1239 Gary Summers Rd Senoia, GA 30276

Estimated Value: $473,000 - $721,000

--

Bed

1

Bath

2,522

Sq Ft

$241/Sq Ft

Est. Value

About This Home

This home is located at 1239 Gary Summers Rd, Senoia, GA 30276 and is currently estimated at $607,274, approximately $240 per square foot. 1239 Gary Summers Rd is a home located in Coweta County with nearby schools including Willis Road Elementary School, East Coweta Middle School, and East Coweta High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 19, 2018

Sold by

Breeding Jarrad L

Bought by

Clark Blakely and Clark Dusty

Current Estimated Value

Purchase Details

Closed on

May 22, 2015

Sold by

Breeding Mary J

Bought by

Clark Dusty and Clark Blakely

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$70,000

Interest Rate

3.77%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 12, 2006

Sold by

Hobson Jeff F and Hobson Don P

Bought by

Breeding Douglas G and Breeding Mary J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$81,000

Interest Rate

6.54%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 21, 1997

Sold by

Haas Joseph A

Bought by

Hobson Don P and Hobson Jeff F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$40,500

Interest Rate

7.7%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 30, 1987

Bought by

Haas Joseph Albert

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Clark Blakely | $27,000 | -- | |

| Clark Dusty | $80,000 | -- | |

| Breeding Douglas G | $90,000 | -- | |

| Hobson Don P | $45,000 | -- | |

| Haas Joseph Albert | $17,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Clark Dusty | $70,000 | |

| Previous Owner | Breeding Douglas G | $81,000 | |

| Previous Owner | Hobson Don P | $40,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,983 | $295,559 | $73,599 | $221,960 |

| 2024 | $5,643 | $243,069 | $40,526 | $202,543 |

| 2023 | $5,643 | $226,134 | $40,898 | $185,235 |

| 2022 | $4,853 | $196,995 | $37,180 | $159,815 |

| 2021 | $4,804 | $182,478 | $35,410 | $147,068 |

| 2020 | $1,048 | $39,558 | $35,410 | $4,148 |

| 2019 | $882 | $30,118 | $27,956 | $2,162 |

| 2018 | $883 | $30,118 | $27,956 | $2,162 |

| 2017 | $883 | $30,118 | $27,955 | $2,163 |

| 2016 | $872 | $30,118 | $27,956 | $2,162 |

| 2015 | $983 | $34,522 | $27,956 | $6,566 |

| 2014 | $975 | $34,522 | $27,956 | $6,566 |

Source: Public Records

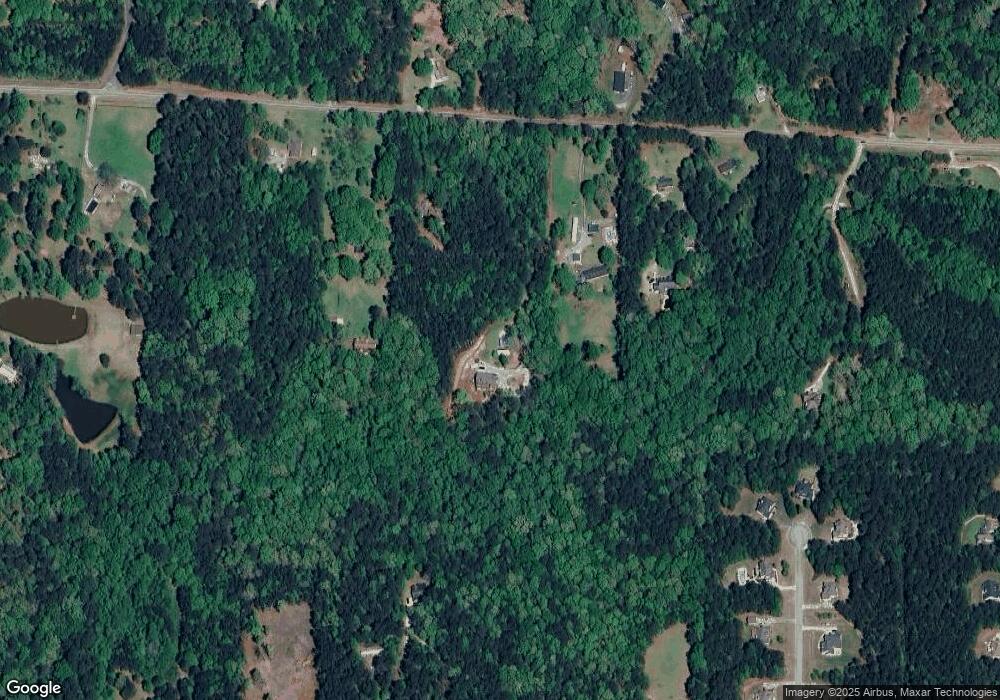

Map

Nearby Homes

- Hampshire Plan at Heritage Pointe

- 285 Staffin Dr

- Edison Plan at Heritage Pointe

- 270 Staffin Dr

- Jean Lee Plan at Heritage Pointe

- 300 Staffin Dr

- 305 Staffin Dr

- Marlene Plan at Heritage Pointe

- SAVANNAH Plan at Heritage Pointe

- 155 Filson Dr

- 330 Renwick Dr

- 310 Savannah Dr

- 933 Stallings Rd

- 316 Hammerstone Ct

- LOT #14 Maddington Ct

- 200 Darien Dr

- 170 Savannah Dr

- 185 Renwick Dr

- 220 Calebee Ave

- 305 Traditions Way

- 1243 Gary Summers Rd

- 1235 Gary Summers Rd

- 1231 Gary Summers Rd

- 1247 Gary Summers Rd

- 50 Dogwood Trail E

- 1253 Gary Summers Rd

- 1201 Gary Summers Rd

- 162 Pintail Point

- 1287 Gary Summers Rd

- 1240 Gary Summers Rd

- 165 Pintail Point

- 146 Pintail Point

- 132 Pintail Point

- 159 Pintail Point

- 139 Pintail Point

- 1220 Gary Summers Rd

- 60 Dogwood Trail E

- 1049 Gary Summers Rd

- 129 Pintail Point

- 1202 Gary Summers Rd