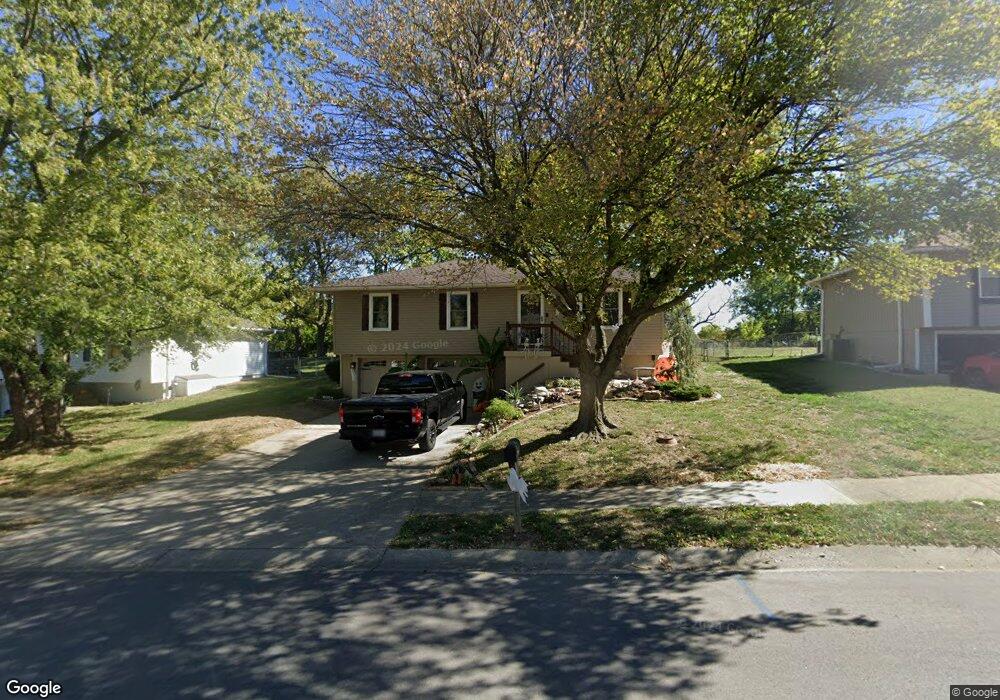

1205 SE Royal St Oak Grove, MO 64075

Estimated Value: $232,000 - $244,192

3

Beds

1

Bath

1,054

Sq Ft

$224/Sq Ft

Est. Value

About This Home

This home is located at 1205 SE Royal St, Oak Grove, MO 64075 and is currently estimated at $236,048, approximately $223 per square foot. 1205 SE Royal St is a home located in Jackson County with nearby schools including Oak Grove Primary School, Oak Grove Elementary School, and Oak Grove Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 31, 2005

Sold by

Stinnett Christopher D and Stinnett Misty D

Bought by

Stinnett Christopher D and Stinnett Misty D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$20,166

Outstanding Balance

$5,934

Interest Rate

5.75%

Mortgage Type

Credit Line Revolving

Estimated Equity

$230,114

Purchase Details

Closed on

Sep 18, 1997

Sold by

Thomas James M and Thomas Katherine

Bought by

Stinnett Christopher D and Curtis Misty D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$73,211

Outstanding Balance

$11,356

Interest Rate

7.48%

Mortgage Type

FHA

Estimated Equity

$224,692

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stinnett Christopher D | -- | Stewart Title Of Ks City Inc | |

| Stinnett Christopher D | -- | Old Republic Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Stinnett Christopher D | $20,166 | |

| Open | Stinnett Christopher D | $73,211 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,790 | $31,910 | $4,102 | $27,808 |

| 2024 | $2,763 | $35,908 | $4,051 | $31,857 |

| 2023 | $2,763 | $35,908 | $4,345 | $31,563 |

| 2022 | $2,034 | $24,130 | $3,658 | $20,472 |

| 2021 | $1,990 | $24,130 | $3,658 | $20,472 |

| 2020 | $1,938 | $22,892 | $3,658 | $19,234 |

| 2019 | $1,843 | $22,892 | $3,658 | $19,234 |

| 2018 | $1,600 | $20,852 | $3,456 | $17,396 |

| 2017 | $1,609 | $20,852 | $3,456 | $17,396 |

| 2016 | $1,609 | $20,330 | $2,983 | $17,347 |

| 2014 | $1,446 | $18,218 | $2,982 | $15,236 |

Source: Public Records

Map

Nearby Homes

- 1407 SE Hillside Dr

- 1604 SE Kingsway St

- 1106 SE Chelsey Ln

- 801 SE 13th St

- 1108 SE Oak Ridge Dr

- 508 SE 12th St

- TBD SE Horseshoe Dr

- 809 SE 19th St

- 2305 SE Horseshoe Dr

- 0 Fulks Rd

- 2004 SE Oak Ridge Dr

- 704 SE 21st St

- 612 SE 21st St

- 509 SE 20th St

- 2112 SE Oak Ridge Dr

- 2200 SE Oak Ridge Dr

- 701 SE 21st St

- 1312 SW Clinton St

- 704 SW Clinton St

- 1705 Locust St

- 1207 SE Royal St

- 1203 SE Royal St

- 1401 SE Royal St

- 1201 SE Royal St

- 1202 SE Royal St

- 28 SE Golden Belt Rd

- 1400 SE Queens Ct

- 1403 SE Royal St

- 1200 SE Royal St

- 1405 SE Royal St

- 1302 SE Queens Ct

- 1604 SE 15th Place

- 1305 SE Queens Ct

- 1604 SE 15th Street Place

- 1304 SE Queens Ct

- 1407 SE Royal St

- 1306 SE Queens Ct

- 1602 SE 15th Place

- 1305 SE Knight Cir

- 1501 SE Royal St