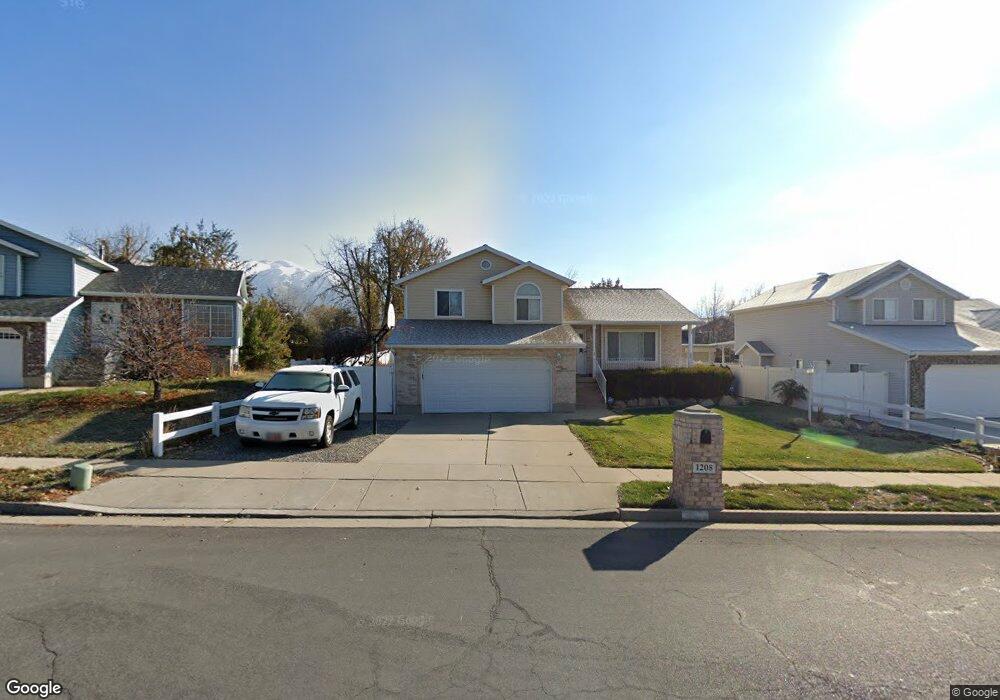

1208 N 100 W Layton, UT 84041

Estimated Value: $496,000 - $542,000

5

Beds

4

Baths

2,205

Sq Ft

$236/Sq Ft

Est. Value

About This Home

This home is located at 1208 N 100 W, Layton, UT 84041 and is currently estimated at $519,528, approximately $235 per square foot. 1208 N 100 W is a home located in Davis County with nearby schools including Crestview Elementary School, Central Davis Junior High School, and Northridge High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 6, 2021

Sold by

Labuguen Jason

Bought by

Labuguen Jason and Labuguen Royanne K

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$333,000

Outstanding Balance

$302,146

Interest Rate

2.9%

Mortgage Type

New Conventional

Estimated Equity

$217,382

Purchase Details

Closed on

Jun 24, 2019

Sold by

Labuguen Jason

Bought by

Labuguen Jason and Labuguen Royanne K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$338,604

Interest Rate

4%

Mortgage Type

VA

Purchase Details

Closed on

Sep 7, 2018

Sold by

Labuguen Jason

Bought by

Labuguen Jason and Labuguen Royanne K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$338,824

Interest Rate

4.5%

Mortgage Type

VA

Purchase Details

Closed on

Sep 6, 2018

Sold by

Griffith Robert John and Griffith Maria Buzianis

Bought by

Labuguen Jason

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$338,824

Interest Rate

4.5%

Mortgage Type

VA

Purchase Details

Closed on

May 10, 2018

Sold by

Griffith Robert J and Griffith Maria B

Bought by

Griffith Roberrt John and Griffith Revocable Living Trust

Purchase Details

Closed on

Apr 6, 2009

Sold by

Griffith Robert J and Griffith Maria B

Bought by

Griffith Maria B and Griffith Robert J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$164,800

Interest Rate

5.06%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 18, 1998

Sold by

Griffith Robert J and Griffith Maria Buzianis

Bought by

Griffith Robert J and Griffith Maria B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$107,000

Interest Rate

6.61%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Labuguen Jason | -- | Trident Title Insurance | |

| Labuguen Jason | -- | Trident Title Insurance | |

| Labuguen Jason | -- | Old Republic Natl Title | |

| Labuguen Jason | -- | Old Republic Natl Title | |

| Labuguen Jason | -- | Old Republic Natl Title | |

| Labuguen Jason | -- | First American Title | |

| Griffith Roberrt John | -- | -- | |

| Griffith Maria B | -- | Hickman Land Title Co | |

| Griffith Robert J | -- | Mountain View Title & Escrow |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Labuguen Jason | $333,000 | |

| Closed | Labuguen Jason | $338,604 | |

| Closed | Labuguen Jason | $338,824 | |

| Previous Owner | Griffith Maria B | $164,800 | |

| Previous Owner | Griffith Robert J | $107,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,684 | $281,050 | $96,945 | $184,105 |

| 2024 | $1,598 | $270,050 | $113,257 | $156,793 |

| 2023 | $1,597 | $472,000 | $137,434 | $334,566 |

| 2022 | $2,096 | $268,950 | $71,829 | $197,121 |

| 2021 | $2,425 | $366,000 | $98,582 | $267,418 |

| 2020 | $2,203 | $319,000 | $83,859 | $235,141 |

| 2019 | $1,897 | $269,000 | $80,484 | $188,516 |

| 2018 | $526 | $242,000 | $80,484 | $161,516 |

| 2016 | $1,563 | $114,840 | $25,122 | $89,718 |

| 2015 | $1,480 | $103,180 | $25,122 | $78,058 |

| 2014 | $1,477 | $105,289 | $25,122 | $80,167 |

| 2013 | $1,445 | $97,554 | $25,325 | $72,229 |

Source: Public Records

Map

Nearby Homes

- 103 W 1275 N

- 1180 N 100 E

- 1096 N 300 W

- 1490 N 175 W

- 324 E 1325 N

- 1583 N 25 E

- 1474 N 285 E

- 1553 N 250 E

- 398 Paul Ave

- 937 Rainbow Dr

- 1908 N 200 W

- 1837 N 440 W

- 785 Sherwood Dr

- 495 Spurlock St

- 480 Spurlock St

- 2044 Evans Cove Loop

- 441 Church St

- 2048 Evans Cove Loop

- 2053 Evans Cove Loop Unit 39

- 806 Valeria Dr