Studio

--

Bath

2,620

Sq Ft

2,614

Sq Ft Lot

About This Home

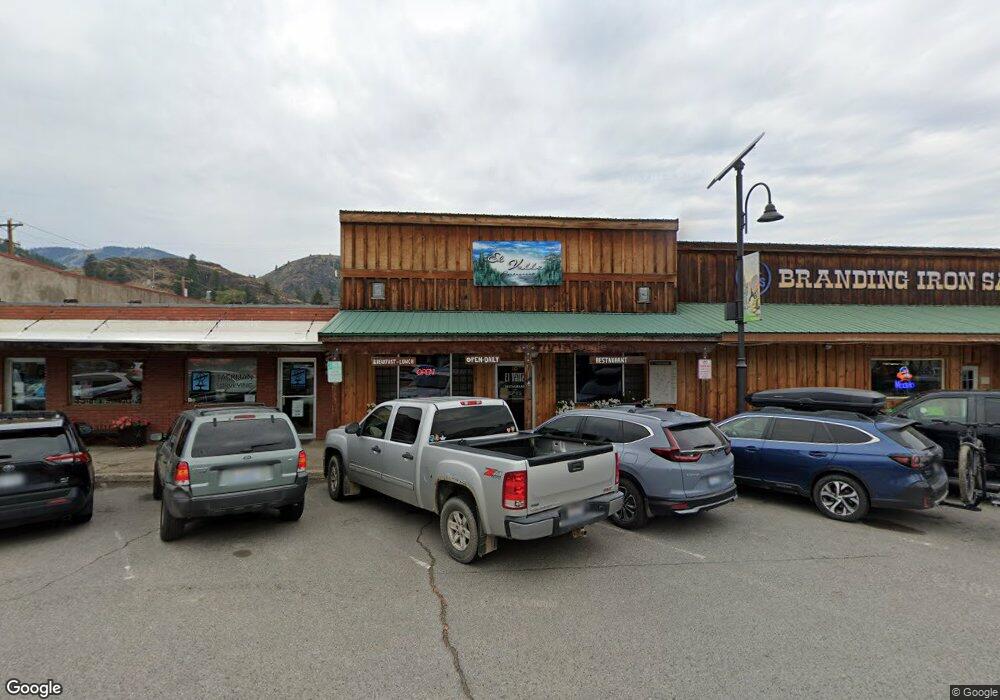

This home is located at 123 Glover St, Twisp, WA 98856. 123 Glover St is a home located in Okanogan County with nearby schools including Methow Valley Elementary School, Liberty Bell Junior/Senior High School, and Methow Valley Independent Learning Center.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 1, 2024

Sold by

Tms Llc

Bought by

Bjs Land Investments Llc

Purchase Details

Closed on

Jun 2, 2017

Sold by

Gd Logan Enterprises Llc

Bought by

Bjs Llc

Purchase Details

Closed on

Jan 14, 2016

Sold by

Farmers State Bank

Bought by

Djs Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$171,200

Interest Rate

3.92%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Jan 13, 2016

Sold by

Bjs Llc

Bought by

Gd Logan Enterprises Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$171,200

Interest Rate

3.92%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Jul 1, 1997

Sold by

Grantham Hough Rosalind and Hough Ted J

Bought by

Seven Ds Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bjs Land Investments Llc | -- | None Listed On Document | |

| Bjs Llc | -- | None Available | |

| Djs Llc | -- | Inland Professional Title | |

| Gd Logan Enterprises Llc | -- | Inland Professional Title | |

| Bjs Llc | -- | Inland Professional Title | |

| Seven Ds Inc | -- | Inland Professional Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Gd Logan Enterprises Llc | $171,200 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,680 | $229,000 | $35,100 | $193,900 |

| 2024 | $1,680 | $229,000 | $35,100 | $193,900 |

| 2022 | $1,954 | $187,000 | $32,400 | $154,600 |

| 2021 | $2,056 | $187,000 | $32,400 | $154,600 |

| 2020 | $2,065 | $187,000 | $32,400 | $154,600 |

| 2019 | $1,979 | $187,000 | $32,400 | $154,600 |

| 2018 | $2,106 | $187,000 | $32,400 | $154,600 |

| 2017 | $1,933 | $187,000 | $32,400 | $154,600 |

| 2016 | $1,825 | $184,400 | $32,400 | $152,000 |

| 2015 | $1,681 | $184,400 | $32,400 | $152,000 |

| 2013 | -- | $184,400 | $32,400 | $152,000 |

Source: Public Records

Map

Nearby Homes

- 140 Twisp Ave W Unit 204

- 115 Johnson St N Unit 1,2,3

- 136 Johnson St

- 318 Lombard St

- 0 Lot 2 Amended Surface Short Plat

- 1110 Riverside Ave

- 1221 Riverside Ave

- 2992 Washington 153

- 48 Thurlow Rd

- 143 Harrier Hill Rd

- 121 Finley Canyon Rd

- 54B Ross Rd Unit B

- 7 Howerton Rd

- 245 Twisp Carlton Rd

- 3A Ross Rd

- 5 Chase Rd

- 300 Cascadian Ct Unit 15

- 302 Cascadian Ct Unit 18

- 7 Round Rock Ln

- 21 Twin Lakes Dr

- 117 Glover St N

- 127 Glover St

- 109 Glover St N

- 109 Glover St

- 135 Glover St

- 102 N Methow Valley Hwy

- 20 Methow Valley Hwy

- 126 N Methow Valley Hwy

- 114 Glover St

- 124 Glover St

- 124 Glover St N

- 204 W 2nd Ave

- 204 E 2nd Ave

- 132 Glover St

- 135 Twisp Ave W

- 111 W 2nd Ave

- 102 S Glover St

- 0 W 2nd Ave Unit 947258

- 121 Twisp Ave

- 210 S Glover St