1220 W Lafayette St Unit 1222 Ottawa, IL 61350

Estimated Value: $263,000 - $274,000

--

Bed

--

Bath

2,492

Sq Ft

$108/Sq Ft

Est. Value

About This Home

This home is located at 1220 W Lafayette St Unit 1222, Ottawa, IL 61350 and is currently estimated at $269,034, approximately $107 per square foot. 1220 W Lafayette St Unit 1222 is a home located in LaSalle County with nearby schools including Ottawa Township High School, Marquette Academy, and Marquette Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 1, 2024

Sold by

Baylis Tyler

Bought by

Pct Property Group Llc

Current Estimated Value

Purchase Details

Closed on

Dec 13, 2022

Sold by

Wilmington Savings Fund Society

Bought by

Cascade Funding Mortgage Trust Hb7

Purchase Details

Closed on

Nov 29, 2022

Sold by

Cascade Funding Mortgage Trust Hb7

Bought by

Baylis Tyler

Purchase Details

Closed on

Mar 24, 2020

Sold by

Nationstar Hecm Acquisition Trust 2018-1

Bought by

Wilmington Savings Fund Society Fsb and Nationstar Hecm Acquisition Trust 2019-2

Purchase Details

Closed on

Dec 20, 2014

Sold by

Joseph Myre Estate

Bought by

Myre Elena

Purchase Details

Closed on

Sep 15, 2011

Sold by

Myre Joseph and Myre Elena

Bought by

Myre Joseph

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Pct Property Group Llc | $259,000 | None Available | |

| Cascade Funding Mortgage Trust Hb7 | -- | None Available | |

| Baylis Tyler | $95,000 | None Available | |

| Wilmington Savings Fund Society Fsb | -- | None Available | |

| Myre Elena | -- | -- | |

| Myre Joseph | -- | None Available |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,860 | $56,903 | $4,716 | $52,187 |

| 2023 | $5,364 | $50,929 | $4,221 | $46,708 |

| 2022 | $4,935 | $46,223 | $5,903 | $40,320 |

| 2021 | $4,658 | $43,325 | $5,533 | $37,792 |

| 2020 | $4,402 | $41,156 | $5,256 | $35,900 |

| 2019 | $4,507 | $40,736 | $5,202 | $35,534 |

| 2018 | $4,394 | $39,758 | $5,077 | $34,681 |

| 2017 | $3,583 | $38,540 | $4,921 | $33,619 |

| 2016 | $3,413 | $36,887 | $4,710 | $32,177 |

| 2015 | $2,994 | $35,187 | $4,493 | $30,694 |

| 2012 | -- | $38,468 | $4,913 | $33,555 |

Source: Public Records

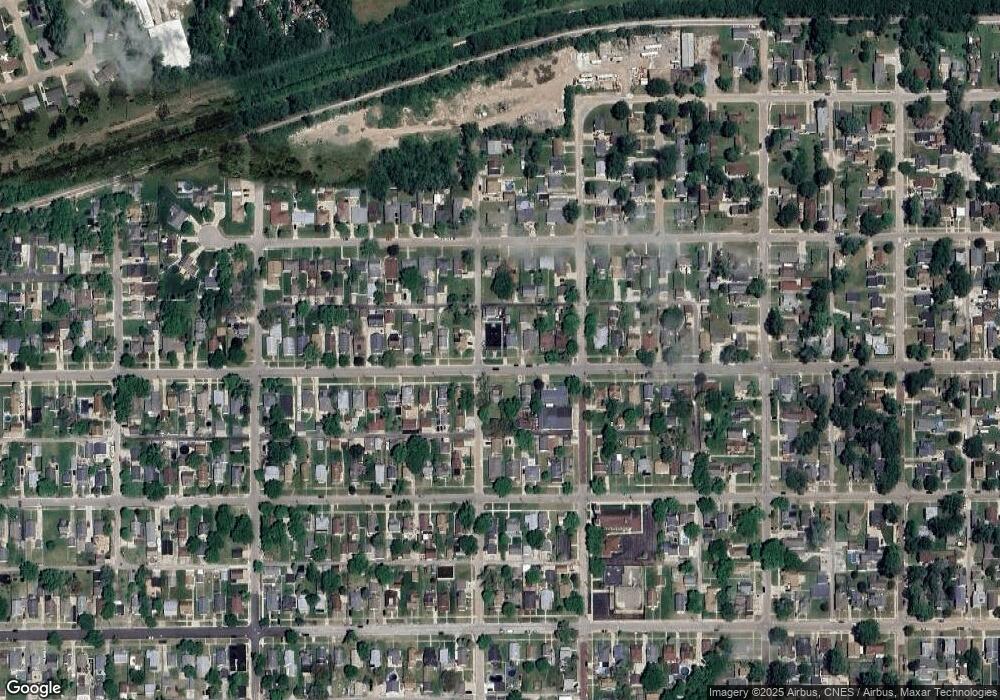

Map

Nearby Homes

- 1314 W Washington St

- 1331 W Washington St

- 1126 Sanger St

- 915 W Superior St

- 1322 W Madison St

- 822 W Lafayette St

- 618 Harden St

- 1213 W Main St

- 718 W Jackson St

- 000 Canal Rd

- 503 Taylor St

- 1102 Illinois Ave

- 718 Sycamore St

- 1201-1217 Illinois Ave

- VL Boyce Memorial Dr

- 1625 W Main St

- 706 Illinois Ave

- 1617 Pine St

- 412 W Lafayette St

- 152 Riverview Dr

- 1220-1222 W Lafayette St

- 1218 W Lafayette St

- 1006 Forest St

- 1304 W Lafayette St

- 1216 W Lafayette St

- 1308 W Lafayette St

- 1208 W Lafayette St

- 1221 W Washington St

- 1316 W Lafayette St

- 1015 Forest St

- 1200 W Lafayette St

- 1205 W Washington St

- 1217 W Lafayette St

- 1219 W Washington St

- 1303 W Lafayette St

- 1213 W Lafayette St

- 1307 W Lafayette St

- 1203 W Washington St

- 1203 W Lafayette St

- 1318 W Lafayette St