121 Laurel Ct Quakertown, PA 18951

Richland NeighborhoodEstimated Value: $280,000 - $299,926

3

Beds

3

Baths

1,480

Sq Ft

$196/Sq Ft

Est. Value

About This Home

This home is located at 121 Laurel Ct, Quakertown, PA 18951 and is currently estimated at $290,732, approximately $196 per square foot. 121 Laurel Ct is a home located in Bucks County with nearby schools including Quakertown Elementary School, Strayer Middle School, and Quakertown Community Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 29, 2013

Sold by

Fox John D and Fox Margaret J

Bought by

Fox Dane

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$139,378

Outstanding Balance

$97,766

Interest Rate

3.56%

Mortgage Type

FHA

Estimated Equity

$192,966

Purchase Details

Closed on

Jun 2, 2000

Sold by

Adams William T

Bought by

Fox John D and Fox Margaret J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$60,000

Interest Rate

8.12%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fox Dane | $141,950 | None Available | |

| Fox John D | $81,500 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Fox Dane | $139,378 | |

| Closed | Fox John D | $60,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,232 | $15,160 | $2,520 | $12,640 |

| 2024 | $3,232 | $15,160 | $2,520 | $12,640 |

| 2023 | $3,168 | $15,160 | $2,520 | $12,640 |

| 2022 | $3,117 | $15,160 | $2,520 | $12,640 |

| 2021 | $3,117 | $15,160 | $2,520 | $12,640 |

| 2020 | $3,117 | $15,160 | $2,520 | $12,640 |

| 2019 | $3,034 | $15,160 | $2,520 | $12,640 |

| 2018 | $2,934 | $15,160 | $2,520 | $12,640 |

| 2017 | $2,847 | $15,160 | $2,520 | $12,640 |

| 2016 | $2,847 | $15,160 | $2,520 | $12,640 |

| 2015 | -- | $15,160 | $2,520 | $12,640 |

| 2014 | -- | $15,160 | $2,520 | $12,640 |

Source: Public Records

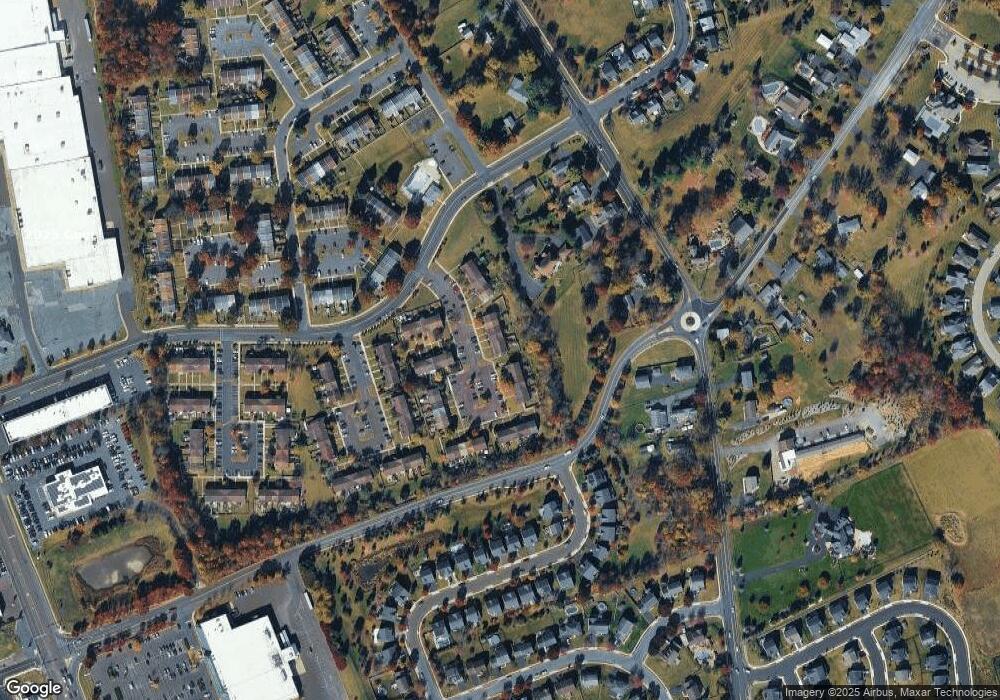

Map

Nearby Homes

- 92 Laurel Ct

- 2228 Blue Gill Dr Unit 54

- 1068 Freedom Ct

- 940 S West End Blvd

- 112 Jefferson Ct

- 55 Morris Rd

- 1124 Longwood Dr

- 141 S 2nd St

- 1125 Arbour Ln

- 262 Fairview Ave

- 27 S 7th St

- 2285 Richland Terrace

- 803 W Broad St

- 9 Maple St

- 2710 S Old Bethlehem Pike

- 56 Dewsbury Ln

- 811 W Mill St

- 5 Essex Ct

- 94 Braithwaite Ln

- 1133 Mariwill Dr