Estimated Value: $236,000 - $272,382

4

Beds

2

Baths

1,800

Sq Ft

$145/Sq Ft

Est. Value

About This Home

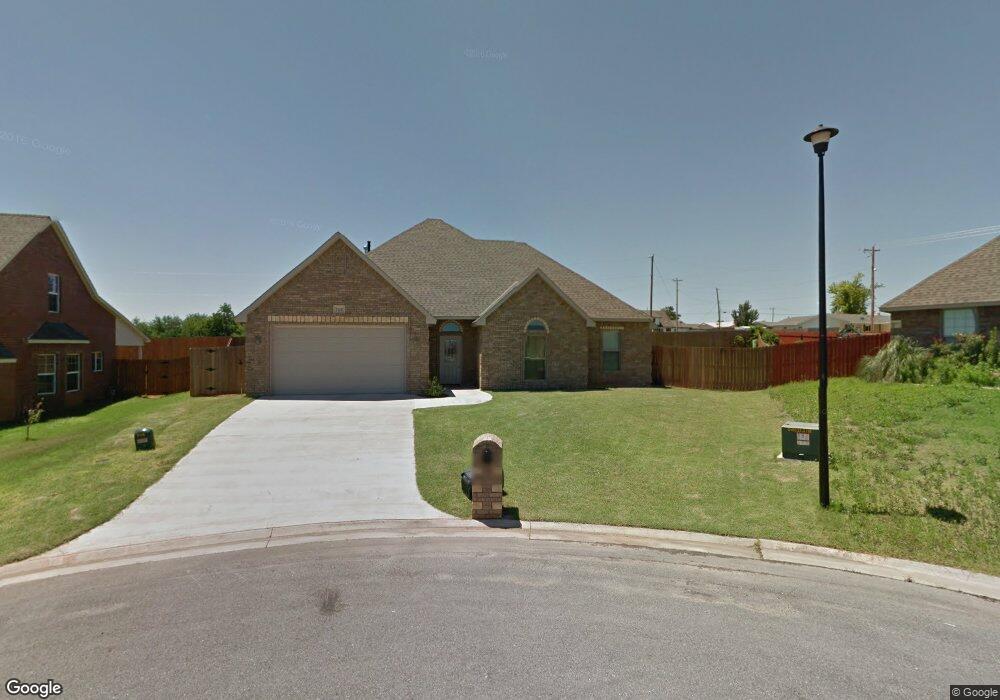

This home is located at 1213 Red Rock Dr, Elgin, OK 73538 and is currently estimated at $260,596, approximately $144 per square foot. 1213 Red Rock Dr is a home located in Comanche County with nearby schools including Elgin Elementary School, Elgin Middle School, and Elgin High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 2, 2024

Sold by

Ivory Russell J and Ivory Marilyn

Bought by

Levels Michael De Ray

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$273,745

Outstanding Balance

$270,597

Interest Rate

6.35%

Mortgage Type

VA

Estimated Equity

-$10,001

Purchase Details

Closed on

Mar 18, 2010

Sold by

Bedlam Development Llc

Bought by

Ivory Russell J and Ivory Marilyn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$186,459

Interest Rate

5.25%

Mortgage Type

FHA

Purchase Details

Closed on

Aug 25, 2009

Sold by

Bridgewood Development Llc

Bought by

Bedlam Development Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$145,574

Interest Rate

5.19%

Mortgage Type

Future Advance Clause Open End Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Levels Michael De Ray | $265,000 | Sovereign Title | |

| Ivory Russell J | $190,000 | -- | |

| Bedlam Development Llc | $21,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Levels Michael De Ray | $273,745 | |

| Previous Owner | Ivory Russell J | $186,459 | |

| Previous Owner | Bedlam Development Llc | $145,574 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,204 | $29,352 | $5,625 | $23,727 |

| 2024 | $2,204 | $27,675 | $4,500 | $23,175 |

| 2023 | $2,204 | $21,337 | $3,825 | $17,512 |

| 2022 | $2,068 | $20,716 | $3,825 | $16,891 |

| 2021 | $2,105 | $20,716 | $3,825 | $16,891 |

| 2020 | $1,948 | $20,359 | $3,825 | $16,534 |

| 2019 | $2,199 | $21,160 | $3,825 | $17,335 |

| 2018 | $2,193 | $21,160 | $3,825 | $17,335 |

| 2017 | $2,065 | $20,836 | $3,150 | $17,686 |

| 2016 | $2,026 | $20,635 | $3,150 | $17,485 |

| 2015 | $2,092 | $21,328 | $2,475 | $18,853 |

| 2014 | $2,048 | $21,328 | $2,475 | $18,853 |

Source: Public Records

Map

Nearby Homes

- 1225 Pebble Trail

- 1408 Limestone Way

- 1405 Limestone Way

- 1414 Limestone Way

- 89 NE Deerfield Dr

- 106 Belle Cir

- 1206 Hershel Dr

- 102 K St

- 304 Crestview Dr

- 326 NE Uvon Ln

- 704 6th St

- 611 7th St

- 519 G St

- 508 2nd St

- 12410 Big Horn Ln

- 10906 Jeremiah Way

- 203 3rd St

- 216 2nd St

- 5499 NE Elk Point Rd

- 101 Pond View

- 1319 Saddle Rock Dr

- 1241 Red Rock Dr

- 1321 Saddle Rock Dr

- 1317 Saddle Rock Dr

- 1329 Saddle Rock Dr

- 1246 Red Rock Dr

- 1201 Pebble Trail

- 1205 Red Rock Dr

- 1217 Red Rock Dr

- 1327 Saddle Rock Dr

- 1313 Saddle Rock Dr

- 1209 Pebble Trail

- 1235 Red Rock Dr

- 1244 Red Rock Dr

- 1331 Saddle Rock Dr

- 1221 Red Rock Dr

- 1201 Red Rock Dr

- 1233 Red Rock Dr

- 1225 Red Rock Dr

- 1213 Pebble Trail