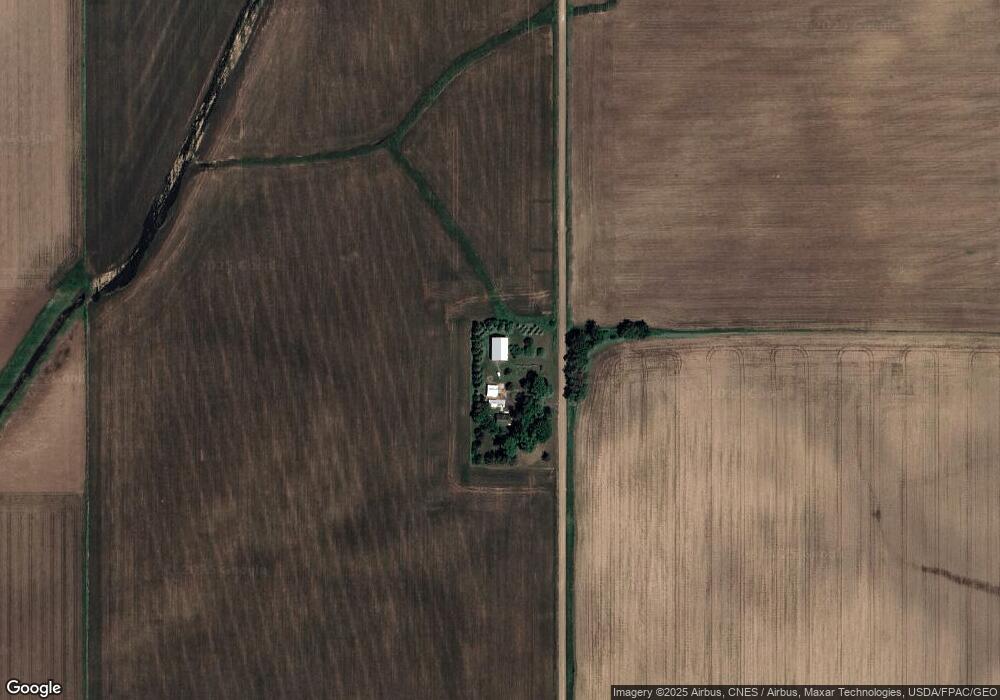

1226 170th St Hammond, WI 54015

Erin Prairie NeighborhoodEstimated Value: $277,000 - $419,000

3

Beds

1

Bath

--

Sq Ft

2.22

Acres

About This Home

This home is located at 1226 170th St, Hammond, WI 54015 and is currently estimated at $357,491. 1226 170th St is a home located in St. Croix County with nearby schools including Saint Croix Central Elementary School, Saint Croix Central Middle School, and St. Croix Central High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 25, 2025

Sold by

Hawes Steven A and Blum Janelle L

Bought by

Jackson Bryan V

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$375,250

Outstanding Balance

$374,691

Interest Rate

7.5%

Mortgage Type

New Conventional

Estimated Equity

-$17,200

Purchase Details

Closed on

Jun 27, 2016

Sold by

Ahbo Rentals Llc

Bought by

Blum Janelle L and Hawes Steven A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$206,625

Interest Rate

3.58%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 11, 2015

Sold by

Brooks Gayle A and Brooks Daniel

Bought by

Ahbo Rentals Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jackson Bryan V | $395,000 | None Listed On Document | |

| Blum Janelle L | $217,500 | Attorney | |

| Ahbo Rentals Llc | $119,000 | St Croix County Abstract & T |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Jackson Bryan V | $375,250 | |

| Previous Owner | Blum Janelle L | $206,625 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $20 | $145,900 | $22,200 | $123,700 |

| 2023 | $1,786 | $145,900 | $22,200 | $123,700 |

| 2022 | $1,861 | $145,900 | $22,200 | $123,700 |

| 2021 | $1,695 | $145,900 | $22,200 | $123,700 |

| 2020 | $1,628 | $102,500 | $22,200 | $80,300 |

| 2019 | $1,462 | $102,500 | $22,200 | $80,300 |

| 2018 | $1,566 | $102,500 | $22,200 | $80,300 |

| 2017 | $1,746 | $102,500 | $22,200 | $80,300 |

| 2016 | $1,746 | $102,500 | $22,200 | $80,300 |

| 2015 | $1,442 | $102,500 | $22,200 | $80,300 |

| 2014 | $1,482 | $102,500 | $22,200 | $80,300 |

| 2013 | $1,377 | $102,500 | $22,200 | $80,300 |

Source: Public Records

Map

Nearby Homes

- 1165 167th St

- 1693 113th Ave

- 1146 167th St

- 1163 178th St Dalton Farm Road Lot 24

- 1314 130th Ave

- 1783 115th Ave

- 1141 178th St Dalton Farm Road Lot 19

- xxx Lot#27 110th Ave

- xxx Lot#17 110th Ave

- 1616 130 Ave

- 1139 178th St Dalton Farm Road Lot 18

- 1137 178th St Dalton Farm Road Lot 17

- 1791 112th Ave

- 1790 112th Ave Dalton Farm Road Lot 10

- xxx Lot #11 110th Ave

- XXX Lot #12 110th Ave

- 1258 150th St

- 1021 167th St

- xxx Lot #6 110th Ave

- xxx Lot #13 110th Ave