak Ln Unit 104

- 1155 Charter Oak Ln Unit 105

- 1155 Charter Oak Ln Unit 202

- 1155 Charter Oak Ln Unit 306

- 1155 Charter Oak Ln

- 1155 Charter Oak Ln Unit 305

- 1155 Charter Oak Ln Unit 205

- 1155 Charter Oak Ln Unit 301