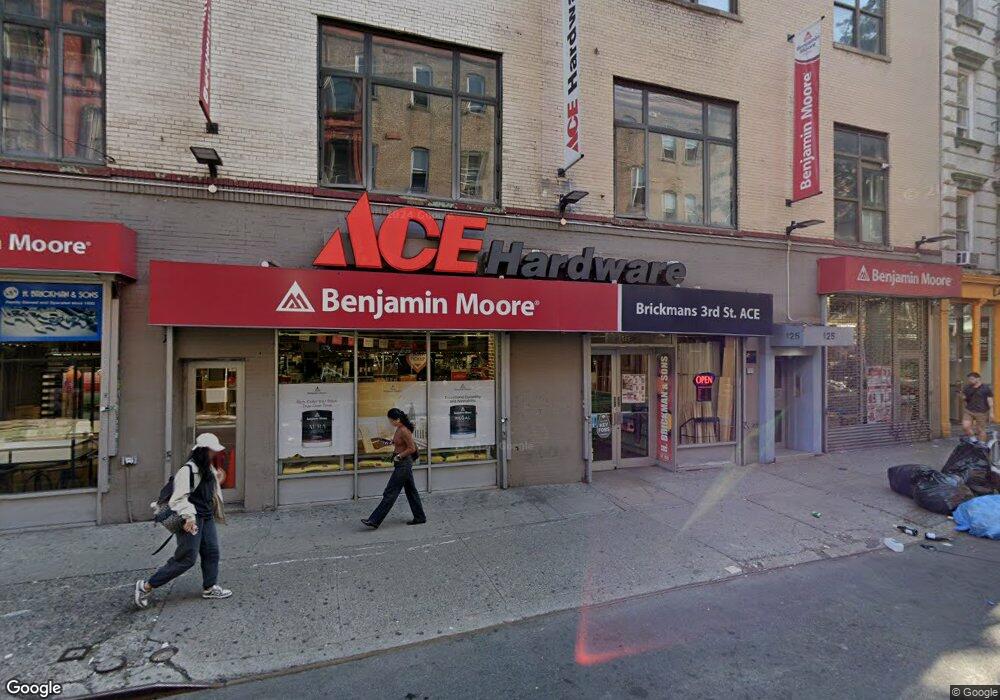

125 W 3rd St New York, NY 10012

Greenwich Village NeighborhoodEstimated Value: $14,864,522

--

Bed

--

Bath

113,754

Sq Ft

$131/Sq Ft

Est. Value

About This Home

This home is located at 125 W 3rd St, New York, NY 10012 and is currently priced at $14,864,522, approximately $130 per square foot. 125 W 3rd St is a home located in New York County with nearby schools including P.S. 3 Charrette School, Middle School 297, and Clinton School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 28, 2005

Sold by

Crystal Tower Llc and % Coral Realty Llc

Bought by

Coral Crystal Llc

Current Estimated Value

Purchase Details

Closed on

Oct 11, 2000

Sold by

Crystal Llc

Bought by

Crystal Tower Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$12,850,000

Outstanding Balance

$4,567,106

Interest Rate

7.75%

Mortgage Type

Commercial

Purchase Details

Closed on

Mar 2, 1999

Sold by

Murphy Hon Francis T

Bought by

Crystal Llc

Purchase Details

Closed on

Jan 9, 1998

Sold by

Pappas John

Bought by

Mcarthur Morgan Llc

Purchase Details

Closed on

Jul 31, 1995

Sold by

Judelson Partners Co

Bought by

L J W P Realty Co Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Coral Crystal Llc | -- | -- | |

| Coral Crystal Llc | -- | -- | |

| Crystal Tower Llc | -- | -- | |

| Crystal Tower Llc | -- | -- | |

| Crystal Llc | $8,200,000 | -- | |

| Crystal Llc | $8,200,000 | -- | |

| Mcarthur Morgan Llc | -- | Commonwealth Land Title Ins | |

| Mcarthur Morgan Llc | -- | Commonwealth Land Title Ins | |

| L J W P Realty Co Llc | -- | Commonwealth Land Title Ins | |

| L J W P Realty Co Llc | -- | Commonwealth Land Title Ins |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Crystal Tower Llc | $12,850,000 | |

| Closed | Crystal Tower Llc | $12,850,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,501,654 | $13,923,270 | $1,165,500 | $12,757,770 |

| 2024 | $1,501,654 | $14,177,250 | $1,165,500 | $13,011,750 |

| 2023 | $1,419,628 | $13,334,850 | $1,165,500 | $12,169,350 |

| 2022 | $1,364,180 | $12,684,150 | $1,165,500 | $11,518,650 |

| 2021 | $1,325,692 | $12,396,600 | $1,165,500 | $11,231,100 |

| 2020 | $1,889,785 | $17,934,750 | $1,165,500 | $16,769,250 |

| 2019 | $1,981,468 | $18,846,000 | $1,165,500 | $17,680,500 |

| 2018 | $1,996,313 | $18,850,500 | $1,165,500 | $17,685,000 |

| 2017 | $1,902,524 | $19,249,650 | $1,165,500 | $18,084,150 |

| 2016 | $1,942,976 | $21,557,250 | $1,165,500 | $20,391,750 |

| 2015 | $972,580 | $18,598,950 | $1,165,500 | $17,433,450 |

| 2014 | $972,580 | $17,382,150 | $1,165,500 | $16,216,650 |

Source: Public Records

Map

Nearby Homes

- 25 Minetta Ln Unit 5C

- 2 Cornelia St Unit 404

- 2 Cornelia St Unit PHA

- 80 W Washington Place

- 290 6th Ave Unit 3CD

- 290 6th Ave Unit 2KL

- 22 Cornelia St Unit 7

- 22 Cornelia St Unit 15

- 24 Cornelia St Unit 13

- 32 Washington Square W Unit 14E

- 69 Washington Place Unit 3/4/5

- 1 Minetta St Unit 5B

- 175 Bleecker St Unit 18

- 122 Waverly Place

- 192 Bleecker St Unit 14

- 211 Thompson St Unit 5L

- 211 Thompson St Unit LJ

- 211 Thompson St Unit 4-C

- 211 Thompson St Unit 5C

- 13 Downing St Unit 9

- 125 W 3rd St Unit 3C

- 125-129 W 3rd St

- 123 W 3rd St

- 123 W 3rd St Unit M

- 123 W 3rd St Unit GG

- 123 W 3rd St Unit OO

- 123 W 3rd St Unit B

- 123 W 3rd St Unit E

- 123 W 3rd St Unit Retail

- 123 W 3rd St Unit I

- 123 W 3rd St Unit P

- 123 W 3rd St Unit K

- 123 W 3rd St Unit D

- 123 W 3rd St Unit G

- 123 W 3rd St Unit J

- 123 W 3rd St Unit N

- 123 W 3rd St Unit H

- 123 W 3rd St Unit 5-P

- 123 W 3rd St Unit F

- 123 W 3rd St Unit L