1210 Sanctuary Place Columbus, OH 43230

Estimated Value: $372,000 - $429,000

3

Beds

4

Baths

1,526

Sq Ft

$263/Sq Ft

Est. Value

About This Home

This home is located at 1210 Sanctuary Place, Columbus, OH 43230 and is currently estimated at $401,215, approximately $262 per square foot. 1210 Sanctuary Place is a home located in Franklin County with nearby schools including High Point Elementary School, Gahanna East Middle School, and Lincoln High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 19, 2017

Sold by

Russo Robert A and Russo Lynn R

Bought by

Russo Matthew E and The Russo Keystone Presrvation

Current Estimated Value

Purchase Details

Closed on

Jun 28, 2007

Sold by

Roth Harmon Lynn

Bought by

Harmon Lynn Roth and Russo Robert A

Purchase Details

Closed on

May 16, 2005

Sold by

He Stonehenge Co

Bought by

Harmon Lynn Roth

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$216,000

Outstanding Balance

$104,792

Interest Rate

4.77%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$296,423

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Russo Matthew E | -- | None Available | |

| Harmon Lynn Roth | $110,200 | Land Sel Ti | |

| Harmon Lynn Roth | $288,400 | Stewart Tit |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Harmon Lynn Roth | $216,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $7,230 | $122,720 | $25,030 | $97,690 |

| 2023 | $7,139 | $122,710 | $25,025 | $97,685 |

| 2022 | $7,097 | $95,030 | $14,700 | $80,330 |

| 2021 | $6,864 | $95,030 | $14,700 | $80,330 |

| 2020 | $6,806 | $95,030 | $14,700 | $80,330 |

| 2019 | $6,496 | $90,510 | $14,000 | $76,510 |

| 2018 | $5,849 | $90,510 | $14,000 | $76,510 |

| 2017 | $5,962 | $90,510 | $14,000 | $76,510 |

| 2016 | $5,245 | $72,520 | $10,990 | $61,530 |

| 2015 | $5,249 | $72,520 | $10,990 | $61,530 |

| 2014 | $5,209 | $72,520 | $10,990 | $61,530 |

| 2013 | $2,587 | $72,520 | $10,990 | $61,530 |

Source: Public Records

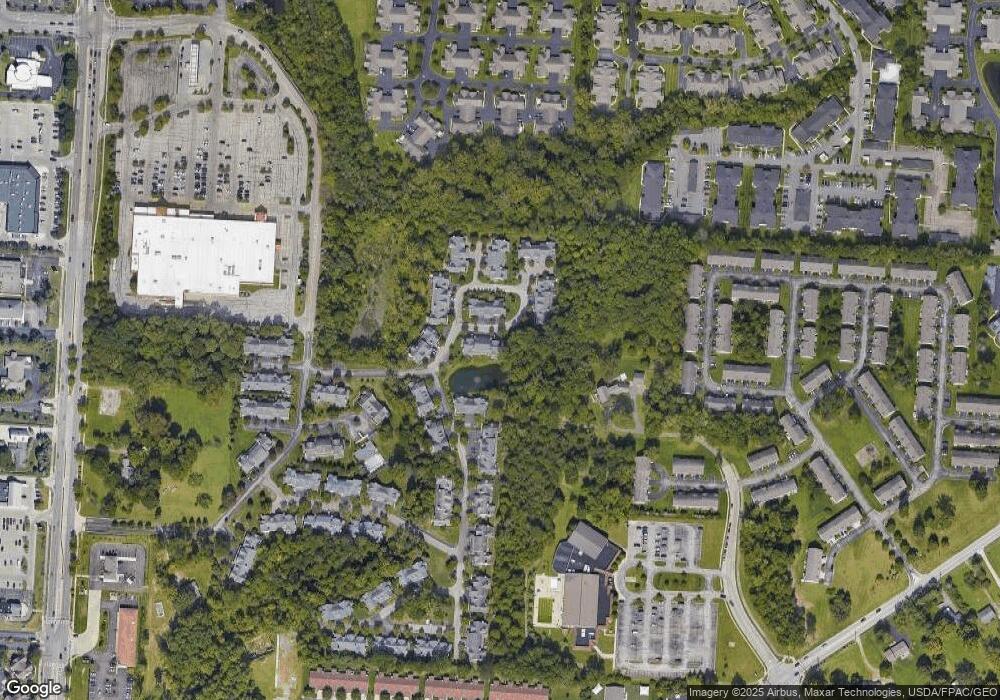

Map

Nearby Homes

- 636 Grove Cir Unit 1803

- 4574 N Hamilton Rd

- 597 Piney Glen Dr Unit 597

- 1199 Riva Ridge Blvd

- 6019 Bentgate Ln Unit 60192

- 3753 Brightwell Ln

- 0 Beecher Crossing

- 4220 E Johnstown Rd

- 4651 E Johnstown Rd

- 6263 Wagtail Rd Unit 13

- 6200 Downwing Ln Unit 20

- 6169 Needletail Rd

- 777 Dark Star Ave

- 3826 Wood Stork Ln Unit 68

- 638 Churchill Dr

- 3977 Spectacle Dr

- 6232 Joes Hopper Rd Unit 52

- 4135 Pathfield Dr

- 1035 Riva Ridge Blvd

- 804 Riva Ridge Blvd

- 1208 Sanctuary Place

- 1206 Sanctuary Place

- 1204 Sanctuary Place

- 1204 Sanctuary Place Unit 35

- 1214 Sanctuary Place

- 1216 Sanctuary Place

- 1216 Sanctuary Place

- 1212 Sanctuary Place

- 1220 Sanctuary Place

- 1220 Sanctuary Place Unit 3-1220

- 1198 Sanctuary Place

- 1222 Sanctuary Place

- 1222 Sanctuary Place Unit 33

- 1222 Sanctuary Place Unit 33-122

- 1202 Sanctuary Place

- 1202 Sanctuary Place Unit 6-1202

- 1211 Sanctuary Place

- 1209 Sanctuary Place

- 1224 Sanctuary Place Unit 33122

- 1224 Sanctuary Place Unit 3-1224