12292 NW 14th St Unit 8 Pembroke Pines, FL 33026

Pembroke Lakes NeighborhoodEstimated Value: $445,000 - $481,000

3

Beds

3

Baths

1,650

Sq Ft

$282/Sq Ft

Est. Value

About This Home

This home is located at 12292 NW 14th St Unit 8, Pembroke Pines, FL 33026 and is currently estimated at $464,815, approximately $281 per square foot. 12292 NW 14th St Unit 8 is a home located in Broward County with nearby schools including Pembroke Lakes Elementary School, Walter C. Young Middle School, and Charles W Flanagan High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 9, 2020

Sold by

Carranza Nancy and Palacios Steve

Bought by

Bembry Taisha

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$266,381

Outstanding Balance

$237,041

Interest Rate

2.8%

Mortgage Type

FHA

Estimated Equity

$227,774

Purchase Details

Closed on

Dec 11, 2008

Sold by

Indymac Federal Bank Fsb

Bought by

Carranza Nancy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$152,625

Interest Rate

5.07%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 13, 2008

Sold by

Ortiz Maria J

Bought by

Indymac Bank Fsb

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$152,625

Interest Rate

5.07%

Mortgage Type

FHA

Purchase Details

Closed on

Jul 31, 1998

Sold by

Gutter Harriet L

Bought by

Ortiz Maria J

Purchase Details

Closed on

Aug 4, 1994

Sold by

Benitez Monica and Benitez Daniel

Bought by

Thilem Harriet L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bembry Taisha | $308,000 | Action Title Agency Llc | |

| Carranza Nancy | $155,000 | Attorney | |

| Indymac Bank Fsb | -- | Attorney | |

| Ortiz Maria J | $97,000 | -- | |

| Thilem Harriet L | $109,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bembry Taisha | $266,381 | |

| Previous Owner | Carranza Nancy | $152,625 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,000 | $290,120 | -- | -- |

| 2024 | $4,847 | $281,950 | -- | -- |

| 2023 | $4,847 | $273,740 | $0 | $0 |

| 2022 | $4,570 | $265,770 | $0 | $0 |

| 2021 | $4,480 | $258,030 | $17,380 | $240,650 |

| 2020 | $1,965 | $125,830 | $0 | $0 |

| 2019 | $1,906 | $123,010 | $0 | $0 |

| 2018 | $1,822 | $120,720 | $0 | $0 |

| 2017 | $1,793 | $118,240 | $0 | $0 |

| 2016 | $1,770 | $115,810 | $0 | $0 |

| 2015 | $1,791 | $115,010 | $0 | $0 |

| 2014 | $1,781 | $114,100 | $0 | $0 |

| 2013 | -- | $125,600 | $14,480 | $111,120 |

Source: Public Records

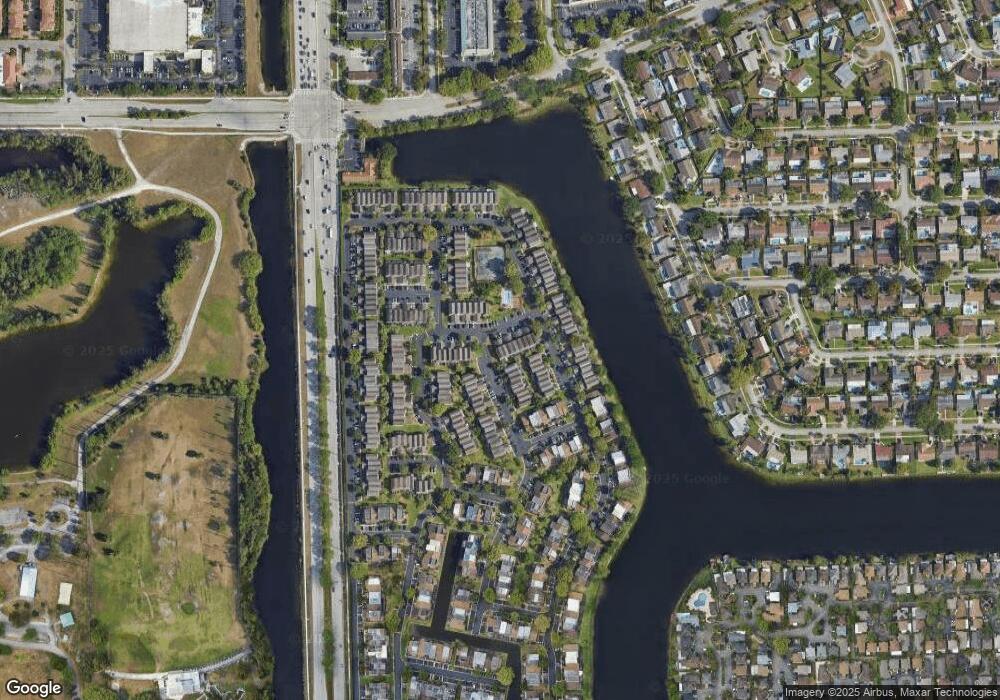

Map

Nearby Homes

- 1333 NW 122nd Terrace

- 1325 NW 123rd Terrace

- 1239 NW 122nd Terrace

- 1237 NW 123rd Terrace

- 11911 NW 14th Ct

- 12305 NW 11th Ct

- 1178 NW 122nd Terrace

- 12064 NW 13th St

- 1143 NW 122nd Terrace

- 11701 NW 14th St

- 12018 NW 13th St

- 12078 NW 11th St Unit 12078

- 1620 NW 118th Ave

- 11740 NW 12th St Unit 11740

- 11657 NW 11th St

- 12467 NW 17th Ct

- 11733 NW 11th St

- 1512 NW 113th Way

- 1799 NW 124th Way Unit 1799

- 1732 NW 124th Place

- 12292 NW 14th St

- 12292 NW 14th St Unit 7

- 12286 NW 14th St

- 12280 NW 14th St

- 12274 NW 14th St Unit 5

- 1381 NW 123rd Ave Unit 1

- 12268 NW 14th St Unit 4

- 1377 NW 123rd Ave

- 12262 NW 14th St Unit 3

- 1390 NW 123rd Ave Unit 7

- 12318 NW 14th St

- 1373 NW 123rd Ave

- 12256 NW 14th St

- 12324 NW 14th St Unit 12324

- 12324 NW 14th St

- 12324 NW 14th St

- 1369 NW 123rd Ave

- 12250 NW 14th St Unit 1

- 1360 NW 122nd Terrace

- 12330 NW 14th St