1222 N 575 W Centerville, UT 84014

Estimated Value: $401,384 - $437,000

2

Beds

2

Baths

1,617

Sq Ft

$260/Sq Ft

Est. Value

About This Home

This home is located at 1222 N 575 W, Centerville, UT 84014 and is currently estimated at $420,596, approximately $260 per square foot. 1222 N 575 W is a home located in Davis County with nearby schools including Stewart Elementary School, Centerville Jr High, and Viewmont High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 1, 2021

Sold by

Christensen Shirley Diane

Bought by

Christensen Shirley Diane and Shirley Diane Christensen 1999 Fam Liv T

Current Estimated Value

Purchase Details

Closed on

Feb 16, 2016

Sold by

Shenefelt Joyce Anne

Bought by

Christensen Jay V and The Jay V Christensen Family Living Trus

Purchase Details

Closed on

Feb 18, 2014

Sold by

Wilson Margaret D

Bought by

Wilson Margaret D

Purchase Details

Closed on

Sep 23, 2011

Sold by

Richins Virgil

Bought by

Wilson Margaret D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$138,500

Interest Rate

4.26%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Christensen Shirley Diane | -- | None Available | |

| Shirley Diane Christensen 1999 Family Living | -- | None Listed On Document | |

| Christensen Jay V | -- | Us Title Company Of Utah | |

| Wilson Margaret D | -- | None Available | |

| Wilson Margaret D | -- | Bonneville Superior |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Wilson Margaret D | $138,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,431 | $221,100 | $72,050 | $149,050 |

| 2024 | $2,319 | $215,600 | $55,000 | $160,600 |

| 2023 | $2,358 | $219,450 | $53,900 | $165,550 |

| 2022 | $2,376 | $403,000 | $96,000 | $307,000 |

| 2021 | $2,034 | $294,000 | $69,000 | $225,000 |

| 2020 | $1,773 | $255,000 | $64,500 | $190,500 |

| 2019 | $1,762 | $248,000 | $62,000 | $186,000 |

| 2018 | $1,583 | $220,000 | $58,000 | $162,000 |

| 2016 | $1,316 | $102,245 | $19,800 | $82,445 |

| 2015 | $1,276 | $94,105 | $19,800 | $74,305 |

| 2014 | $1,235 | $93,785 | $18,333 | $75,452 |

| 2013 | -- | $98,335 | $20,900 | $77,435 |

Source: Public Records

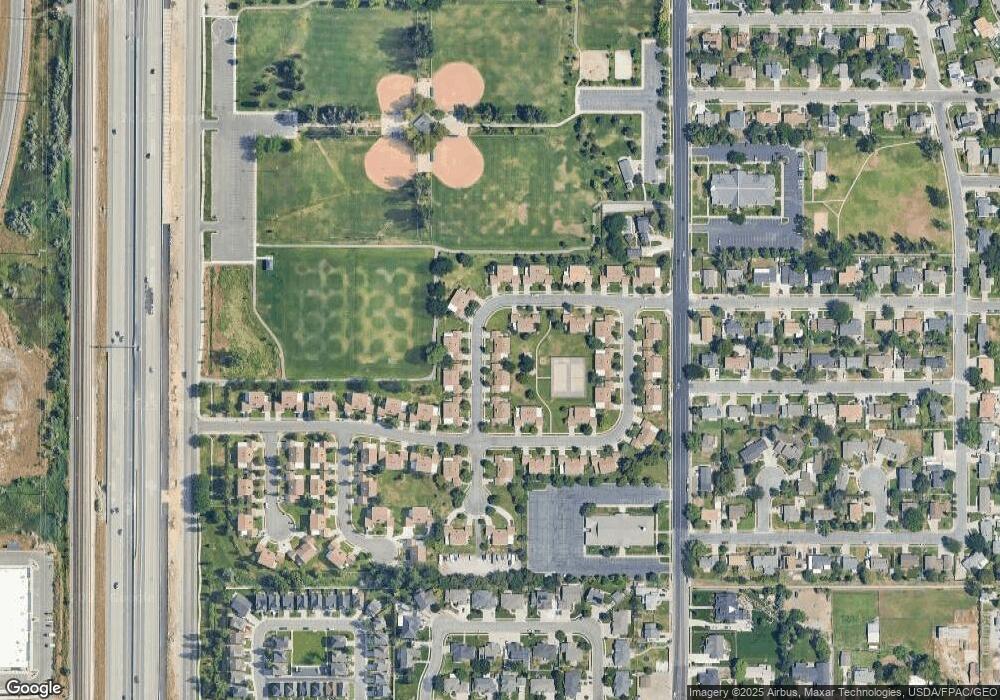

Map

Nearby Homes

- 1154 N 700 W

- 732 W 1175 N

- 429 W 1050 N

- 271 Brookfield Ln

- 495 Creek View Rd

- 781 Pheasantbrook Dr

- 775 Pheasantbrook Cir

- 509 Applewood Dr

- 638 N 800 W

- 282 W 650 N

- 67 W Pheasantbrook Dr

- 1441 N Main St

- 447 W 620 N Unit 106

- 281 W 650 N Unit C

- 171 W 650 N

- 1285 Nola Dr

- 145 Ford Canyon Dr

- 274 N 100 W

- 733 W 1825 N

- 232 N 100 W