1221 Swift Creek Unit 85 Greensboro, GA 30642

Estimated Value: $1,606,000 - $2,276,000

3

Beds

4

Baths

5,000

Sq Ft

$372/Sq Ft

Est. Value

About This Home

This home is located at 1221 Swift Creek Unit 85, Greensboro, GA 30642 and is currently estimated at $1,861,783, approximately $372 per square foot. 1221 Swift Creek Unit 85 is a home located in Greene County with nearby schools including Greene County High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 15, 2020

Sold by

Robertson Jerry B

Bought by

Bartolotta Margaret H and Bartolotta Richard

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,148,400

Outstanding Balance

$1,128,653

Interest Rate

2.85%

Mortgage Type

FHA

Estimated Equity

$733,130

Purchase Details

Closed on

Apr 12, 2011

Sold by

Robertson Jerry B

Bought by

Robertson Jerry B and Robertson Rose S

Purchase Details

Closed on

Jun 24, 2005

Sold by

Linger Longer Development

Bought by

Robertson Jerry B and Robertson Rose S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$234,000

Interest Rate

5.57%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bartolotta Margaret H | $875,000 | -- | |

| Robertson Jerry B | -- | -- | |

| Robertson Jerry B | $260,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bartolotta Margaret H | $1,148,400 | |

| Closed | Bartolotta Margaret H | $1,148,400 | |

| Previous Owner | Robertson Jerry B | $234,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,040 | $596,840 | $170,000 | $426,840 |

| 2024 | $7,627 | $517,000 | $110,000 | $407,000 |

| 2023 | $8,819 | $508,040 | $110,000 | $398,040 |

| 2022 | $8,819 | $493,440 | $70,000 | $423,440 |

| 2021 | $6,845 | $427,160 | $70,000 | $357,160 |

| 2020 | $7,185 | $342,480 | $52,000 | $290,480 |

| 2019 | $7,295 | $342,480 | $52,000 | $290,480 |

| 2018 | $7,273 | $342,480 | $52,000 | $290,480 |

| 2017 | $6,761 | $338,845 | $52,000 | $286,845 |

| 2016 | $6,826 | $341,963 | $52,000 | $289,963 |

| 2015 | $6,702 | $341,962 | $52,000 | $289,963 |

| 2014 | $6,325 | $315,598 | $52,000 | $263,598 |

Source: Public Records

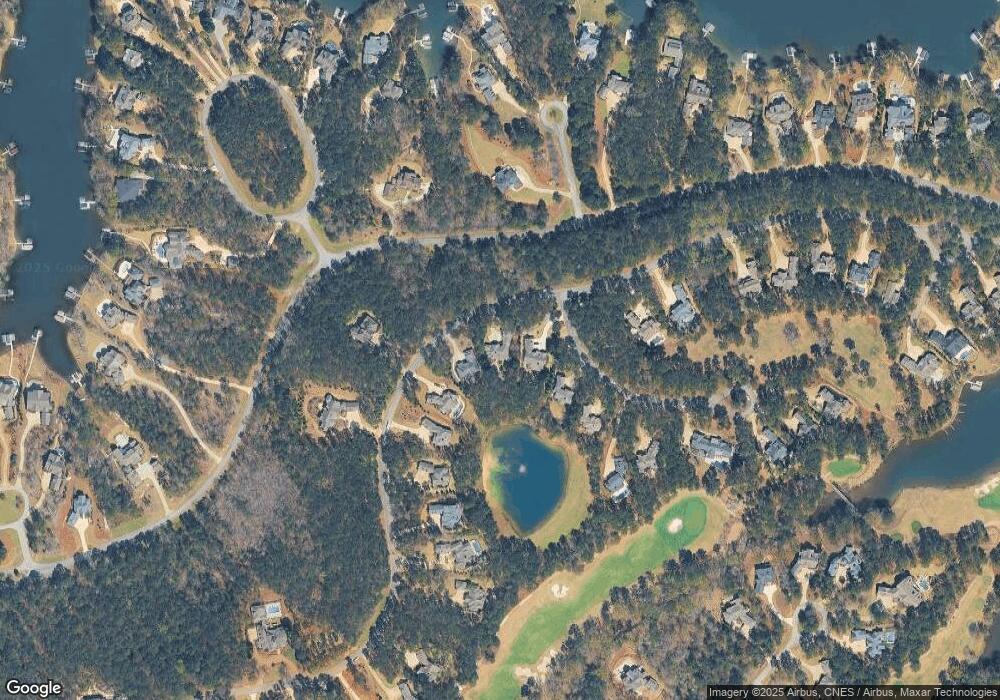

Map

Nearby Homes

- 1201 Swift Creek

- 1010 Amasa Ln

- 1140 Fox Bend

- 1321 Swift Creek

- 1131 Broadpoint Dr

- 1110 Broadpoint Dr

- 1051 Swift Creek

- 1071 Brookside

- 1050 Tailwater

- 1050 Tailwater Unit A

- 1030 Tailwater

- 1030 Creekside

- 1030 Creekside Unit A

- 1080 Tailwater

- 1020 Portage Trail

- 1010 Creekside Unit A

- 1010 Creekside

- 1010 Portage Trail

- 1020 Homestead

- 5010 Browns Ford Rd

- 1221 Swift Creek

- 1001 Amasa Ln

- 1211 Swift Creek

- 1011 Amasa Ln

- 1061 Amasa Ln

- 1191 Swift Creek Unit 82

- 1191 Swift Creek

- 1241 Swift Creek Unit 111

- 1241 Swift Creek

- 1021 Amasa Ln

- 1210 Swift Creek

- 1181 Swift Creek

- 1251 Swift Creek

- N N Shore Dr Unit LOT 3

- 1190 Swift Creek

- 1000 N Shore Ct

- 1000 N Shore Ct Unit 22

- 1031 Amasa Ln

- 1171 Swift Creek

- 1261 Swift Creek