121 Fawn Meadow Dr Dripping Springs, TX 78620

Estimated Value: $682,000 - $1,080,104

3

Beds

3

Baths

2,120

Sq Ft

$438/Sq Ft

Est. Value

About This Home

This home is located at 121 Fawn Meadow Dr, Dripping Springs, TX 78620 and is currently estimated at $929,035, approximately $438 per square foot. 121 Fawn Meadow Dr is a home located in Hays County with nearby schools including Dripping Springs Middle School, Dripping Springs High School, and Acton Academy Dripping Springs.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 20, 2017

Sold by

Richardson Paula Jean and Richardson Elvie Louis

Bought by

J J Reid Enterprises Llc

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$204,000

Outstanding Balance

$170,942

Interest Rate

3.85%

Estimated Equity

$758,093

Purchase Details

Closed on

Jun 8, 2009

Sold by

Windham Laurie

Bought by

Reid James P and Reid Jennifer L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$250,000

Interest Rate

4.7%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 14, 2006

Sold by

Robinson James R and Robinson Brenda H

Bought by

Windham Laurie

Purchase Details

Closed on

Jun 1, 2001

Sold by

Bohannon Clyde C and Bohannon Thora

Bought by

Reid James P and Reid Jennifer L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| J J Reid Enterprises Llc | -- | None Available | |

| Reid James P | -- | Independence Title | |

| Windham Laurie | -- | None Available | |

| Reid James P | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | J J Reid Enterprises Llc | $204,000 | |

| Previous Owner | Reid James P | $250,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,982 | $588,540 | -- | -- |

| 2024 | $7,982 | $592,350 | $753,030 | $466,530 |

| 2023 | $8,810 | $583,459 | $753,030 | $628,090 |

| 2022 | $9,047 | $530,417 | $247,000 | $333,880 |

| 2021 | $9,021 | $482,197 | $247,000 | $305,550 |

| 2020 | $7,659 | $438,361 | $74,050 | $376,810 |

| 2019 | $8,218 | $398,510 | $61,150 | $337,360 |

| 2018 | $7,905 | $381,190 | $61,150 | $320,040 |

| 2017 | $7,800 | $373,310 | $61,150 | $312,160 |

| 2016 | $7,439 | $356,010 | $61,150 | $294,860 |

| 2015 | $6,395 | $341,840 | $61,150 | $280,690 |

Source: Public Records

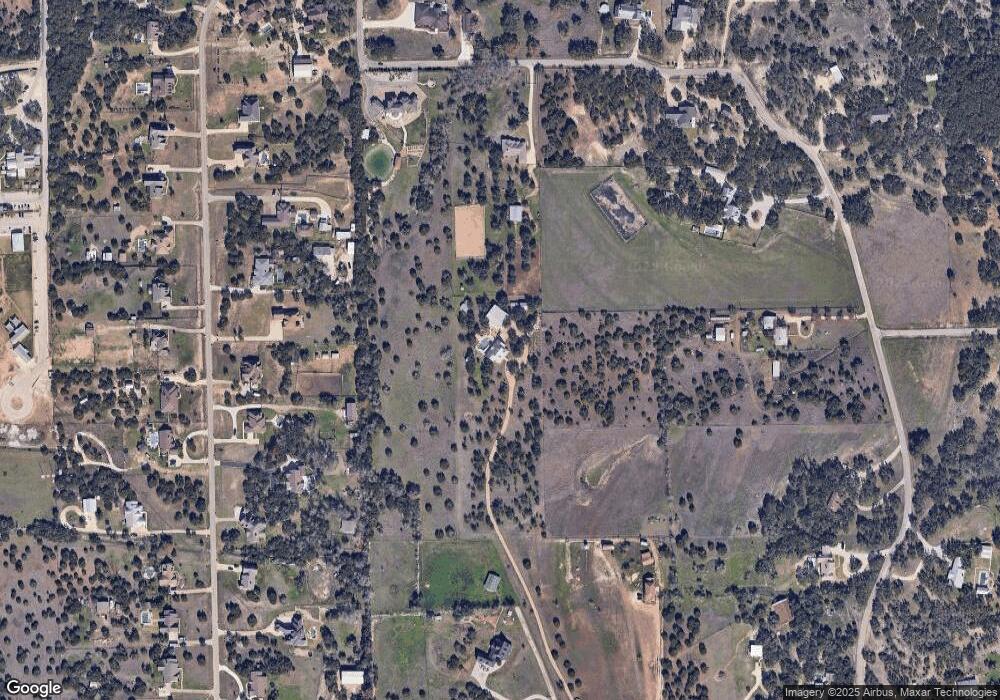

Map

Nearby Homes

- 1440 Deerfield Rd

- 220 Fawn Meadow Dr

- 351 Fawn Meadow Dr

- 724 Chama Trace

- 601 Hays Country Acres Rd

- 2450 E Creek Cove

- 550 Hays Country Acres Rd

- 294 Frog Pond Ln

- 1021 Westland Ridge Rd

- 1006 Foothills Dr

- 1120 Canyon View Rd

- 220 Lanier Ranch Rd

- 211 E Creek Dr

- 816 Drifting Wind Run

- 907 Iron Willow Loop

- 843 Iron Willow Loop

- 798 Iron Willow Loop

- 1305 Park Cove

- 201 N Canyonwood Dr

- 1026 Canyon Bend Dr

- 1330 Deerfield Rd

- 419 Chama Trace

- 453 Chama Trace

- 485 Chama Trace

- 353 Chama Trace

- 1550 Deerfield Rd

- 519 Chama Trace

- 151 Fawn Meadow Dr

- 1660 Deerfield Rd

- 101 Fawn Meadow Dr

- 551 Chama Trace

- TBD - lot 3 Deerfield Rd

- TBD Lot 3 Deerfield Rd

- TBD - lot 4 Deerfield Rd

- TBD Lot 4 Deerfield Rd

- TBD Lot 5 Deerfield Rd

- 317 Chama Trace

- TBD - Lot 1 Deerfield Rd

- TBD Deerfield Rd