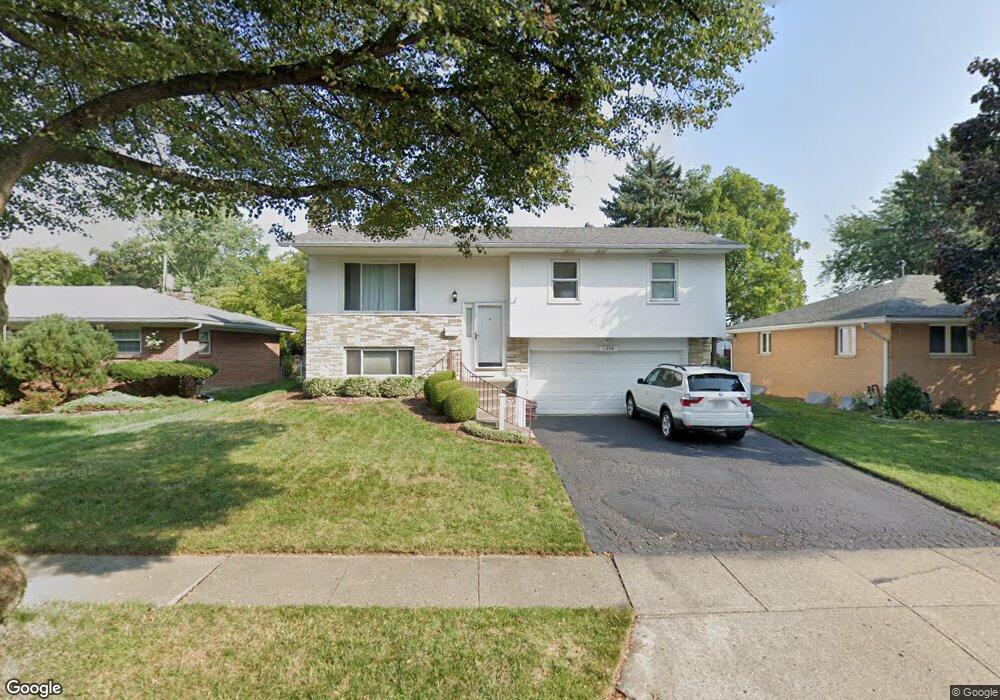

1250 Kildale Square S Columbus, OH 43229

Devonshire NeighborhoodEstimated Value: $255,000 - $288,000

3

Beds

2

Baths

1,620

Sq Ft

$168/Sq Ft

Est. Value

About This Home

This home is located at 1250 Kildale Square S, Columbus, OH 43229 and is currently estimated at $271,939, approximately $167 per square foot. 1250 Kildale Square S is a home located in Franklin County with nearby schools including Devonshire Alternative Elementary School, Woodward Park Middle School, and Beechcroft High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 24, 2001

Sold by

Morris Dwight

Bought by

Lanier Paul and Lanier Carla D

Current Estimated Value

Purchase Details

Closed on

May 29, 1998

Sold by

Brown Kimberly K

Bought by

Morris Dwight

Purchase Details

Closed on

Aug 24, 1995

Sold by

Rinesmith Ralph R

Bought by

Kimberly K Brown

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$83,078

Interest Rate

7.43%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 1, 1986

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lanier Paul | $110,200 | Chicago Title West | |

| Morris Dwight | $99,900 | Stewart Title Agency | |

| Kimberly K Brown | $84,500 | -- | |

| -- | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Kimberly K Brown | $83,078 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,682 | $82,040 | $17,500 | $64,540 |

| 2023 | $3,635 | $82,040 | $17,500 | $64,540 |

| 2022 | $2,681 | $51,700 | $12,600 | $39,100 |

| 2021 | $2,686 | $51,700 | $12,600 | $39,100 |

| 2020 | $2,690 | $51,700 | $12,600 | $39,100 |

| 2019 | $2,491 | $41,060 | $10,080 | $30,980 |

| 2018 | $2,331 | $41,060 | $10,080 | $30,980 |

| 2017 | $2,444 | $41,060 | $10,080 | $30,980 |

| 2016 | $2,398 | $36,200 | $7,670 | $28,530 |

| 2015 | $2,177 | $36,200 | $7,670 | $28,530 |

| 2014 | $2,182 | $36,200 | $7,670 | $28,530 |

| 2013 | $1,195 | $40,180 | $8,505 | $31,675 |

Source: Public Records

Map

Nearby Homes

- 1268 Kildale Ct

- 1288 Oakfield Dr N

- 6189 Northgap Dr

- 6211 Parkdale Dr

- 1409 Bosworth Place

- 1421 Bosworth Place

- 1294 Clydesdale Ct

- 6407 Faircrest Rd

- 1460 Burnley Square N

- 1322 Bolenhill Ct

- 1171 Newbury Dr

- 1549 Alpine Dr

- 6458 Faircrest Rd

- 6342 Bellmeadow Dr

- 5990 Ambleside Dr

- 6035 Karl Rd

- 1635 Tendril Ct

- 6355 Johnanne St

- 6245 Sharon Woods Blvd

- 6496 Hearthstone Ave

- 1258 Kildale Square S

- 1242 Kildale Square S

- 1234 Kildale Square S

- 1251 Kildale Ct

- 1266 Kildale Square S

- 1259 Kildale Ct

- 1243 Kildale Ct

- 1267 Kildale Ct

- 1245 Kildale Square S

- 1255 Kildale Square S

- 1226 Kildale Square S

- 1237 Kildale Ct

- 1235 Kildale Square S

- 1271 Kildale Ct

- 1272 Kildale Square S

- 1269 Kildale Square S

- 1229 Kildale Square S

- 1279 Kildale Ct

- 6408 Kildale Square W

- 1218 Kildale Square S