121 Jarmon Rd Elkton, MD 21921

Estimated Value: $286,000 - $382,034

--

Bed

3

Baths

2,360

Sq Ft

$143/Sq Ft

Est. Value

About This Home

This home is located at 121 Jarmon Rd, Elkton, MD 21921 and is currently estimated at $338,259, approximately $143 per square foot. 121 Jarmon Rd is a home located in Cecil County with nearby schools including Thomson Estates Elementary School, Elkton Middle School, and Elkton High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 1, 2025

Sold by

Robert Roy Mitchell and Robert Nancy Hallsted

Bought by

Baranski James Scott

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$294,566

Outstanding Balance

$293,308

Interest Rate

6.85%

Mortgage Type

New Conventional

Estimated Equity

$44,951

Purchase Details

Closed on

Feb 23, 2017

Sold by

Mitchell Robert R and Mitchell Nancy H

Bought by

Mitchell Robert Roy and Mitchell Nancy Hallsted

Purchase Details

Closed on

Dec 29, 1975

Sold by

Rin Chun-Hsun and Rin Jui-Chih

Bought by

Mitchell Robert R and Mitchell Nancy H

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Baranski James Scott | $300,000 | Kirsh Title | |

| Baranski James Scott | $300,000 | Kirsh Title | |

| Mitchell Robert Roy | -- | None Available | |

| Mitchell Robert R | $31,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Baranski James Scott | $294,566 | |

| Closed | Baranski James Scott | $294,566 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,934 | $268,133 | $0 | $0 |

| 2024 | $2,312 | $243,200 | $51,700 | $191,500 |

| 2023 | $1,962 | $241,000 | $0 | $0 |

| 2022 | $2,644 | $238,800 | $0 | $0 |

| 2021 | $2,591 | $236,600 | $51,700 | $184,900 |

| 2020 | $2,508 | $224,500 | $0 | $0 |

| 2019 | $2,407 | $212,400 | $0 | $0 |

| 2018 | $2,310 | $200,300 | $71,700 | $128,600 |

| 2017 | $2,310 | $200,300 | $0 | $0 |

| 2016 | $2,235 | $200,300 | $0 | $0 |

| 2015 | $2,235 | $202,700 | $0 | $0 |

| 2014 | $2,340 | $202,700 | $0 | $0 |

Source: Public Records

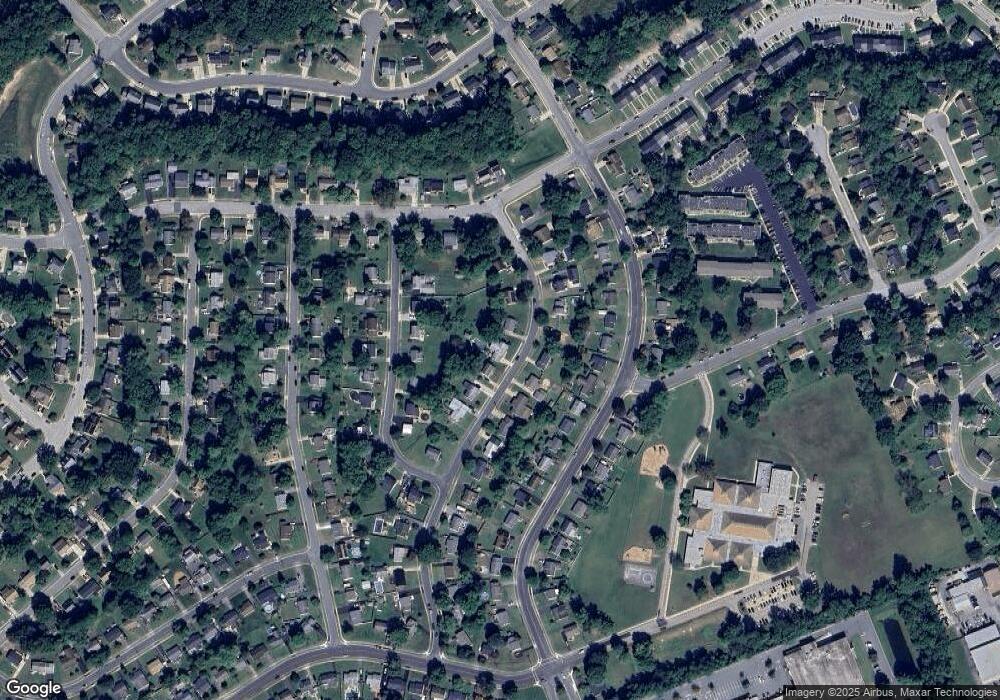

Map

Nearby Homes

- 155 E Village Rd

- 112 Courtney Dr

- 182 E Village Rd

- 124 Michaels Way

- 113 Michaels Way

- 114 Saint Louis Dr

- Juniper Plan at Gray Mount Commons

- 606 Gray Mount Cir

- 520 Saint Charles St

- 413 Gray Mount Cir

- 0 Delaware Ave Unit MDCC2018992

- 4 Saint Pats Cir

- 0 E Pulaski Hwy

- 112 Ben Blvd

- 6 Shade Tree Ln

- 102 Independence Dr

- 114 Creswell Ave

- 23 Hatteras Ct

- 103 State St

- 222 Thomas Jefferson Terrace