12056 Maxim Way Cincinnati, OH 45249

Highpoint NeighborhoodEstimated Value: $270,000 - $313,000

3

Beds

2

Baths

1,445

Sq Ft

$205/Sq Ft

Est. Value

About This Home

This home is located at 12056 Maxim Way, Cincinnati, OH 45249 and is currently estimated at $295,968, approximately $204 per square foot. 12056 Maxim Way is a home located in Hamilton County with nearby schools including Edwin H Greene Intermediate Middle School, Sycamore Junior High School, and Sycamore High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 18, 2007

Sold by

Fair Bonnie L and Bradley Leslie

Bought by

Fair Bonnie L and Bradley Leslie

Current Estimated Value

Purchase Details

Closed on

Jun 19, 2001

Sold by

Hornsby Teresa A

Bought by

Grote Leo

Purchase Details

Closed on

May 30, 2000

Sold by

Grote Leo

Bought by

Fair Bonnie L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$101,850

Interest Rate

8.18%

Purchase Details

Closed on

Jun 29, 1999

Sold by

Murrie Michael

Bought by

Hornsby Jack R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$133,950

Interest Rate

7.28%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fair Bonnie L | -- | Attorney | |

| Grote Leo | -- | -- | |

| Fair Bonnie L | -- | -- | |

| Grote Leo | $141,500 | -- | |

| Hornsby Jack R | $141,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Fair Bonnie L | $101,850 | |

| Previous Owner | Hornsby Jack R | $133,950 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,068 | $83,948 | $14,210 | $69,738 |

| 2023 | $4,048 | $83,948 | $14,210 | $69,738 |

| 2022 | $3,399 | $57,341 | $11,368 | $45,973 |

| 2021 | $3,330 | $57,341 | $11,368 | $45,973 |

| 2020 | $3,361 | $57,341 | $11,368 | $45,973 |

| 2019 | $3,016 | $49,431 | $9,800 | $39,631 |

| 2018 | $2,901 | $49,431 | $9,800 | $39,631 |

| 2017 | $2,718 | $49,431 | $9,800 | $39,631 |

| 2016 | $2,896 | $50,715 | $12,250 | $38,465 |

| 2015 | $2,597 | $50,715 | $12,250 | $38,465 |

| 2014 | $2,579 | $50,715 | $12,250 | $38,465 |

| 2013 | $2,658 | $50,715 | $12,250 | $38,465 |

Source: Public Records

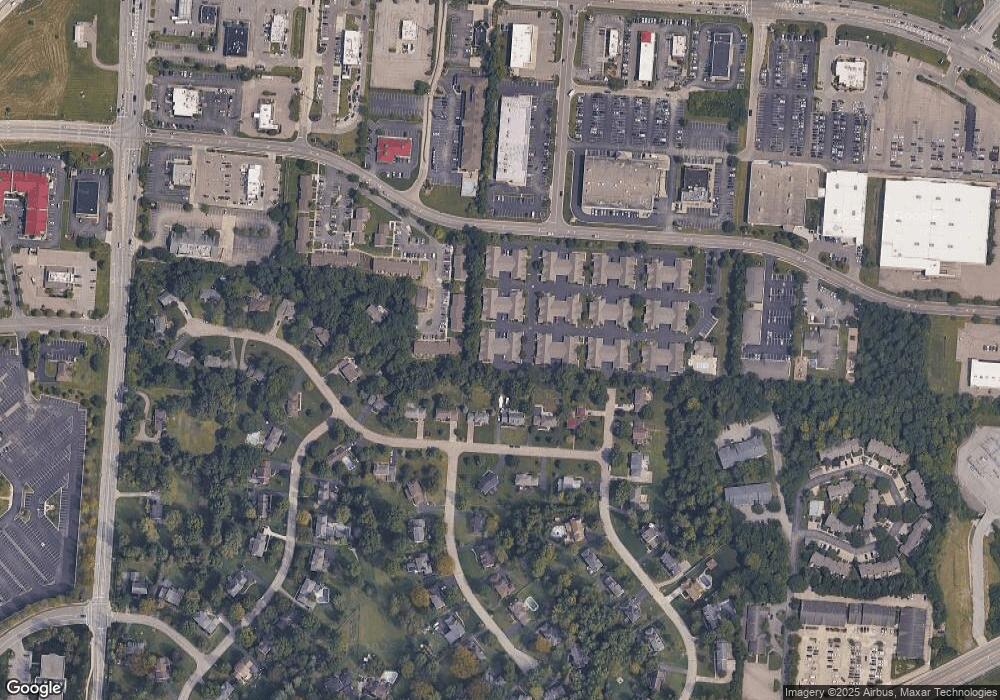

Map

Nearby Homes

- 8936 Cypresspoint Ln

- 11971 Olde Dominion Dr Unit 7

- 12016 Mason Rd

- 9141 Dominion Cir

- 9130 Dominion Cir

- 9160 Symmes Landing Dr

- 11730 Gable Glen Ln

- 11724 Gable Glen Ln

- 11722 Gable Glen Ln

- 11782 Gable Glen Ln

- 220 Carrington Ln

- 11659 Symmes Valley Dr

- 210 Carrington Ln

- 11783 Gable Glen Ln

- 11811 Vaukvalley Ln

- 11807 Vaukvalley Ln

- 710 Carrington Place

- 12091 Carrington Ln

- 12130 Crestfield Ct

- 12050 Maxim Way

- 12054 Maxim Way Unit 12054

- 12052 Maxim Way

- 12046 Maxim Way Unit 12046

- 12044 Maxim Way Unit 12044

- 12042 Maxim Way

- 12063 Maxim Way

- 9012 Cypresspoint Ln

- 9024 Cypresspoint Ln

- 9000 Cypresspoint Ln

- 9036 Cypresspoint Ln

- 12032 Maxim Way Unit 12032

- 12030 Maxim Way Unit 12030

- 12036 Maxim Way Unit 12036

- 12021 Maxim Way

- 12022 Maxim Way

- 12022 Maxim Way Unit 7B

- 12034 Maxim Way

- 12034 Maxim Way Unit 12034

- 12026 Maxim Way