12430 Heimberger Rd NW Baltimore, OH 43105

Estimated Value: $578,000 - $847,747

3

Beds

4

Baths

3,870

Sq Ft

$195/Sq Ft

Est. Value

About This Home

This home is located at 12430 Heimberger Rd NW, Baltimore, OH 43105 and is currently estimated at $756,249, approximately $195 per square foot. 12430 Heimberger Rd NW is a home located in Fairfield County with nearby schools including Etna Elementary School, Pataskala Elementary School, and Watkins Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 26, 2020

Sold by

Given Not

Bought by

Richardson Craig A and Richardson Dawn M

Current Estimated Value

Purchase Details

Closed on

Dec 12, 2007

Sold by

Richardson James A and Richardson Linda C

Bought by

Richardson Craig A and Richardson Dawn M

Purchase Details

Closed on

Feb 21, 1995

Sold by

Gaiser Eduard

Bought by

Richardson James A and Richardson Linda C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$160,000

Interest Rate

6.38%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 1, 1992

Sold by

Gaiser Edward

Bought by

Gaiser Edward

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Richardson Craig A | -- | -- | |

| Richardson Craig A | -- | Valmer Land Title Agency | |

| Richardson James A | $368,000 | -- | |

| Gaiser Edward | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Richardson James A | $160,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $16,022 | $232,780 | $44,970 | $187,810 |

| 2023 | $10,139 | $232,780 | $44,970 | $187,810 |

| 2022 | $10,958 | $232,780 | $44,970 | $187,810 |

| 2021 | $8,464 | $165,500 | $40,880 | $124,620 |

| 2020 | $8,945 | $165,500 | $40,880 | $124,620 |

| 2019 | $9,135 | $165,500 | $40,880 | $124,620 |

| 2018 | $7,702 | $136,940 | $35,970 | $100,970 |

| 2017 | $7,716 | $135,450 | $35,970 | $99,480 |

| 2016 | $7,156 | $135,450 | $35,970 | $99,480 |

| 2015 | $6,708 | $131,780 | $35,970 | $95,810 |

| 2014 | $6,485 | $131,780 | $35,970 | $95,810 |

| 2013 | $6,485 | $131,170 | $35,970 | $95,200 |

Source: Public Records

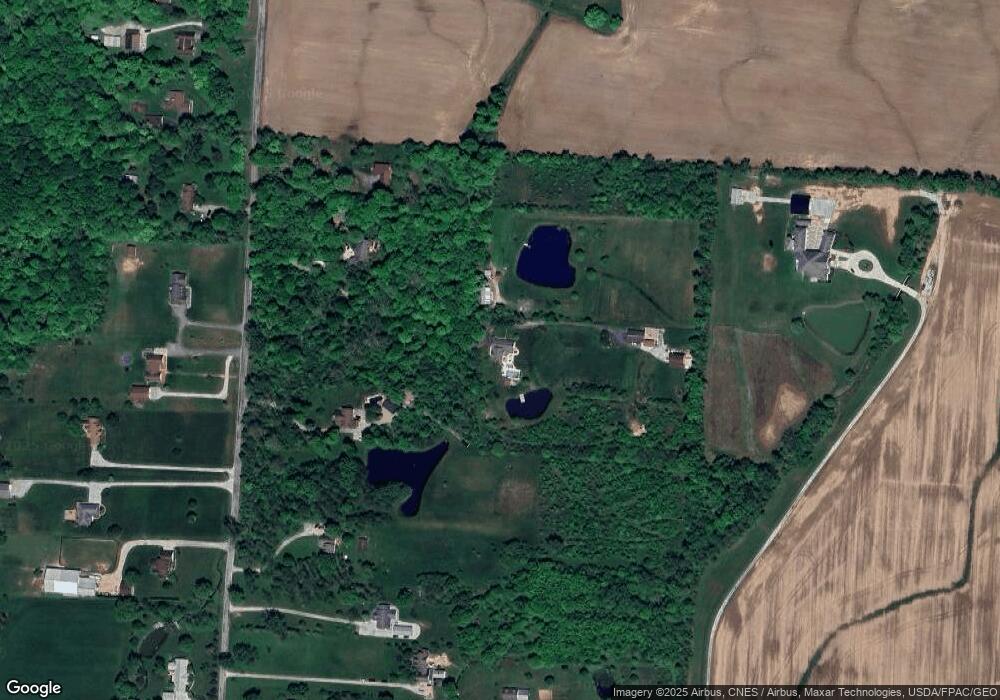

Map

Nearby Homes

- 13165 Heimberger Rd NW

- 4435 Blacklick Eastern Rd NW

- 0 Heimberger Rd NW Unit 224007682

- 13254 Brandon Mill Dr NW

- 2597 Blacklick Eastern Rd NW

- 10959 Heimberger Rd NW

- 12419 Roesta Ln NW

- 11130 Smoke Rd SW

- 0 Etna Rd NW

- 12250 Basil Rd NW

- 0 Heimberger Ln NW

- 5952 Refugee Rd NW

- 11135 Basil Rd NW

- 10964 Hazelton-Etna Rd SW

- 10293 Smoke Rd SW

- 12517 Heritage Way

- 10415 Stoudertown Rd NW

- 10499 Hazelton Etna Rd SW

- 10475 Hazelton Etna Rd SW

- 1590 Stemen Rd NW

- 12683 Oakwood Way NW

- 12350 Heimberger Rd NW

- 12440 Heimberger Rd NW

- 12480 Heimberger Rd NW

- 12258 Heimberger Rd NW

- 12236 Heimberger Rd NW

- 12212 Heimberger Rd NW

- 12437 Heimberger Rd NW

- 3696 Blacklick Eastern Rd NW

- 12425 Heimberger Rd NW

- 12465 Heimberger Rd NW

- 12515 Heimberger Rd NW

- 12325 Heimberger Rd NW

- 12188 Heimberger Rd NW

- 12555 Heimberger Rd NW

- 12305 Heimberger Rd NW

- 12199 Heimberger Rd NW

- 12160 Heimberger Rd NW

- 12261 Heimberger Rd NW

- 12605 Heimberger Rd NW