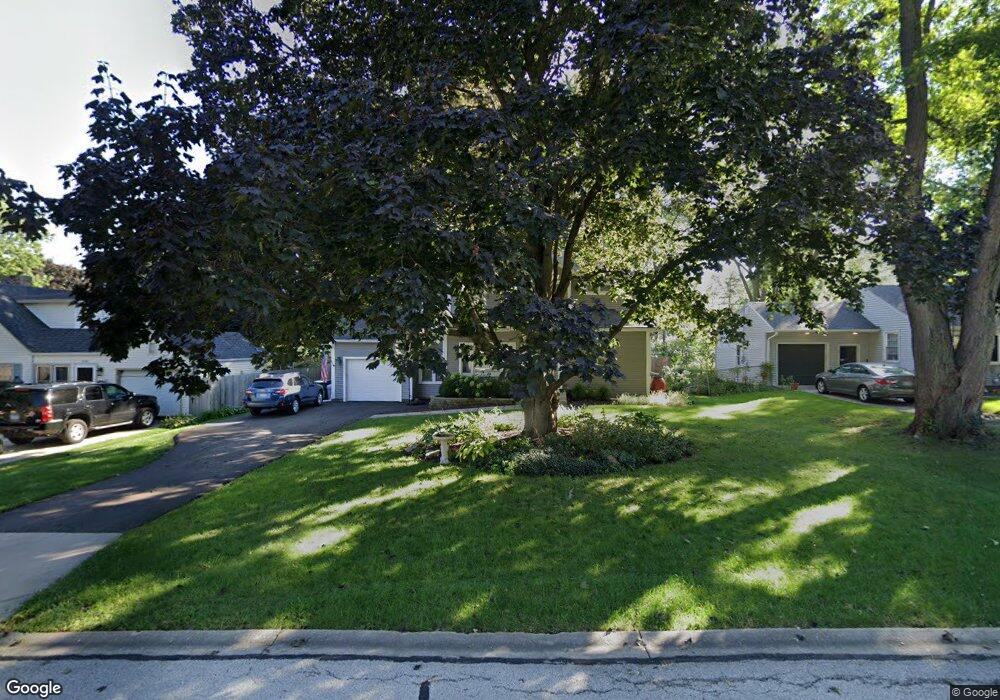

1228 Brandywine Cir Unit 3 Batavia, IL 60510

Southwest Batavia NeighborhoodEstimated Value: $342,000 - $413,000

3

Beds

3

Baths

1,617

Sq Ft

$223/Sq Ft

Est. Value

About This Home

This home is located at 1228 Brandywine Cir Unit 3, Batavia, IL 60510 and is currently estimated at $361,087, approximately $223 per square foot. 1228 Brandywine Cir Unit 3 is a home located in Kane County with nearby schools including Sam Rotolo Middle School, Batavia Sr High School, and Mooseheart Child City & School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 7, 2017

Sold by

Rembert Julee A

Bought by

Cybulski Jeffrey T and Cybulski Melissa

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$251,143

Outstanding Balance

$207,014

Interest Rate

3.87%

Mortgage Type

FHA

Estimated Equity

$154,073

Purchase Details

Closed on

Mar 1, 2001

Sold by

Howard Jeffrey D and Howard Sandra M

Bought by

Rempert Julee A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$121,200

Interest Rate

7.03%

Purchase Details

Closed on

Jan 4, 2001

Sold by

Howard Sandra M and Lentz Robert G

Bought by

Howard Jeffrey D and Howard Sandra M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$121,200

Interest Rate

7.03%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cybulski Jeffrey T | $256,000 | Fidelity National Title | |

| Rempert Julee A | $151,500 | Greater Illinois Title Compa | |

| Howard Jeffrey D | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Cybulski Jeffrey T | $251,143 | |

| Previous Owner | Rempert Julee A | $121,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $7,637 | $104,591 | $15,696 | $88,895 |

| 2023 | $7,459 | $94,928 | $14,246 | $80,682 |

| 2022 | $7,122 | $88,718 | $13,314 | $75,404 |

| 2021 | $6,829 | $84,141 | $12,627 | $71,514 |

| 2020 | $6,658 | $82,523 | $12,384 | $70,139 |

| 2019 | $6,309 | $77,000 | $11,946 | $65,054 |

| 2018 | $6,715 | $80,419 | $11,491 | $68,928 |

| 2017 | $5,255 | $63,596 | $11,112 | $52,484 |

| 2016 | $5,136 | $61,743 | $10,788 | $50,955 |

| 2015 | -- | $60,337 | $10,542 | $49,795 |

| 2014 | -- | $58,438 | $10,210 | $48,228 |

| 2013 | -- | $59,496 | $12,209 | $47,287 |

Source: Public Records

Map

Nearby Homes

- 818 Bernadette Ln

- 1280 Brandywine Cir

- 1316 Brandywine Cir Unit 4

- 1232 S Batavia Ave

- 1010 S Jefferson St

- 344 Danforth Dr

- 369 Danforth Dr

- 384 Danforth Dr

- 396 Danforth Dr

- 303 Danforth Dr

- 717 S Batavia Ave

- 524 Walnut St

- 1375 Green Pheasant Ln

- 245 Stone Manor Cir

- 1676 Carlstedt Dr

- 404 S Batavia Ave

- 231 Evergreen Dr

- 514 Main St

- 605 Main St

- 860 S River St

- 1224 Brandywine Cir

- 1232 Brandywine Cir Unit 1

- 763 Standish Ct

- 765 Standish Ct

- 1222 Brandywine Cir

- 801 Standish Ct

- 1240 Brandywine Cir

- 761 Standish Ct

- 1229 Brandywine Cir

- 1225 Brandywine Cir

- 1220 Brandywine Cir

- 1231 Brandywine Cir Unit 1

- 1221 Brandywine Cir

- 805 Standish Ct

- 759 Standish Ct

- 1219 Brandywine Cir

- 1248 Brandywine Cir Unit 1

- 1249 Brandywine Cir

- 701 Mount Vernon Place

- 1165 Concord Ct