1241 SW Chawla Ct Port Orchard, WA 98367

Estimated Value: $763,000 - $904,000

3

Beds

2

Baths

3,404

Sq Ft

$242/Sq Ft

Est. Value

About This Home

This home is located at 1241 SW Chawla Ct, Port Orchard, WA 98367 and is currently estimated at $822,906, approximately $241 per square foot. 1241 SW Chawla Ct is a home located in Kitsap County with nearby schools including Sidney Glen Elementary School, Cedar Heights Middle School, and South Kitsap High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 23, 2001

Sold by

Grimaud Ok Sun

Bought by

Grimaud Ok S and Chon Jin H

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$161,000

Interest Rate

6.98%

Purchase Details

Closed on

Jan 23, 2001

Sold by

Grimaud Richard C

Bought by

Grimaud Ok Sun

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$161,000

Interest Rate

6.98%

Purchase Details

Closed on

Oct 12, 1994

Sold by

Cole Robert W and Cole Mona Y

Bought by

Grimaud Richard C and Grimaud Ok Sun

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$160,000

Interest Rate

5.75%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Grimaud Ok S | $76,253 | Land Title Company | |

| Grimaud Ok Sun | -- | -- | |

| Grimaud Richard C | $200,000 | Stewart Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Grimaud Ok S | $161,000 | |

| Closed | Grimaud Richard C | $160,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2026 | $6,823 | $787,640 | $167,920 | $619,720 |

| 2025 | $6,823 | $787,640 | $167,920 | $619,720 |

| 2024 | $6,616 | $787,640 | $167,920 | $619,720 |

| 2023 | $6,573 | $787,640 | $167,920 | $619,720 |

| 2022 | $6,276 | $629,630 | $133,850 | $495,780 |

| 2021 | $5,966 | $565,810 | $121,680 | $444,130 |

| 2020 | $6,201 | $571,870 | $105,030 | $466,840 |

| 2019 | $5,231 | $529,620 | $97,070 | $432,550 |

| 2018 | $5,566 | $429,060 | $83,550 | $345,510 |

| 2017 | $4,675 | $429,060 | $83,550 | $345,510 |

| 2016 | $4,531 | $380,240 | $79,570 | $300,670 |

| 2015 | $4,380 | $372,330 | $79,570 | $292,760 |

| 2014 | -- | $317,820 | $72,470 | $245,350 |

| 2013 | -- | $331,000 | $85,650 | $245,350 |

Source: Public Records

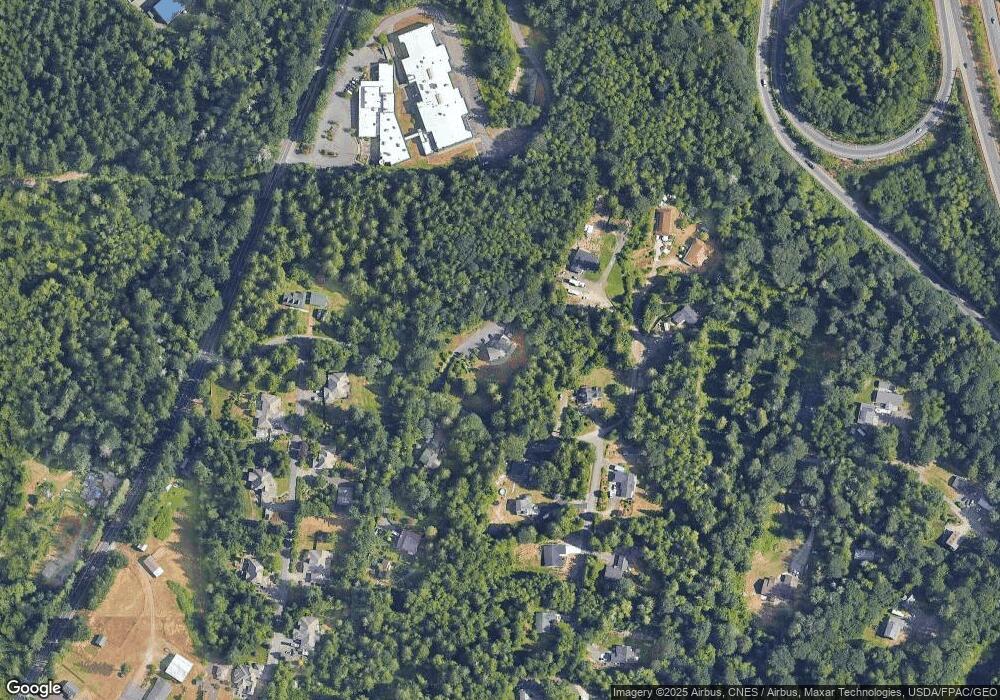

Map

Nearby Homes

- 1566 SW Old Clifton Rd

- 4595 Weyers Ln SW

- 2703 Anderson Hill Rd SW

- 155 May St W

- 2561 Anderson Hill Rd SW

- 171 SW Marcia Way

- 512 SW Berry Lake Rd Unit 15

- 4460 Castleton Rd SW

- 1885 SW Bay St

- 4510 Castleton Rd SW

- 3850 Portside Dr

- 122 Fireweed St

- 2430 Puget Sound Blvd

- 1160 Eagle Crest Place

- 280 Flower Meadows St

- 4715 Olivine Dr SW

- 4930 Castleton Rd SW

- 4710 Rutherford Cir SW

- 1277 Sherman Ave

- Powell Plan at Sinclair Ridge at McCormick - Sinclair Ridge

- 1221 SW Chawla Ct

- 1201 SW Chawla Ct

- 5141 Mccool Place SW

- 5150 Independence Place SW

- 0 Franway Ln SW

- 1220 SW Chawla Ct

- 5161 Mccool Place SW

- 5151 Independence Place SW

- 1270 SW Chawla Ct

- 1271 SW Chawla Ct

- 1200 SW Chawla Ct

- 5170 Independence Place SW

- 5171 Independence Place SW

- 5140 Mccool Place SW

- 5181 Mccool Place SW

- 5190 Independence Place SW

- 1360 SW Old Clifton Rd

- 1352 SW Old Clifton Rd

- 5160 Mccool Place SW

- 5191 Independence Place SW